Ethereum Prices for Freefall: Brutal Reality Check for 2025

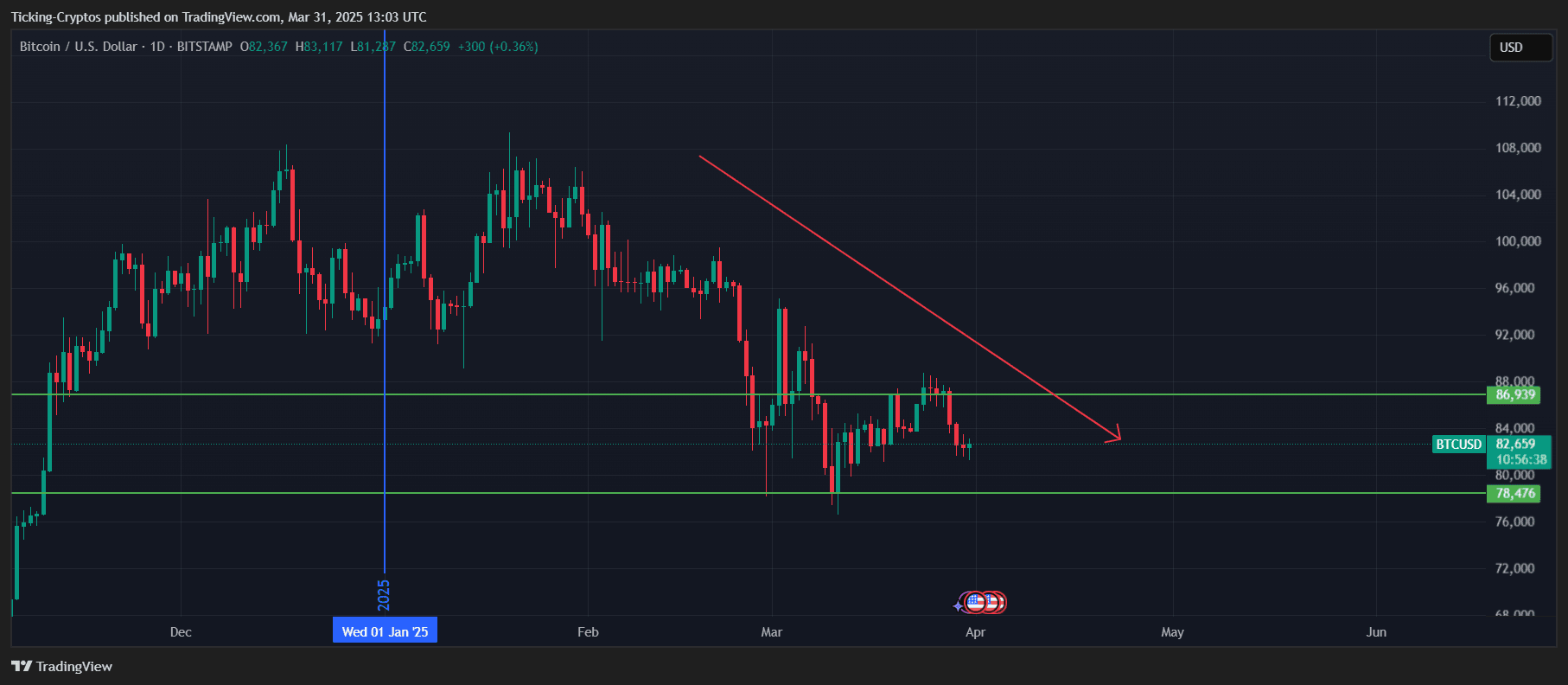

The crypto market has been bleeding red over the past few weeks, with its total market capitalization plunging by more than 20%. Meanwhile, Bitcoin made the headlines by temporarily touching on its all-time high of $109,000, before retreating violently to around $81,000.

