The Ethereum ETF closed for another week in the red amid continuing his investor’s hesitation, recording a net spill.

In particular, there was no net inflow for the week since the end of February.

Ethereum ETFs are facing stable spills

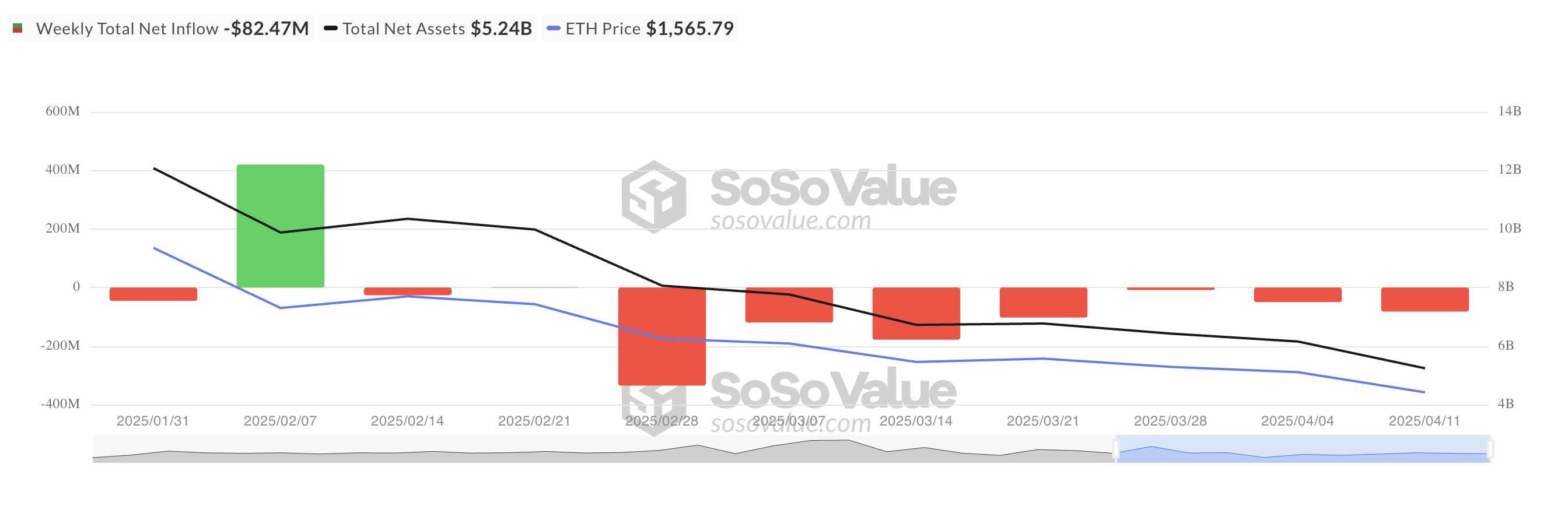

The Ethereum Backed ETF has recorded a net outflow for seven consecutive weeks, highlighting its sustained institutional he on assets.

This week alone, net outflows from Spot ETH ETFs totaled $82.47 million, a 39% surge from the $49 million recorded in the previous week’s outflow.

All Ethereum spot ETF net flow. Source: SosoValue

The selling pressure on coins has skyrocketed as the institutional presence in the ETH market has steadily declined.

Over the past week, ETH prices have fallen by 11%. A stable outflow from coin-backed funds suggests that downward momentum could continue, increasing the chances of prices falling below $1,500.

