Data on the chain shows that Bitcoin has recently noticed a surge in the new all-time high (ATH), but the monthly inflows have been considerably slower.

Bitcoin has noticed that the cap is growing at a significantly slower rate

Bitcoin Realization Cap has set up a new record, according to data from on-chain analytics company GlassNode. The “realized cap” here refers to the capitalization model of Bitcoin that calculates the total value of an asset by assuming that the “actual” value of a token in circulation equals the spot price that was last traded on the network.

The final transaction for a particular coin is likely to represent the last point where the hand has been changed, so the price on transfer indicates the current cost base of the coin.

The realized cap essentially determines the amount of capital the investor has used to purchase Bitcoin, as it summarises this acquisition value of all tokens in the distribution supply.

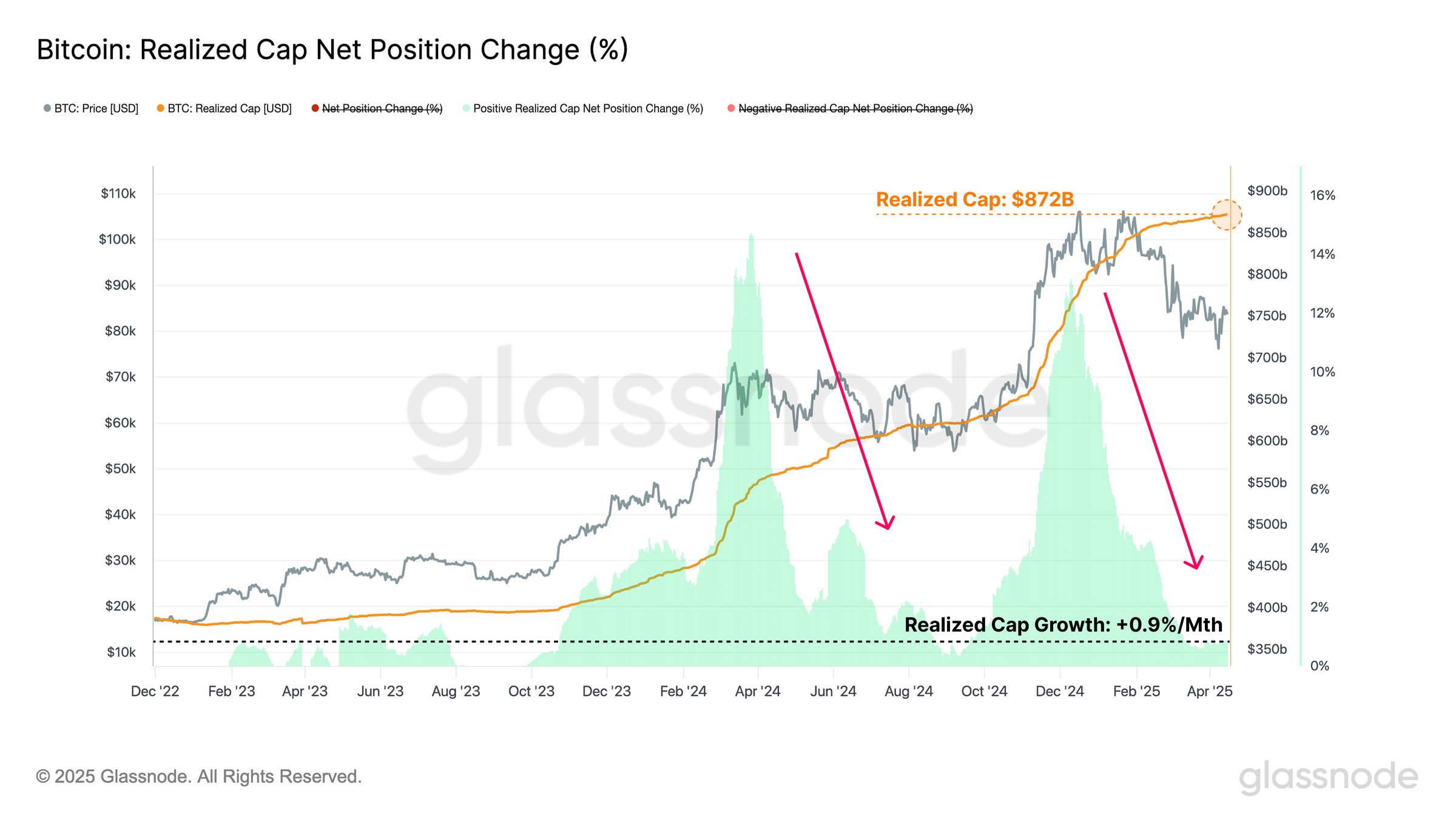

Now, here is a chart of indicators shared by analytics companies that show value trends over the past few years.

As shown in the graph above, Bitcoin Real Two Cap has been tracking uptrends for a while. Every time the indicator value rises, it means that net capital is flowing into cryptocurrency. Therefore, a long-term surge means that BTC enjoys a continuous influx.

That said, capital flows in without breaks, but growth rates fluctuate with cycles. The chart shows that the realized cap rose particularly sharply during the first quarter of 2024 and two periods of Q4 2024.

After the first quarter phase, capital inflows slowed rapidly, and so far it appears that Q4 2024 is looking at something similar. At the height of December inflows, metrics’ growth rate was around 13% per month. Today, this value has dropped to just 0.9% per month.

Of course, growth is still continuing, and the indicators were able to set a new record of $872 billion. However, as GlassNode explained, slowing down could indicate “a softening of investor appetite – a risk-off sentiment in signaling.”

Both periods of last year’s fresh capital inflow coincided with Bitcoin bull rally, but the slowing phase between the two led to a bearish integration of cryptocurrency.

The latest decline in CAP growth realized has thus far resulted in a significant drawdown in asset prices. Given last year’s trends, it’s possible that a proper reversal will not occur in BTC until the metric catches a sharper uptrend.

BTC price

Bitcoin has been working on sideways for the past few days as its price still floats at the $84,700 mark.

Dall-E, Glassnode.com featured images, tradingView.com charts