BTC/USD 1 Day Chart – TradingView

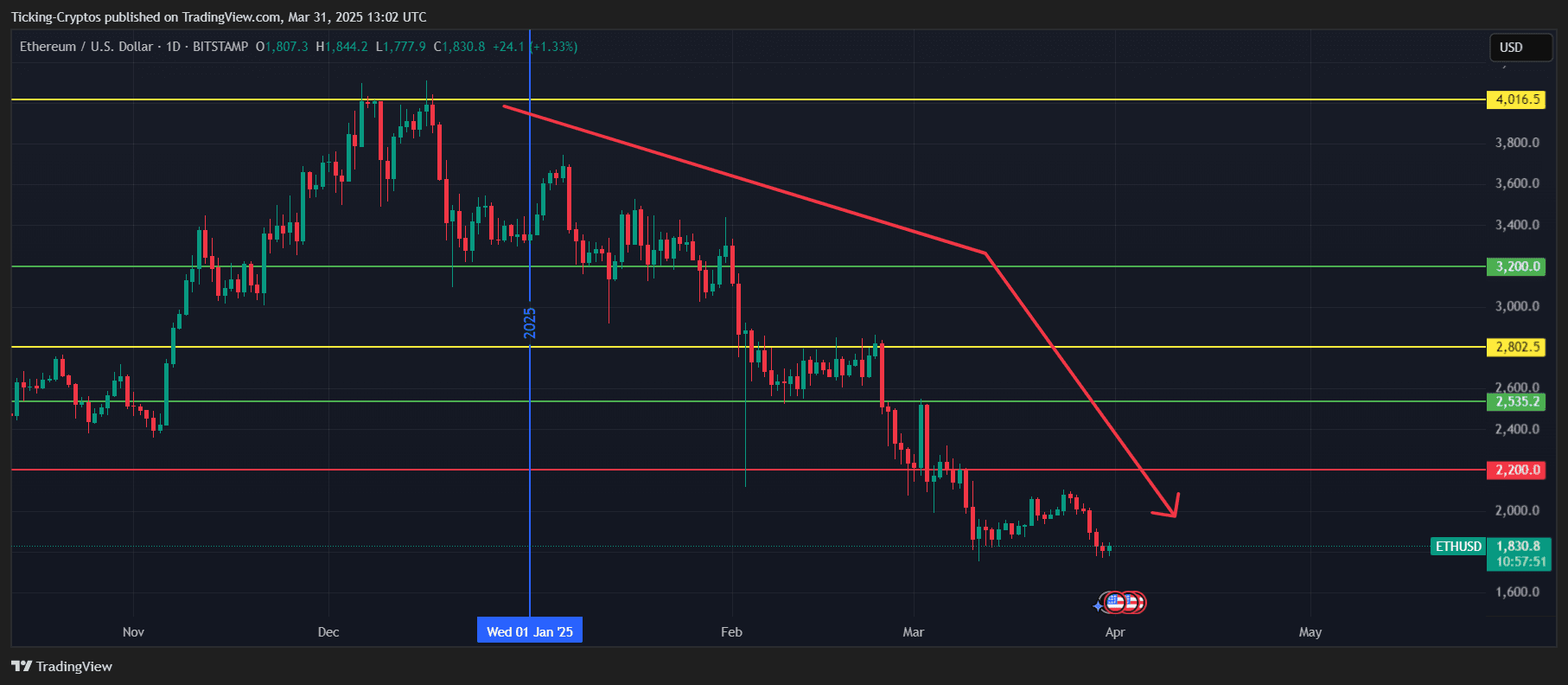

The price performance of Ethereum in 2025 is nothing short of miserable. ETH crashed more than 50% since the start of the year, plunging from its highest price of $4,000 in December 2024 to just $1,820. This dramatic downturn led many Ethereum fans to question their investment decisions and desperately searched Ethereum price prediction guidance.

