This is a segment of the Forward Guidance Newsletter. Subscribe to read the full edition.

This week is one of the biggest things we’ve done in a while, for the release of economic data.

Let’s run some charts and takeout in the spirit of all this data.

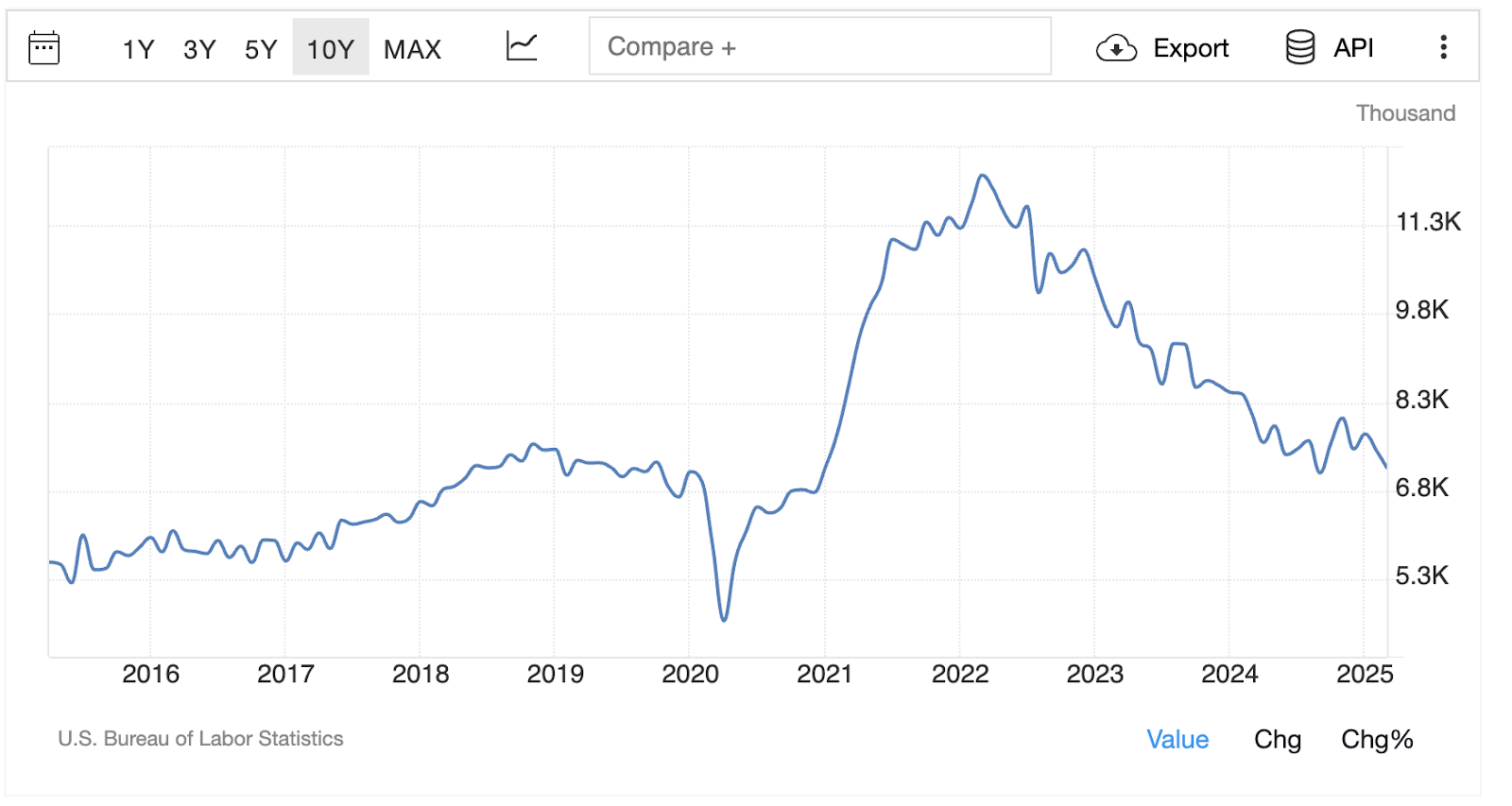

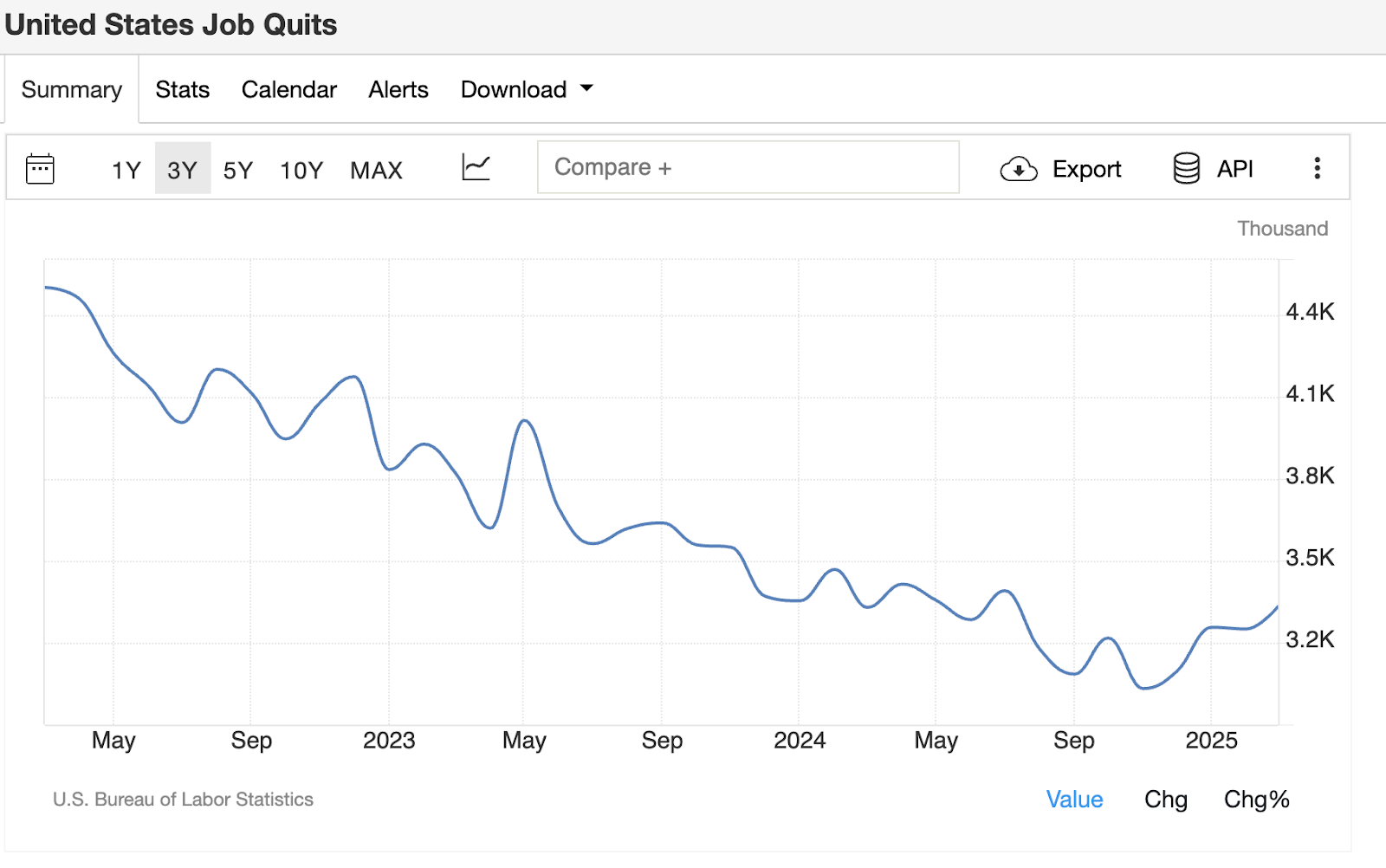

Jolts Report

On Tuesday we received our job openings and labor turnover investigation (JOLTS) report. It was a mixture.

