Recently, it is possible that the seemingly bullish Bitcoin (BTC) will become traps analysis Provided by the renowned Chartist Peter Brandt.

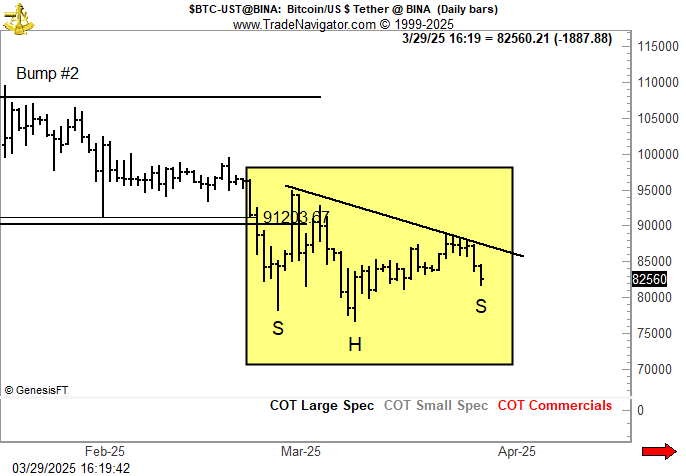

The largest cryptocurrencies by market capitalization form a reverse head and shoulder pattern on daily charts, usually considered to be a sign of a bullish reversal. However, there is a catch. The pattern currently under development for Bitcoin prices is a downward neckline.

The brand, who has over 40 years of experience as a commodity trader, says he prefers the H&S pattern with the horizontal neckline because he is more reliable.

The downward neckline means that the bullish momentum of cryptocurrency is probably declining due to a lack of aggressive purchases. Therefore, future breakouts should not be ruled out as fake outs and prices will return below the pattern’s neckline.

Back to $60,000?

Famous trader Josh Orschuwitz has also been paying attention to the bullish pattern of recent social media posts on one-day charts. He seems confident this could be the last chance for the Bulls to step up. Otherwise, Bitcoin is at risk of returning to the $60,000 to $70,000 range.

1d $ btc

Here’s the Bulls’ final call at IH&S.

When you enter April 2nd, you will see the amount of pricing news already available, or you will see the amount of pricing news already on pic.twitter.com/4pqwuva8oq.

– #333kbyjuly2025 (@carpenoctom) March 29, 2025

According to data provided by Coingecko, Bitcoin is currently trading at $83,091 after losing 0.7% in the last 24 hours. Earlier this Sunday, cryptocurrency reached an intraday low of $81,769.

Cryptocurrency is struggling to revive its bullish momentum, and global trade tensions are putting extreme pressure on risk-on assets.