Ethereum (ETH) is below $2,000 after temporarily winning a threshold following the recent FOMC conference. The bullish momentum quickly fades, and ETH again shows signs of weakness.

Technical indicators including RSI and DMI indicate an increase in bear pressure in the short term. Traders are currently monitoring key support and resistance levels to see if ETH continues to fix or attempt to recover.

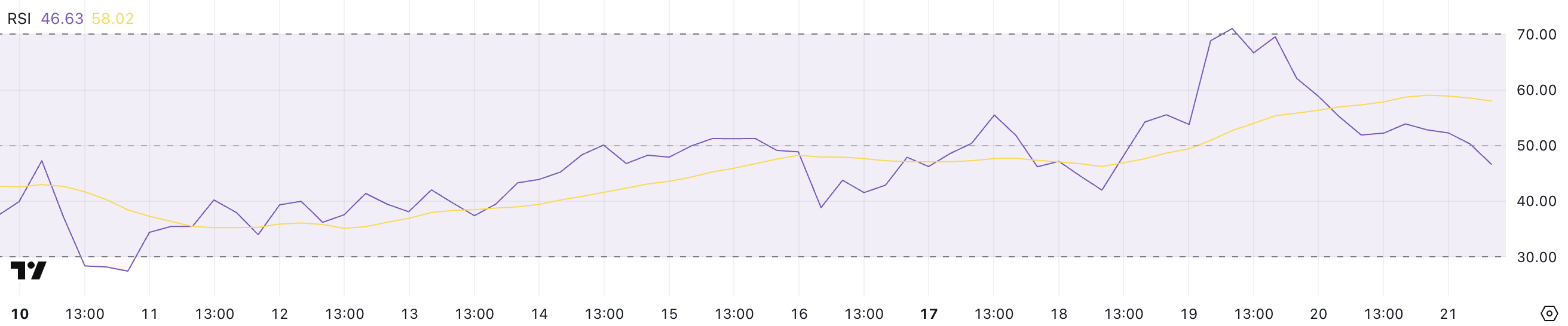

Ethereum RSI is down after touching on the acquired level

Ethereum’s RSI has dropped sharply to 46.63 from 71 just two days ago, indicating a change in momentum.

Relative Strength Index (RSI) is a momentum oscillator that measures the speed and variation of price movements on a scale of 0-100. Measurements above 70 suggest that an asset is being acquired in excess, while levels below 30 indicate that it may be sold in excess.

eth rsi. Source: TradingView.

Eth’s RSI currently sits near 46, indicating that it has entered neutral territory and has faded its recent bullish momentum. This could mean a period of integration or additional negative side risk if the seller remains in control.

Traders may expect ETH to bounce steadily when demand is returned.

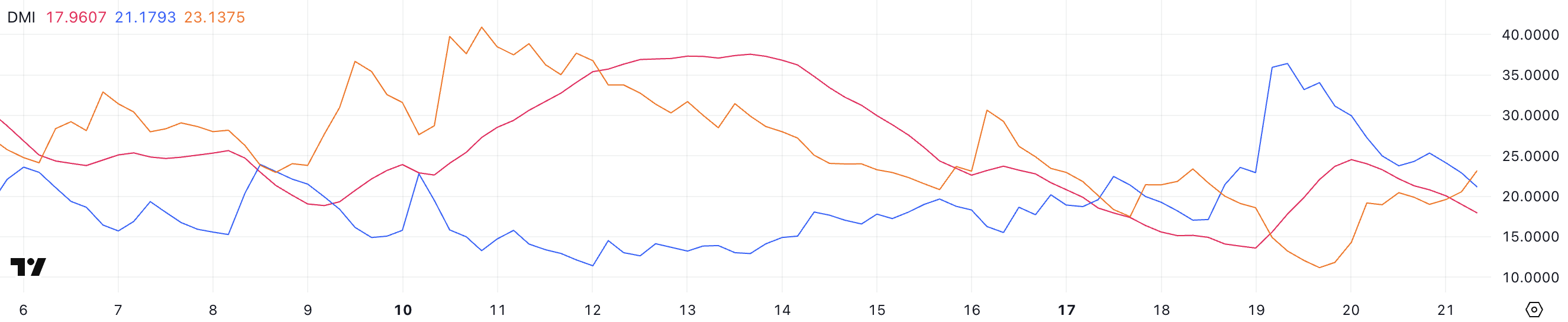

ETH DMI shows that the seller is in control again

Ethereum’s DMI chart shows ADX fell from 24.5 to 17.96 yesterday, indicating a weaker trend.

The Mean Directional Index (ADX) measures the intensity of trends, with values above 25 suggesting strong trends and values below 20 referring to weak or ranged markets.

ETH DMI. Source: TradingView.

At the same time, Eth’s +DI has fallen from 34 to 21.17, indicating that bullish momentum is declining. Meanwhile, the -DI rose from 11.17 to 23.12, suggesting a rise in bearish pressure.

With ADX drops and -DI exceeds +DI, Ethereum could face more downsides or enter the integration phase as sellers gain more influence on price action.

Will Ethereum be able to surge 30% soon?

Ethereum prices are currently in the correction phase, and if this trend continues, the main support levels could be tested at $1,867 and $1,823.

Breaks below these zones could open the door to decline deeply to $1,759, as ETH risks falling below $1,700 for the first time since October 2023.

ETH price analysis. Source: TradingView.

However, if Ethereum can reverse the current downward trend and regain bullish momentum, it could push towards resistance at $2,106.

At the stronger rally, you can see ETH aiming for $2,320 and $2,546, offering a potential upside of about 30% from the current level.