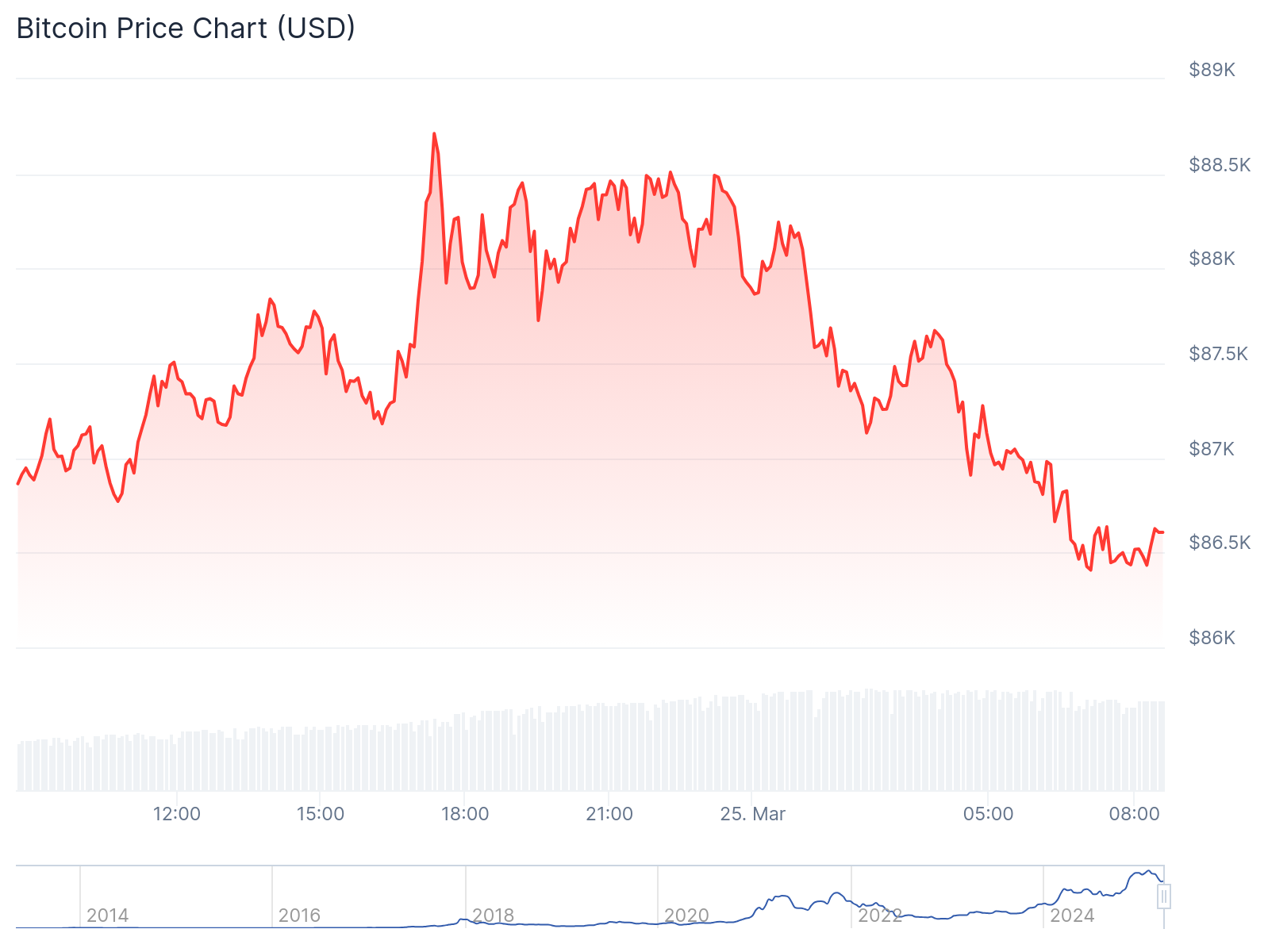

Bitcoin (BTC) prices extended the recovery on Monday, exceeding $88,000 as the confluence of macroeconomic and institutional factors increased market sentiment.