ETH/USD 1-Day Chart – TradingView

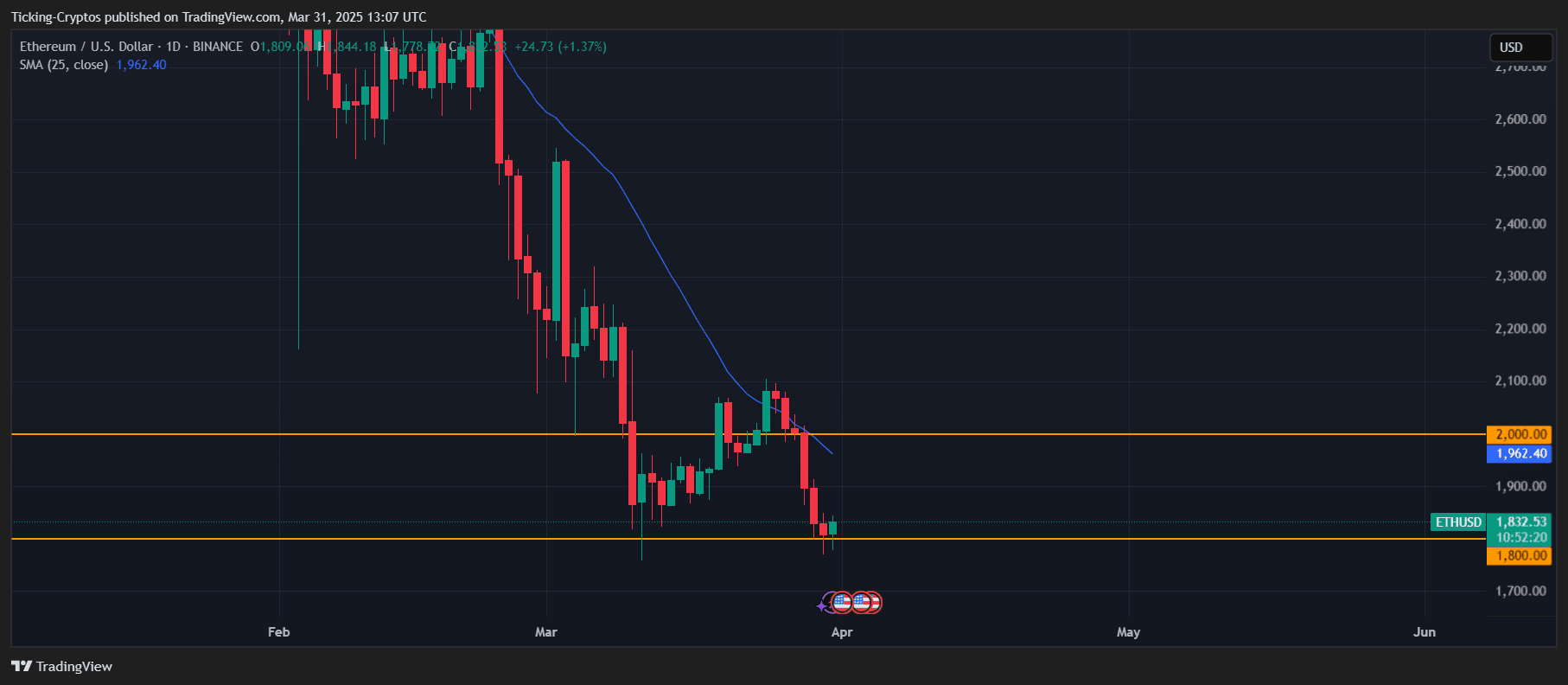

Important $1,800 Support: Ethereum’s Last Line of Defense

The $1,800 price level is a very strong support area for Ethereum. This psychological and technical level has historically served as a decisive battlefield between bulls and bears. ETH prices are currently at risk at this threshold, so traders are breathless looking to see how the market breaks.

ETH/USD 1-Day Chart – TradingView

Technical analysts point out that $1,800 in support has been held multiple times during previous market slump. However, the current fierceness of sales pressure raises serious questions about whether this critical level will continue to be held in the face of wider market weakness.

Ethereum price forecast: Rebound or further descent?

