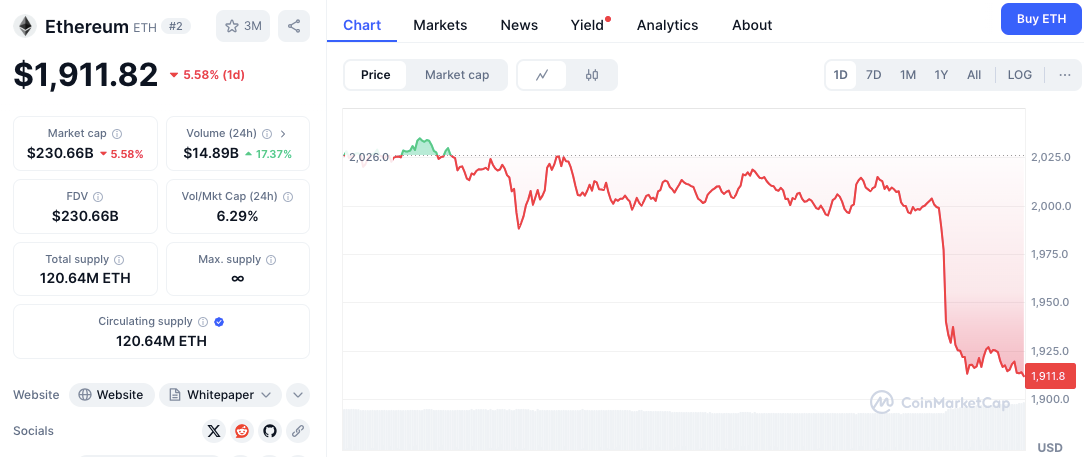

Ethereum (Eth) saw a sharp price drop that shook investors’ trust after relative stability. Cryptocurrency is currently trading at around $1,917, over 5% in the last 24 hours, according to data from CoinmarketCap. The move suggests a potential breakdown from previous horizontal trading ranges, sparking new debate about Ethereum’s short-term direction.

Where did Ethereum find support after drop?

Ethereum prices are currently testing immediate support within the $1,900-$1,910 range. Early chart signs suggest that this area may provide temporary cushioning for further sales pressures.

If this level cannot be held convincingly, the next potential technical support zone will be between $1,875 and $1,880, based on historic price action nearby. A break below that could open the door to test important psychological levels around $1,800.

What resistance levels should I regain to recover for recovery?

For potential recovery attempts, Ethereum faces immediate resistance near the $1,950-1,960 zone. The area will serve as support before the recent sale and will likely be a hurdle along the way.

Related: Will Ethereum lose the edge of deflation as ETH Burns disappear?

More than that, the $2,000 mark stands out as both a significant psychological barrier and a level of involvement in the previous integration phase. Additional resistance is around $2,025-2,030, marking the recent significant intraday highs that bullish traders need to overcome to show stronger momentum.

Technical indicators show attention of ETH bulls

ETH/USD Daily Price Chart, Source: TradingView

Current technical indicators on the daily chart suggest a careful, short-term outlook for ETH. Currently, the relative strength index (RSI) reads around 38.68, below the neutral 50 mark. This reading generally shows a general bearish momentum.

It is not yet a classic “oversold” territory (usually below 30), but it suggests that sellers are currently in control. Recently, a moving average convergence divergence (MACD) indicator has flashed bullish crossover signals. However, price action has not been able to respond positively to this point. Such divergence refers to fundamentally weak purchasing pressure despite the indicator signal.

The Ethereum Derivatives Market Shows Mixed Signals

According to Coinglass data, Ethereum’s activities in the derivatives market reflect a somewhat mixed sentiment. The increase in total trading volume of ETH futures (up 9.63% to $39.06 billion), but in reality, there was a decline in open interest overall (down 3.26% to $22.47 billion). This decline in open interest suggests that several leveraged positions likely closed during the price decline.

Related: Ethereum Foundation ETH Sales: Isn’t the price mover you thought?

Interestingly, the ETH options market saw an increase in activity at the same time. Options trading volume is nearly 30% (topped $666 million). These diverse trends may indicate an increase in hedging activity or speculative play, using options amid declining spot markets.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.