On one side, after several months of positive surprises, the opening of the work missed the flaws and began to roll.

Conversely, we have seen the Quits rate actually rise, suggesting an increase in confidence in the job market by individuals willing to quit their jobs and find something better elsewhere.

It is very rare to see these two prints branch out. I think we need to look at Friday’s employment report to get a cleaner read on the labour market direction, which is a key driver of the Fed’s response function.

GDP Print

As mentioned in yesterday’s newsletter, I received the first look of the Q1 GDP print. This was also very mixed. The topline numbers for quarters beyond the quarter hidden some interesting insights:

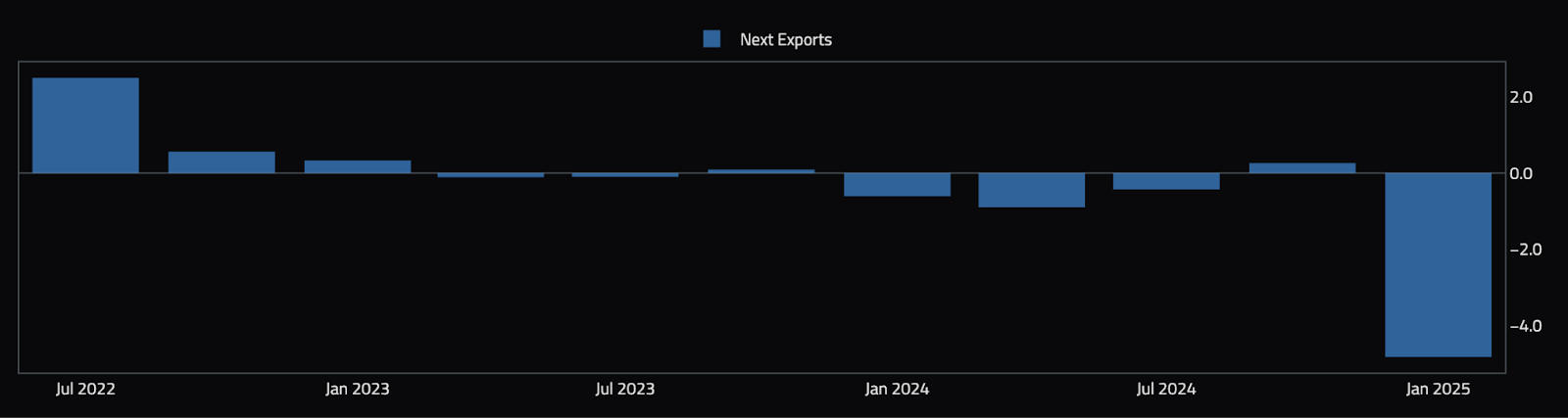

The big driver was primarily due to a drop in net exports due to a significant increase in imports. It mechanically reduces GDP growth.

