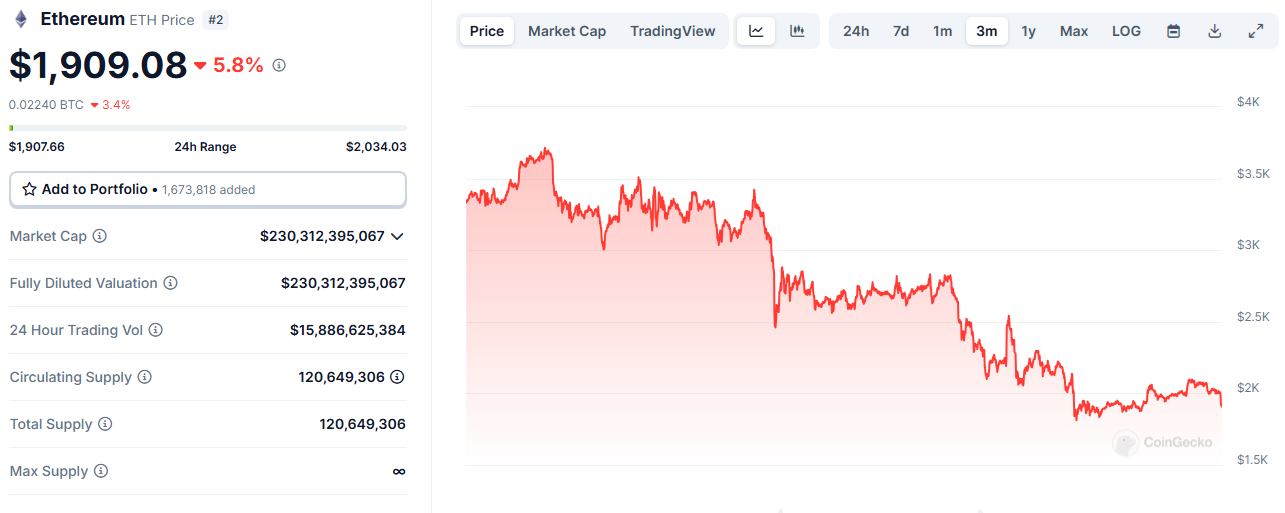

Ethereum (ETH) again fell below $2,000, losing more than 5% overnight. ETH only had a deeper crash than Bitcoin (BTC) and returned to $86,000.

Ethereum (ETH) crashed again, sinking under $2,000 after a slump in the general market. The token has not achieved its promised breakout and is trading at 0.022 BTC. In Fiat’s words, ETH was traded at $1,917.21, close to the low range of three months.

Ethereum (ETH) trades near a 3-month low, but there are signs that whales are accumulating at levels below $2,000. |Source: Coingecko

ETH sentiment remained neutral, with open interest down to $9.9 billion. Derivative traders accumulate liquidity at the $2,040 and $2,100 levels, but ETH can immerse themselves in the $1,800 range to settle long positions before returning to short squeezes.

Whales accumulate less than $2,000 ETH

Despite the market drawdown, ETH still invites whales to buy dip. Tokens are still required for defi, trading or other utility purposes, or as collateral for Defi loans. ETH remains at a crossroads, with 45% of holders in the money, 51% holding unrealized losses and small neutral subsections.

The story for ETH is contradictory, with some stories of tokens becoming obsolete or falling into a low range. But recently Whale accumulation The token indicates that at least a relief gathering is considered possible.

Individual Whale They also trade ETH, like in the case of a single buyer who won a $108 million ETH. Previous example shows a Whale acquisition ETH from retailers on multiple orders from the previous quarter.

Although ETH is not immediately rare, whales accumulate coins that are easily accessible for trading and short-term profits. Holding ETH in a self-controlled wallet is still useful, including staking, lending, and providing liquidity.

ETH is also seeing sales pressure from hackers

ETH remains the most widely used token for parking revenue from hacks and exploits. Some of the ETH from Bibit Exploits may still be washed through distributed services.

Recently, two addresses received 14,064 ETH from Thorchain and Coinflip. They quickly traded tokens on Dai for over $27 million at the price of ETH $1,956. One of the addresses continues receive ETH from Torcaine as the origin of the funds remains unknown.

Hacker traders are extremely aggressive and use decentralized liquidity pools to little consideration for slippage in prices or prices. Unlike trader whales, hackers use the first right moment to sell and move funds.

Ethereum prices remain near record lows

Ethereum prices remain nearing an all-time low, indicating low demand for network services. Because only a few services are widely used, the average transaction is as low as $0.02.

Most of Ethereum’s gas goes to Stablecoin transfers, as well as Uniswap Universal Routers. The general ETH relocation and USDT movement burns around 58 ETH per day from fees, and is the two most important activities on the network. Other types of swap, bridging, or NFTS mint slows down, and fewer projects have been required to organize airdrops with point farming.

The decentralized swap will drop to a price of $0.28, debt borrowing fees will be $0.23, and bridging will be $0.09. Nevertheless, network activity has slowed significantly, with retail users not returning.

Ethereum Network is communicated 310k Daily Active Wallet is at a level that you won’t see after September 2024. At the same time, more addresses are Receive ETHshows spikes from wallets over 203k.

As a result of declining activity, Ethereum inflation continues to rise, splitting at 0.80% for the first time in months. Low but persistent inflation means that the network generates 948K additional ETH in one year. This could continue to lower prices and shift tokens to a lower range.