Binance, the world’s leading Bitcoin (BTC) and cryptocurrency exchange, is undergoing a phase of uncertainty following a series of events that have put its operational and financial stability under scrutiny.

What started as a technical glitch during a period of high volatility It escalated to a crisis of trust. It affects the user’s perception of security.

In this context, to understand why fear of Binance has skyrocketed, it is essential to analyze six keys. This phenomenon is a combination of operational problems, accusations of manipulation, and institutional responses aimed at restoring lost trust.

1. In the wake of the October 2025 incident

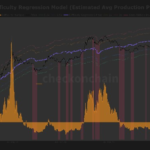

Binance’s stability was seriously compromised on October 10, 2025. On that day, Bitcoin came under massive selling pressure from institutional investors and the retail sector.

Binance, which processes the world’s largest trading volume, failure to maintain service integrity in the face of what was described as extreme volatility; Motivated by macroeconomic factors.

During the most critical period of price decline, users reported an almost complete paralysis of order execution. There were obvious cracks in the exchange’s technical infrastructure. Long delays in withdrawals, disappearance of balances from the user interface, inability to access both the mobile app and web version.

The company allocated a total of $683 million to compensate victims, but the reputational damage had already been done. This technical vulnerability calls into question the company’s ability to respond in times of financial stress..

2. Complaints regarding suspected market manipulation

After the October incident, talk of a simple technical error gave way to more serious allegations. Various complaints suggest that the exchange allegedly adjusted data internally to avoid refund obligations.

According to testimonies collected by CriptoNoticias on social networks Some payment records may have been manually changed As such, your losses remain outside the eligibility period established for compensation.

These accusations point to alleged market manipulation and a lack of transparency in the internal audit process.

3. Story of user leakage and risks

Distrust causes a visible reaction and that is the flight of capital. A growing number of investors have announced their decision to close their accounts and liquidate their holdings in BNB, the platform’s cryptocurrency.

Fear of possible bankruptcy or definitive blockage of funds has promoted what is known in this field as FUD. (fear, anxiety, doubt).

Celebrities such as Binance founder Zhao Changpeng (CZ) have warned of the existence of smear campaigns organized through fake accounts, but negative sentiment remains strong.

4. Technical issues when withdrawing money

Difficulties with retirement services increase fear; This left many users temporarily unable to access their fundsas reported by the exchange itself, on February 2nd.

These shortcomings coincided with a sharp decline in the Bitcoin and other cryptocurrency markets. Binance quickly reported that it had identified and resolved the technical issue (an outage that lasted approximately 15 minutes), allowing normal trading to resume.

but, The company did not provide exhaustive details about the root cause, instead prioritizing quick restoration of service. and the guarantee that your funds will remain safe.

Ultimately, episodes like this remind us that not only speed of response, but also full transparency and proactive prevention remain essential to maintaining user trust in the long term.

5. Cease and Desist Letter to Critics

Another factor to understand why fear of Binance has skyrocketed The appearance of a suspicious dismissal notice It was directed at those it accused of contributing to the bankrupt trading and October’s financial collapse. These statements posted on social media signaled an attempt to silence dissident voices and fueled talk of possible bankruptcy.

It is a document, usually drafted by an attorney or affected party, sent by one organization or individual to another organization or individual requesting that it immediately stop and not resume conduct that is considered illegal or harmful.

Binance categorically denied these versions, calling the document a “forgery of a very active imagination” and warning against misleading information.

Social Network X’s cryptocurrency division played a key role in identifying that the letter was specifically designed to promote a misleading narrative. in fact, Some of the posts I shared received notes from the community It clearly warned that these are fabricated documents designed to promote a false narrative.

6. Surveillance of Zhao Changpeng

CZ’s character remains a focus of controversy even after he left Binance’s leadership in 2023 following an agreement with U.S. authorities and a short stint in prison (later pardoned by U.S. President Donald Trump).

The businessman is accused of market-distorting conduct. Criticisms include allegations that Binance manipulated prices by selling large amounts of Bitcoin to create liquidity and influence the market. Especially during high volatility events like October 10th.as reported by CriptoNoticias.

He is accused of historically helping Binance accumulate a disproportionate advantage in the exchange sector, driving out competitors through aggressive fees, selective listings, and what are described as opaque practices that stifle real competition.

CZ responded forcefully to these allegations, repeatedly calling them “imaginary FUD” or “an exaggerated and disconnected version of reality.”

Binance responds with transparency measures

Binance has taken concrete actions to address concerns raised about its solvency and financial stability. On January 30, 2026, the company announced the full conversion of its User Safe Asset Fund (SAFU). The value from USDC to Bitcoin is equivalent to $1 billion.

The process, which is expected to be completed within 30 days, began this week with the transfer of 1,315 BTC (approximately $100 million). If the value of the Fund falls below $800 million due to fluctuations in BTC price, the Fund will rebalance..

Additionally, yesterday, February 5, 2026, Binance published a reserve update test through CoinMarketCap (its own platform).

The numbers show that Total reserves are approximately $155.64 billion (Reported by various media outlets as 155.6 billion) This is far more than all other major exchanges combined.

Bitcoin and derivatives account for approximately 32% (approximately $49.84 billion), strengthening its dominant position in the market. These measures are aimed at restoring confidence amid sustained volatility and speculation.

With these reserve numbers in their favor, the future of the platform will largely depend on whether the system can demonstrate that it can withstand the next high demand cycle without collapsing.