BTC rose 4.24% over 24 hours at $88,599 at press.

BTC/USD 1 day chart. Source: Coingecko

The rally followed last week’s 4.25% rebound, followed by a surge in open profits and a return of ETF inflows.

According to Cryptoquant, the total public interest amounted to over $32 billion, with Coinglas reporting a $614.6 million jump in Binance on BTC-USDT futures during early trading.

Source: cryptoquant/x

In a tweet, Coinglas said “approximately 7,000 BTC of open interest has been added to Binance Futures,” suggesting trader exposure and an increase in imminent volatility.

Arthur Hayes sets BTC to a $110,000 target, but retrace warning

Bitmex co-founder Arthur Hayes predicted that Bitcoin could reach $110,000 before it was raised to $76,500.

In a post on X, Hayes said the macroeconomic tailwind, particularly the Federal Reserve dove tone, and President Donald Trump’s flexible tariff stance could push BTC to new local highs.

Arthur Hayes bets that $BTC will first reach $110,000. Source: Arthur Hayes

“The Fed will move from quantitative tightening to quantitative easing,” Hayes argued that he hopes for liquidity to drive demand for BTC. He also downplayed the long-term impact of US tariffs and caused “temporary” confusion over wider price trends.

Hayes suggested that Bitcoin could ultimately target $250,000, but highlighted the possibility of pullbacks after the $110,000 level.

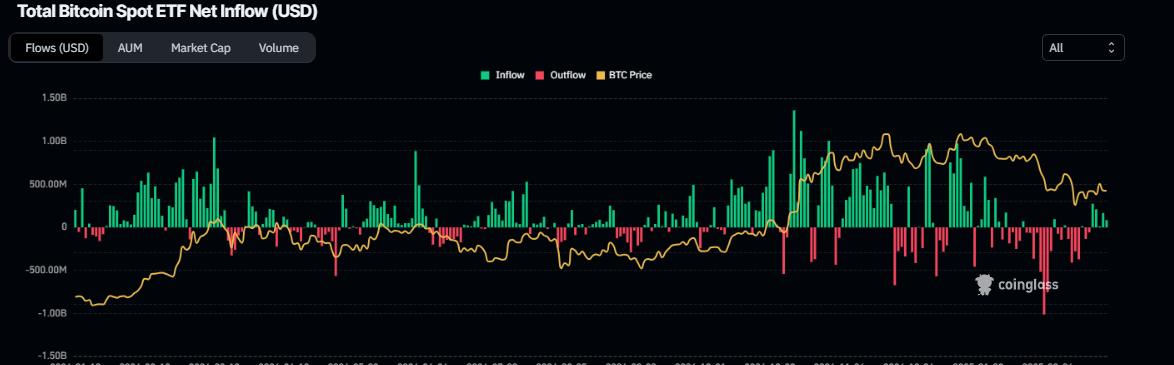

Bitcoin ETF inflows return as strategy buys more BTC

Institutional appetite showed signs of recovery last week. According to Coinglas, Bitcoin Spot ETFS recorded a net inflow of $7443 million after recording a $830 million spill the previous week.

Total Bitcoin Spot ETF Net Inflow Chart | Source: Coinglass

Meanwhile, Crypto Firm Strategy acquired $584 million in BTC on March 24, increasing its holdings to 506,137 BTC.

The company used 197 million share revenues and revenue from its broader $21 billion share issuance program.

Critics warn that a positive accumulation of strategy could be in favor of BTC, which is over $80,000. A lack of funds or suspension of stock issuance can put pressure on prices.

Still, the influx of ETFs suggests that more investors could return interest.