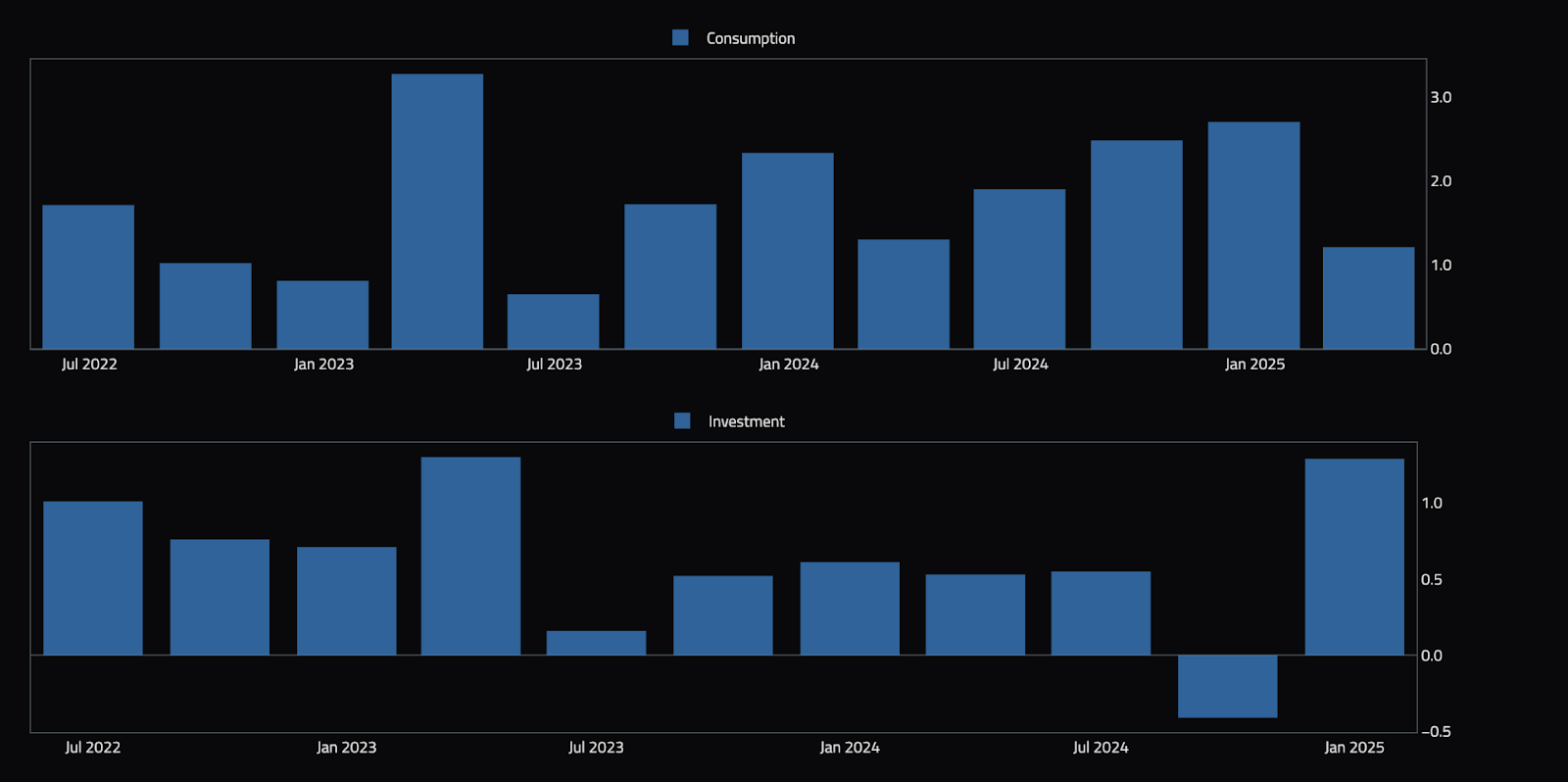

However, looking at the more important components of GDP, consumption has been properly postponed and investment has actually skyrocketed!

This suggests something I’ve been thinking about recently. In other words, tariffs may be creating mirages on hard data. This mirage creates the emergence of a strong economy for all the tariffs that arise from both consumers and businesses looking to buy goods before the tariffs really begin.