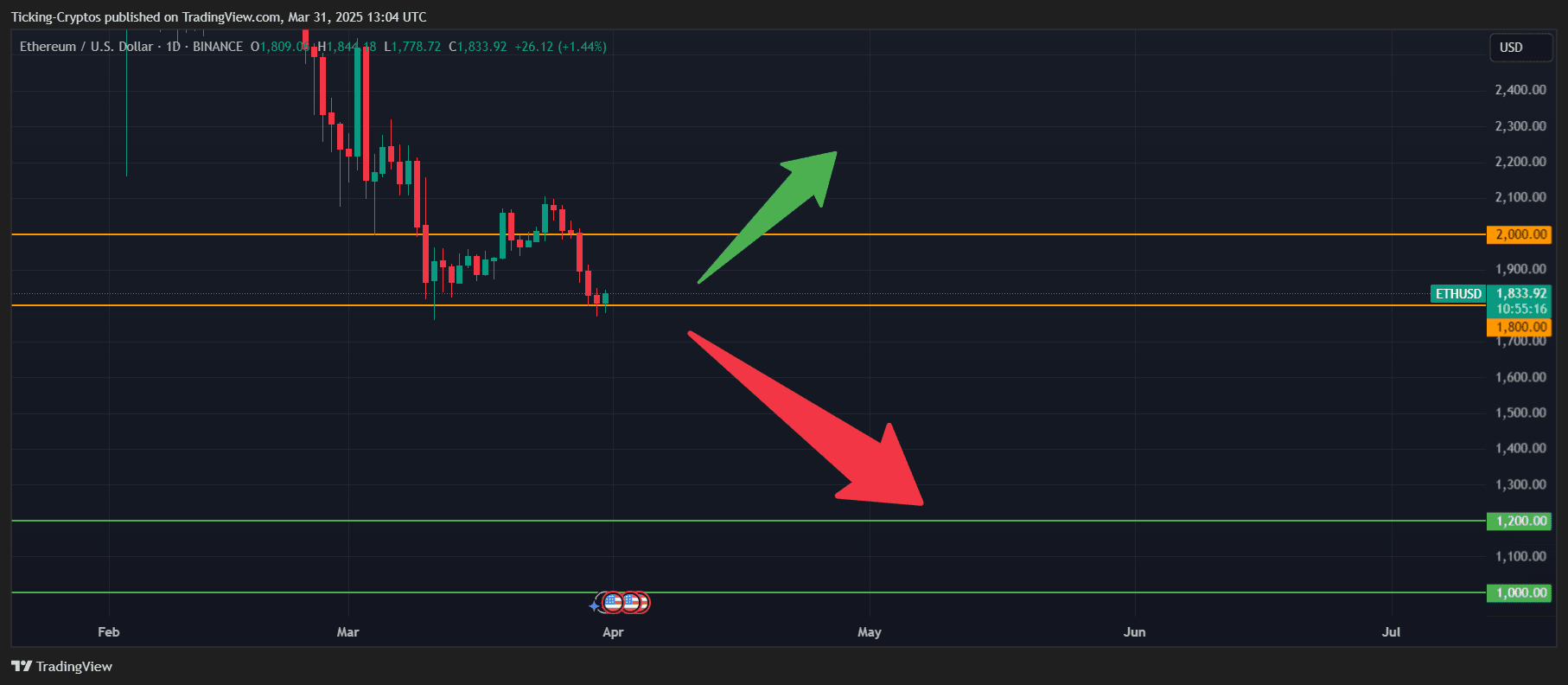

Two different scenarios are emerging for the price action of Ethereum in the near future.

Scenario 1: ETH Price Rebounds from $1,800

If Ethereum could rebound from its current price of $1,800, then the ETH price could be expected to regain the psychologically significant $2,000. This represents a modest 10% recovery, potentially indicating that the worst selloffs are behind us.

A compelling move above $2,000 could further strengthen buyer confidence and lead to additional benefits, but significant resistance is expected in the $2,200-$2,400 range based on previous price actions.

Scenario 2: ETH Prices are below support

More often than not, it includes a critical support level violation of $1,800. It is expected that Ethereum will crash further to $1,400, especially if the seller pushes the price to under $1,750, and ETH closes daily candles under $1,600.

In this bearish scenario, the next major support zone is between $1,000 and $1,200, which is not seen from the previous Crypto Winter depths. Analysts believe this scenario is unlikely to be less than rebound, but careful risk management suggests that investors need to prepare for this possibility.

ETH/USD 1-Day Chart – TradingView

How to Protect Your ETH Investment Now

The crash to $1,000 represents a lesser Ethereum price forecast scenario, but responsible investors need to take precautions. Setting up a stop loss order just below $1,750 provides protection against catastrophic losses if a support level of $1,800 fails.

For those with a long-term perspective on the potential price of Ethereum, this current weakness may represent an opportunity for accumulation, but can only afford to lose capital and implement appropriate risk management strategies.