BTC price faces $89K to resistance as Bulls test key level

Despite Monday’s advantages, BTC prices are approaching critical resistance.

According to Ali Martinez, BTC is facing a “$89,000 key resistance cluster,” with its 50-day moving average corresponding to a downward trend.

Rekt Capital added that Bitcoin is testing the 21-week EMA as support. “Recovering 21-EMA as support and Bitcoin can break out to ~$93,500,” the analyst posted on X.

The BTC price reached an intraday high of $88,804 on Monday, but could not exceed $88,000 during previous sessions. The daily closure on March 3rd exists at $92,000.

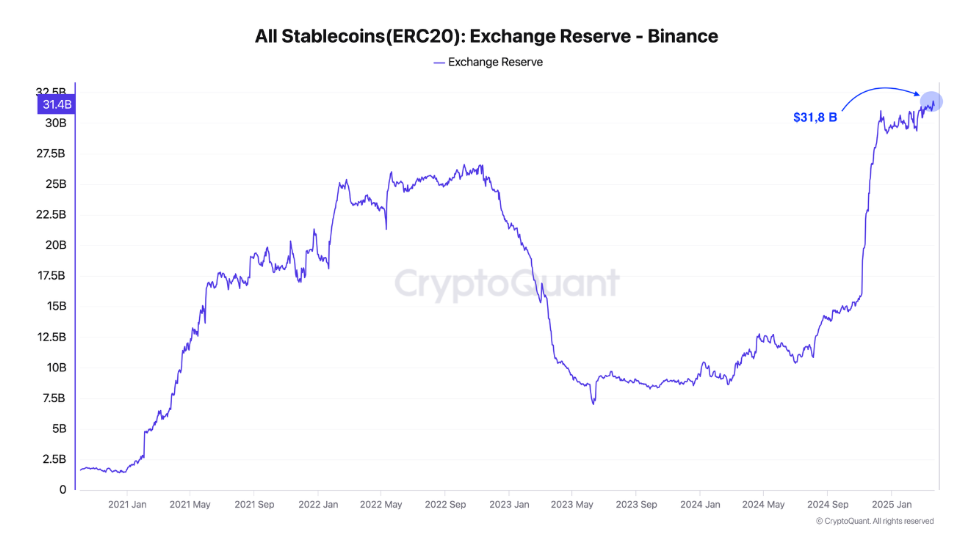

Stablecoin reserves surges as traders see fresh liquidity

On-chain data also points to bullish undercurrents. Cryptoquant reported that Binance’s ERC-20 Stablecoin reserve reached an all-time high of $31 billion.

All Stablecoin (ERC-20) Exchange Reserve Binance Chart | Source: Cryptoquant

The rise in the Stablecoin balance often shows the pressure of buying coming in as traders prepare to enter the market.

Coupled with increasing open interest, this suggests that liquidity could support even more upside down, but also increases risk.

“Leveraged-driven pumps increase liquidation risks” Cryptoquant warned. If the rally loses steam, an overexposed location can cause the sale of the cascade.

Macro factors focus on BTC prices

Economists expect the Core Personal Consumption Expense (PCE) Index, the Federal Reserve’s preferred inflation gauge, will rise 2.7% in February.

If confirmed, this will support Fed Chairman Jerome Powell’s recent statement on temporary inflation and bolster bets on rate reductions in 2025.

Trump’s reported plan to ease some tariffs before April 2nd has also lifted shares.

The S&P 500 futures rose 1.5% on March 24, further easing fears of a full-scale economic slowdown.

BTC price eye $92K – but momentum remains fragile

Bitcoin appears to be in a good position to challenge $92,000, but its momentum remains vulnerable.

Concerns about recessions, excessive AI stock valuations and US federal spending cuts continue to weigh in the broader risk market.

Bitcoin’s short-term pass depends on ETF demand, macro policy shifts, and leveraged trader behavior.

As fluidity is built and open interest rises, volatility can surge in both directions.