Core PCE Print

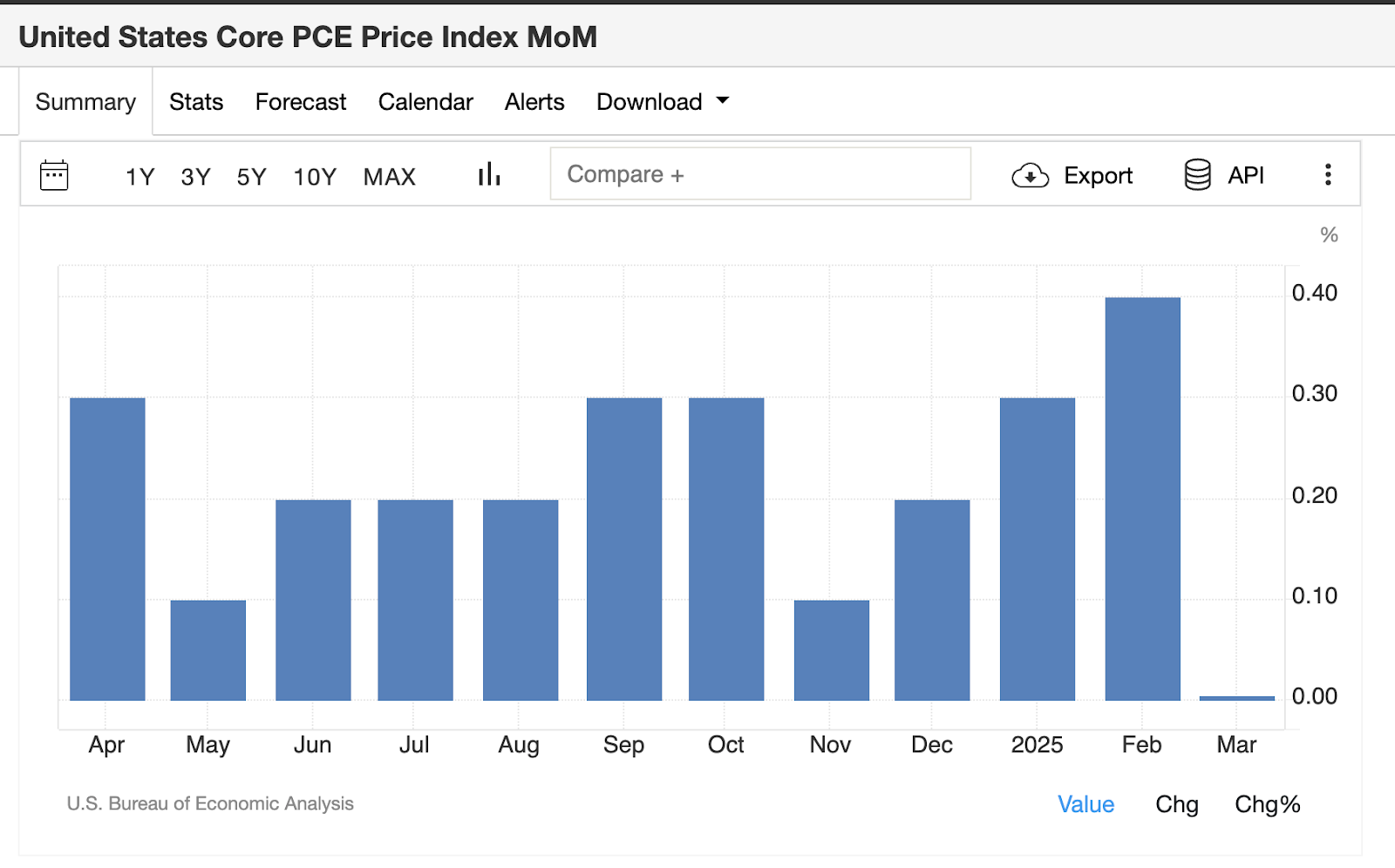

I also got a Core Personal Consumption Expense (PCE) print. This has arrived at 0% for a month (consensus expectations of 0.1%)!

This kind of data is on a quick truck where inflation returns to targets, if you’re not afraid of tariff-related inflation, sheds light on how the Fed can cut crazy interest rates.