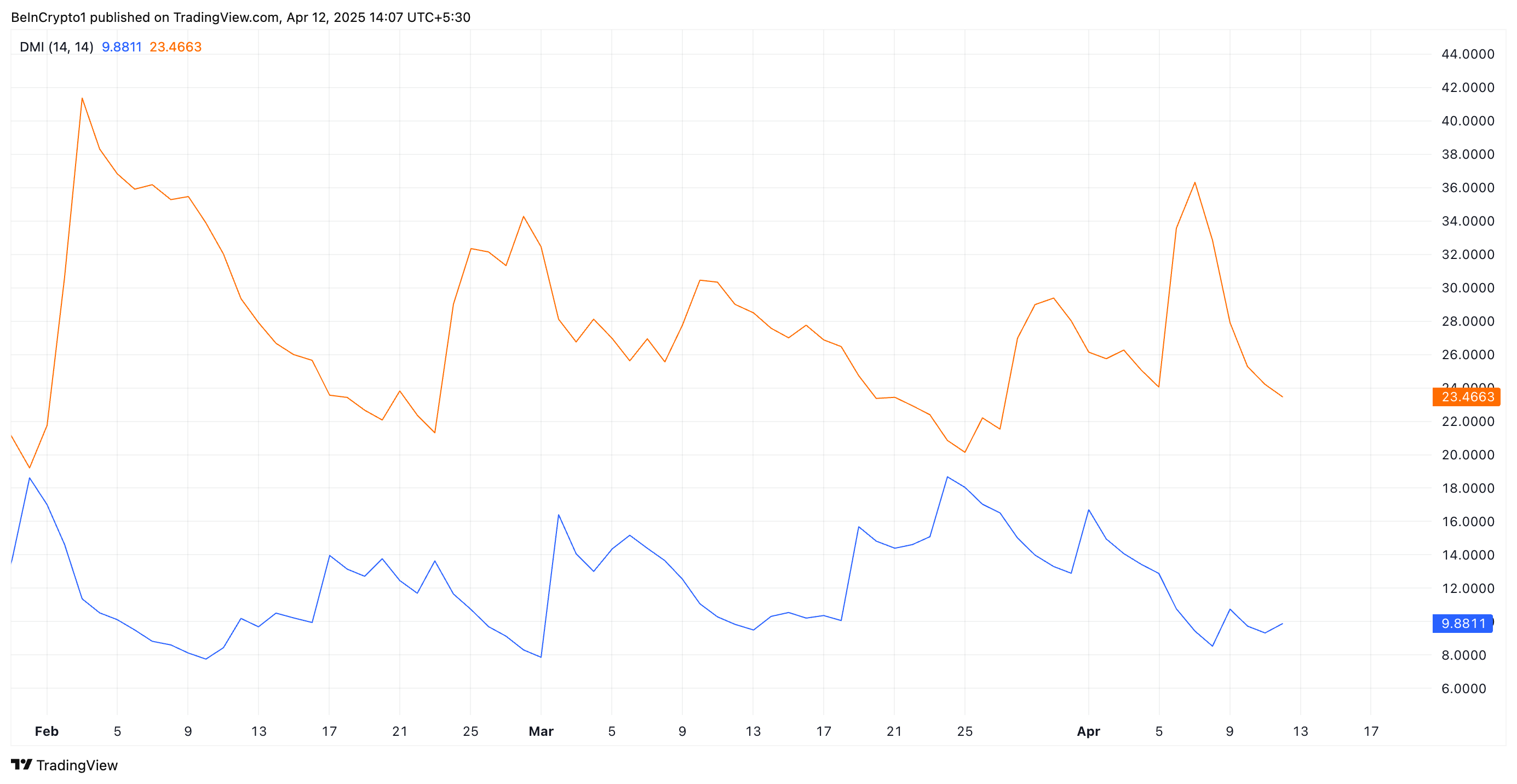

The price list shows that technology indicators remain bearish, confirming increasing pressure from the market’s seller side. For example, during pressing, the measurements from the directional movement index (DMI) of ETH indicate the positive directional index (+DI) below the negative directional index (-DI).

ETH DMI. Source: TradingView

The DMI indicator measures the strength of an asset’s price trends. It consists of two rows: +DI, which represents the upward price movement, and -DI, which represents the downward price movement.

Like ETH, when +DI is placed under -DI, the market tends to be bearish, and downward price movements dominate market sentiment.

Ethereum prices could fall below $1,500

The lack of institutional capital could slow down significant rebounds in ETH prices and could further attenuate the short-term outlook for recovery. If demand is tilted further, ETH can break out of the narrow range and follow the downward trend.

In this scenario, Altcoin could fall below $1,500 and reach $1,395.

ETH price analysis. Source: TradingView

However, if ETH witnesses a positive change in the surge in sentiment and demand, its price could rise to $2,114.