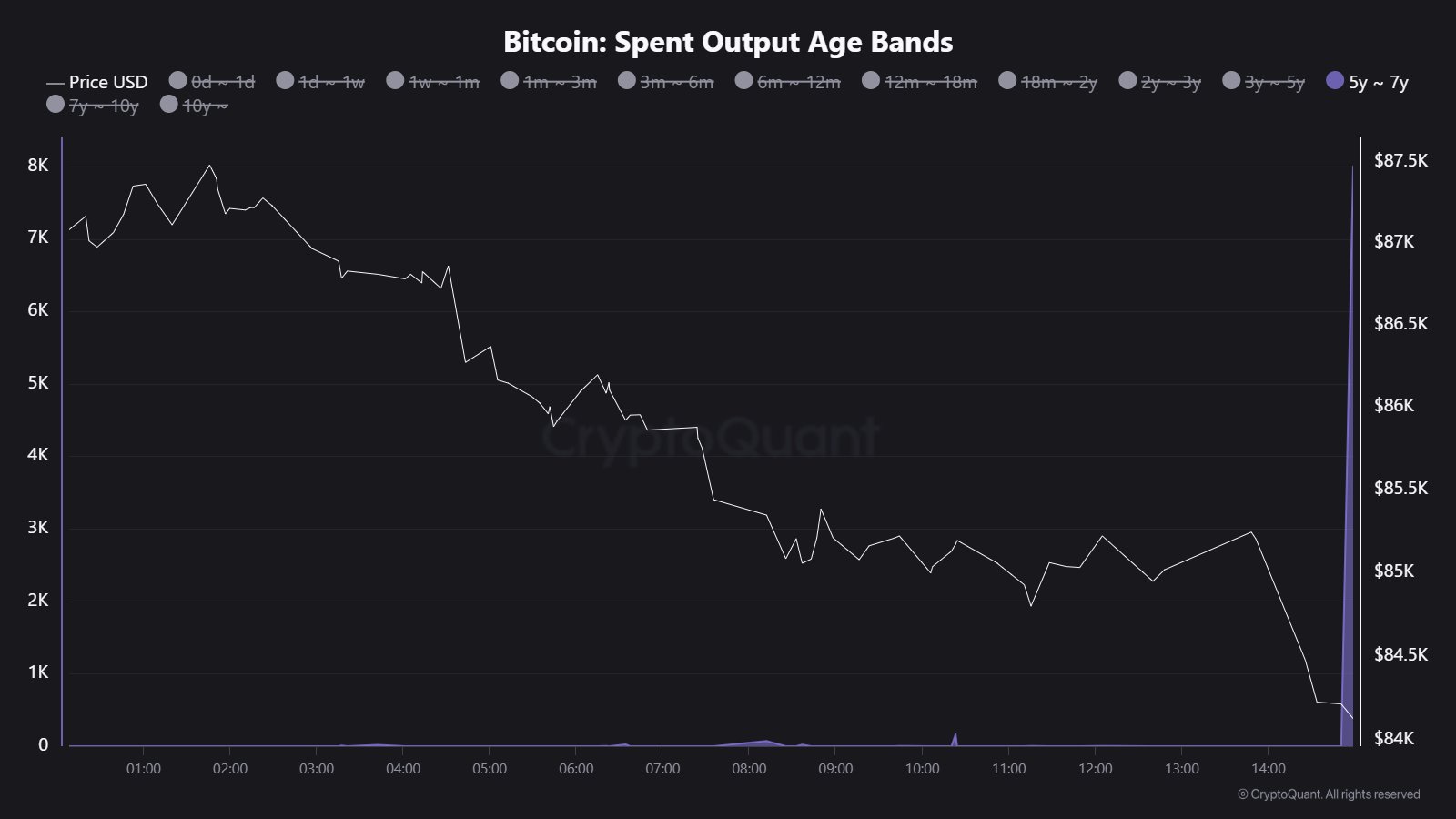

Popular crypto analyst Maartunn reports that 8,000 Bitcoins (BTC) that have been dormant for five to seven years have suddenly moved, increasing the current bearish concerns of the crypto. The development succumbed to massive sales pressures driven by President Donald Trump’s Hawkish tariff policy after a rather adventurous week as BTC struggled to exceed $89,000 following the initial stable bullish climb.

$674 million in old BTC transfers in one block – cause of alarm?

The used output age band is an important metric for measuring how much time your Bitcoin token does not have before it moves. According to X-Post’s Maartuun, the metric recently revealed that 8,000 BTC worth $674 million, the last transferred between 2018 and 2020, has recently moved in one block with market attention.

This transmission follows the recent activation string of dormant Bitcoin stashes. On March 24th, a 14-year inactive Bitcoin wallet suddenly moved $8.5 million in 100 Bitcoins. Meanwhile, in early March, six ancient Bitcoin wallets also moved 250 BTC, worth $22 million.

In particular, the most recent transactions reported by Maartuun are much larger in size and have a potentially strong impact on the uncertain Bitcoin market. Generally, such large amounts of BTC movement from long-term dormancy are interpreted as signals to be subject to sales pressure that leads to major price corrections.

However, there are other non-potential motivations behind such transactions, such as internal wallet shuffling by institutional investors and large holders, and cold storage reorganizations. Currently, the owner of the new wallet receiving the 8,000 is unknown, which reduces the likelihood of a bearish response from BTC holders.

Bitcoin Price Overview

On the last day, Bitcoin prices fell 4.00% after the US government announced its intention to impose a 25% tariff on car imports and goods from China, Mexico and Canada from April 3rd.

These measures by the Donald Trump administration are burning fear of a potential economic slowdown, which could push high-risk assets such as BTC further down to lower-risk assets from investors’ portfolios.

At the time of pressing, Bitcoin is currently trading at $83,693, reflecting a decline of 0.72% and 2.53% over the past seven and 30 days, respectively. Meanwhile, daily trading volume of assets has increased by 19.38%, valued at $31.5 billion. BTC’s market capitalization is currently at $1.66 trillion, still accounting for the dominant 61.1% of the crypto market as a whole.

BTC trading for $83,727 on daily charts | Source: BTCUSDT chart at tradingView.com