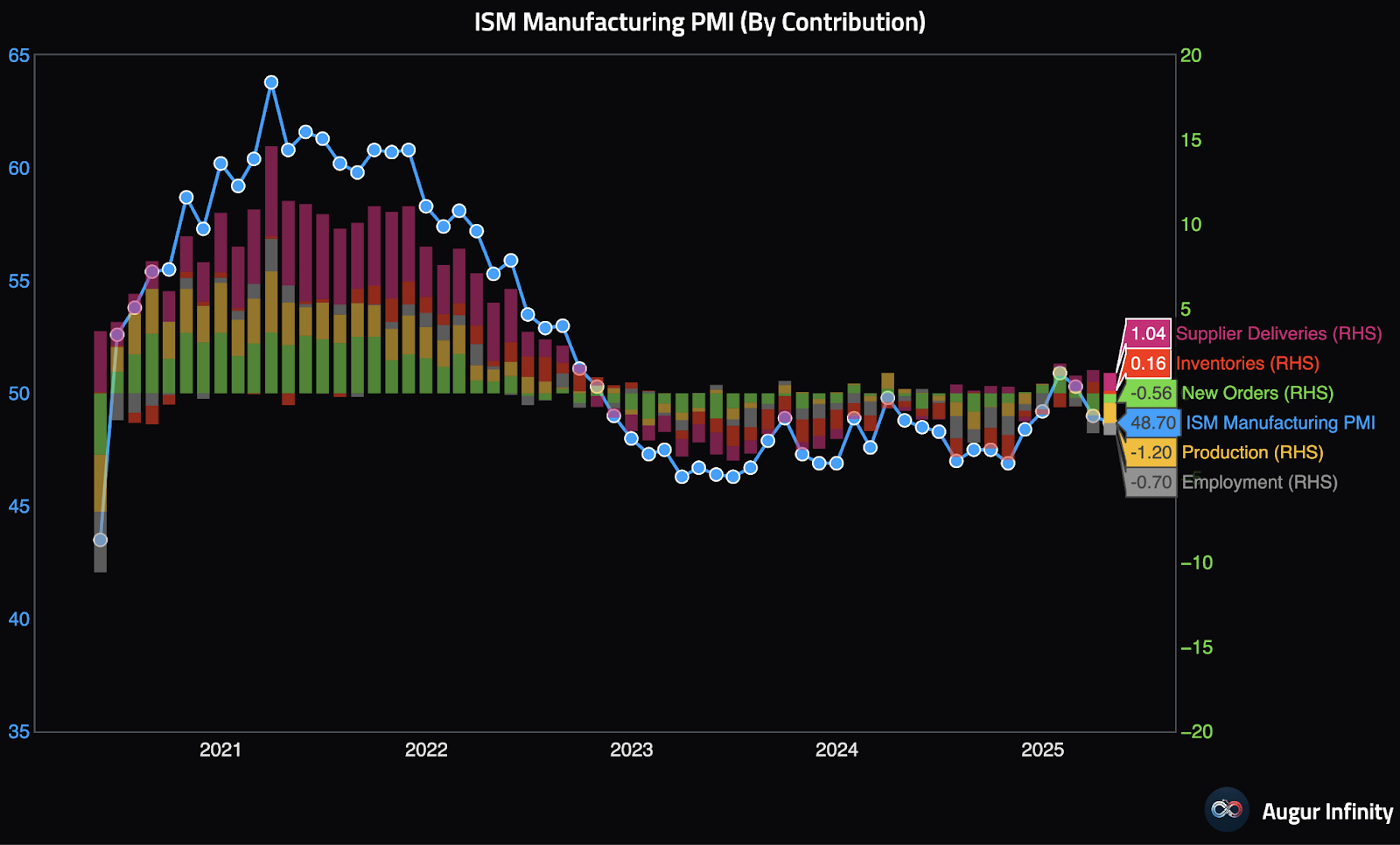

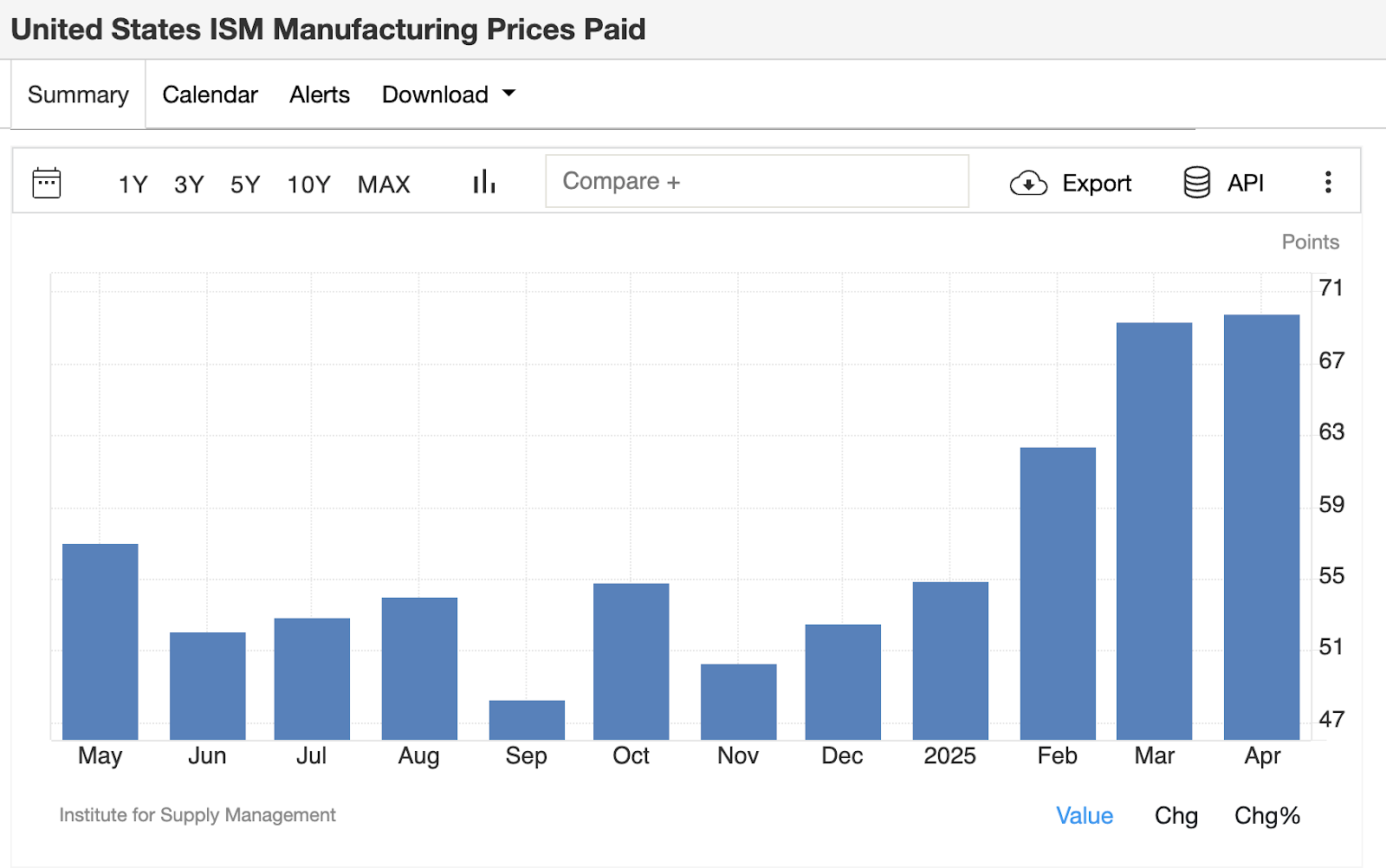

ISM Survey

Finally, today we saw the results of a PMI survey on ISM manufacturing. This provides a major look at how the economy is digesting tariff wars.