Bitcoin is currently trading between $82,856 and $83,032 at 7:30am ET on Sunday, with a market capitalization of $1.65 trillion and a 24-hour global trade volume of $15.6 billion. Over the past 24 hours, cryptocurrency prices ranged between $81,629 and $83,496.03, down 23.6% from the all-time high on January 20, 2025.

Bitcoin

On the one-hour chart, Bitcoin shows signs of short-term consolidation after the recent bounce from the recent $81,629. Despite the temporary upward momentum, lower highs and lower lows indicate wider cave persistence. The $84,500 resistance remains a significant level, with $81,600 support being important. The volume pattern suggests weak buyer participation, with the green bar not convicted. A breakout of over $83,500 with an increase in volume could indicate a short-term bullish move, but rejection at this level reinforces bearish feelings.

BTC/USD 1H chart via BitStamp on March 30th, 2025.

The four-hour chart gives a clearer view of the recent relief rally from the low of $81,629. Minor volume spikes on sale highlight market uncertainty, but the lack of strong purchase volumes undermines the reliability of the rebound. The large resistance range of $83,500 to $84,000 is extremely important. Failure to violate this zone suggests continuous downside pressure, but breakouts with volume surges may provide a purchase opportunity. Traders should monitor patterns of rejection or bullish confirmation at these levels.

BTC/USD 4H chart via BitStamp on March 30th, 2025.

