Binance continues to draw out higher Stablecoin deposits, reaching record levels of ERC-20 reserves. Exchange is the leader in leveraged trading. Here, stubcoins are the key to building new positions.

Binance continues to be the leader of Stablecoin Remerves as most traders chose market operators as their main trading venue. The influx of Stablecoins boosted the derivative market and set the stage for peak liquidity available.

The inflow of stubcoin into Binance was vertical in the last few months of 2024, but growth slowed in the first quarter of 2024. Despite the slowdown in the market, stubcoin supply remains high, with assets standing by the opportunity to trade. Stablecoins have expanded as a way to reduce risk. During this market cycle, stubcoin supply is growing, even as the crypto market struggles with a 30% drawdown from its peak.

Binance’s Stablecoins expanded to above the bull market in 2021, based on demand for derivative trading positions. |Source: Cryptoquant

The influx of stubcoins reached primarily derivative exchanges, with supply peaking at tokens above 47B. Since most activities relied on the leveraged location of BTC and ETH, spot exchanges attracted a much lower share of Stablecoin’s sales.

Stablecoin inflows increase derivative transactions

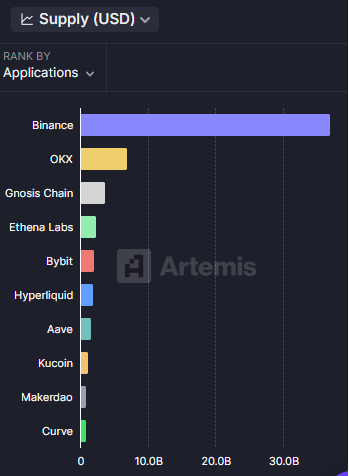

The total supply of stubcoin on the exchange reached various types of 45B tokens, with USDT and USDC still being the most common. Binance carries over 33B tokens, including centrally controlled FDUSD. Binance’s USDC totals $3.38 billion, USDT $29.4 billion, and FDUSD another $1.5 billion. The exchange also has the most active trading pair of USDT, earning $16.7 billion in 24-hour volume.

Binance Trading is the main use case for Stablecoins, with up to $330 billion inflows from USDT, USDC, FDUSD and other major dollar-based tokens. |Source: Artemis

The exchange reflects regional restrictions and is increasing the use of regulated USDC tokens in the Eurozone while discontinuing USDT products. This shift has not affected the general influx of tokens. Binance has achieved more than $1.7 billion in daily trading volumes, boosted by native BNB tokens and the value of multiple Stablecoin markets.

The market also has 5.34% of all USDC transactions, and has the most active trading pair against BTC. The recent influx of stubcoin has primarily increased the liquidity and spot market in the derivatives BTC market. Inflows into centralized exchanges follow the general expansion of stable rocks to tokens above 229B, depending on which assets are counted. Most stubcoins are covered in dollars, with the alternative currency being around $2 billion.

Stablecoins is one of Binance’s major reserve assets. The exchange carries over $133 billion in total assets based on the transparency report. USDT reserve is 104% of the user’s bill. The USDC market is even more over-species, claiming that 161% of users. Excess reserves increase with fees, liquidation costs and other user-based payments.

Binance is still there too reading Carries the most important share of the open profits of assets, with the assets being centralized exchange, derivatives.

BNB Smart Chain Carries 7bs with Stablecoins

A decentralized binance ecosystem carries 7B or more with bridge or native stubcoins. This chain is the fourth largest network with stable supply expansion.

Over 53% of all stubcoins are still in Ethereum. The ERC-20 stub coins are also the most frequently deposited. Tron carries over 28% of total supply, while Solana has over 10B in USDC or 5.4% of total supply.

Three major Stablecoins on the BNB chain, USDT, USDC and FDUSD constitute a supply of approximately 5.9b, exceeding 2.2b in the last 12 months. The rest of the balance is for other small bridge-type stablecoins.

The BNB Smart Chain is used for simple transfers and payments via Stablecoins. USDT Transfer makes that $4.5 billiontravelling around $500 million in USDC, FDUSD has around $60 million in daily transfers. Most senders in BNB Smart chains prefer USDT, the main source of liquidity for payment or decentralized swap.

For now, the growth of the BNB smart chain has lagged behind the success of Binance’s derivatives market.