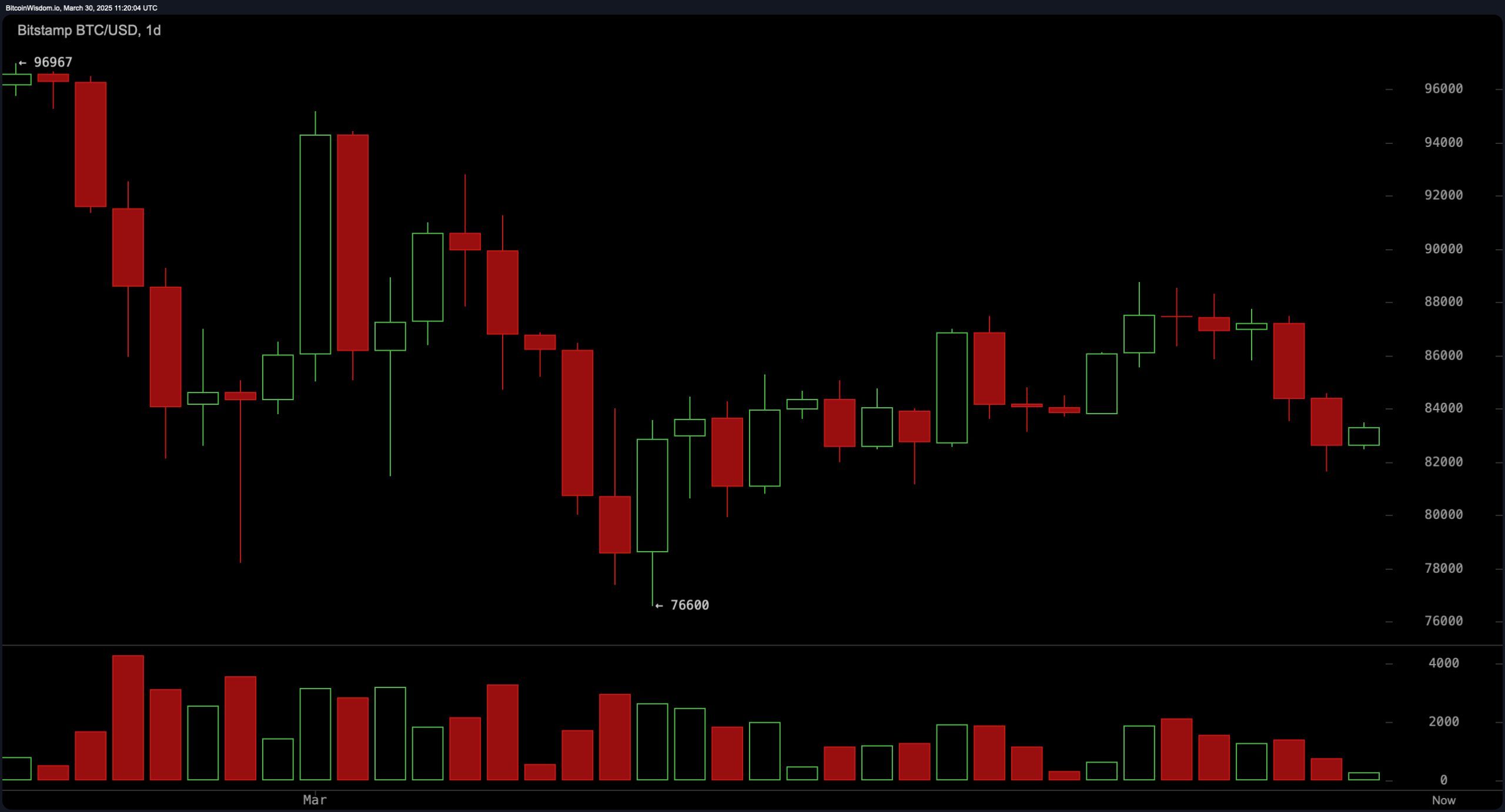

On the daily charts, Bitcoin remained on a defined downtrend, falling from its recent high of 96,967. Clusters of red candles with extended wicks indicate intermittent green candles that show occasional purchase support, but suggest sustained sales pressure. The closest support for $82,000 is currently being tested, but if this level fails it could be a further negative side. Resistance levels between $88,000 and $90,000 pose an additional challenge to bullish momentum. Continuous movements above these zones are supported by increased volume and may indicate a reversal of the trend.

BTC/USD 1D chart via BitStamp on March 30th, 2025.

Oscillator analysis reflects market indecisiveness. The relative strength index (RSI) of 44, the probabilistic of 30, the commodity channel index (CCI) of -54, and the mean direction index (ADX) of 23 all indicate neutral conditions. However, the negative value of the great oscillator of -10 suggests a fundamental bearish pressure. In contrast, a positive value of the Momentum Indicator from a moving average convergence divergence (MACD) of -939 and a Moving Average Convergence Divergence (MACD) of -939 provide some encouragement to buyers. This divergence of this signal emphasizes the need for further confirmation before establishing directional bias.

Fibonacci retracement levels provide valuable reference points over all periods. On the daily chart, key levels from a height of $96,967 to $76,600 low include $91,607 (23.6%), $88,758 (38.2%), $86,784 (50%), $84,811 (61.8%) and 82,022 (78.6%). On the four-hour chart, it offers low results of $88,772 and $81,629, with $87,148 (23.6%), $85,999 (38.2%), $85,201 (50%), $84,404 (61.8%) and 83,069 (78.6%). Similarly, retracement levels for the 1-hour chart range from a lowest price of $84,561 to $81,629, $83,869 (23.6%) (38.2%), $83,095 (50%), $82,749 (78%), $82 (78%), $83,440 (38.2%), $83,440 (38.2%), $83,440 (38.2%), $83,440 (38.2%), $83,440 (38.2%), $83,440 (38.2%), $83,440 (38.2%). These levels are key to identifying potential reversals or continuance points.

Moving averages (MAS) mainly draw bearish pictures. All short- and long-term exponential moving averages (EMA) and simple moving averages (SMA) show negative emotions. The EMA (10) costs $84,808 and the SMA (10) costs $85,331, both reinforcing short-term bearish feelings. A long-term average including an EMA of $88,207 (50) and an SMA of $88,799 (50) further validates this view. Additionally, the EMA (200) was $85,496 and the SMA (200) at $85,938, highlighting the lack of bullish belief in the market. Downward pressure can last until Bitcoin can regain these levels.

Bull Verdict:

If Bitcoin exceeds the $84,000 resistance level, a volume surge could unfold a bullish scenario. Verification from the oscillator, especially the momentum and MACD, may provide further verification to the buyer. If prices are maintained above the main moving average, then a push to the next resistance at $88,000 could be. However, the bull must pay attention to the rejection of resistance, which could negate the upward momentum.

Bear Verdict:

The bearish outlook remains dominant, with Bitcoin struggling to regain its critical resistance level. The persistent rejection of nearly $84,000 is combined with a negative bias from most moving averages, suggesting additional negative side risk. If support is a $81,600 break, the seller can target lower levels at $76,600 as the next major support. The path with minimal resistance remains downward until meaningful purchase pressure occurs.