Bitcoin spent most of the week within strict integration. However, unlike previous integrations, this has a bullish undertone. Price actions that form a potential structural shift beyond key support levels make traders wary of breakout movements.

The recent price action for Bitcoin (BTC) has been marked by a decline in volatility and a decrease in volume, but this may not be a sign of a weakness. Instead, the technical structure and support dynamics suggest that the market is being wound up before the next move. Prices exceed key support zones, and volume behavior is a feature of accumulation and may set breakout stages.

Important technical points

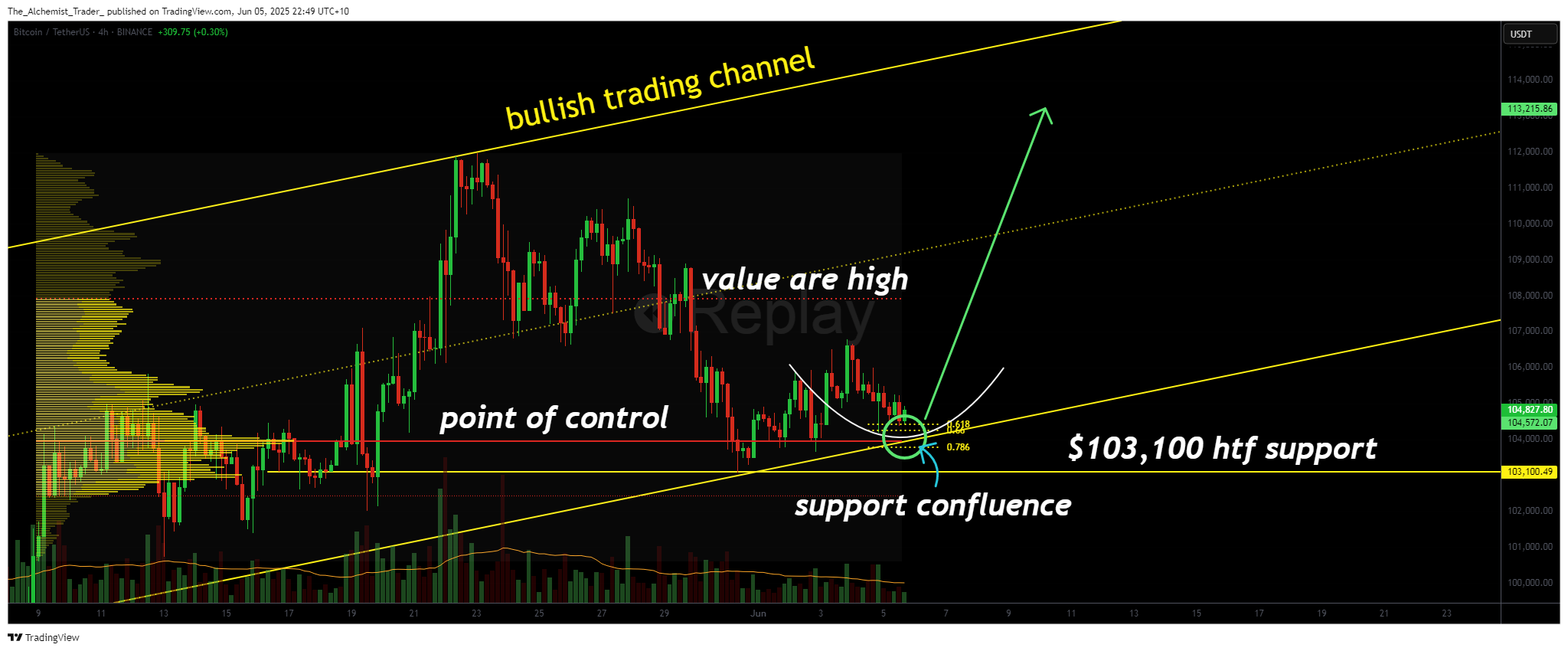

- Control support points: Bitcoin is held above the POC, which follows both the low bull channel and the retracement of the 0.618 Fibonacci.

- Round bottom formation: The price structure of the 4-hour chart has been transformed into a round bottom pattern. It is often a sign of upward momentum.

- A decrease in volume indicates accumulation: When prices exceed support, volume is reduced as it is a general signal of pre-inflammatory accumulation.

BTCUSDT (4H) Chart, Source: TradingView

Bitcoin is integrated within a narrow range, but the location of this range is important. Instead of compressing under resistance or within neutral zones, the price lies on a technically strong support cluster. Points of control, the highest trading volume price level coincides with channel low support and 0.618 Fibonacci retracement, creating a robust zone that is held through multiple retests.

You might like it too: Light chain ai grabs a spot on the watchlist while waiting for a market shift where litecoin never comes

In the 4-hour time frame, candles have been consistently closed above this level, indicating that buyers are guarding the zone. The price structure gradually forms what appears to be a round bottom, suggesting the construction of inversion patterns and strengths with potential support.

During this period, the volume is tapered. This is a general feature of the accumulation stage. Typically, such low-capacity compression resolves with a sharp-directed breakout when the volume re-enters the market. For Bitcoin, recovery of the height of the value area is the first signal of strength. This level has acted as a ceiling in recent weeks and marks the current volume profile limit.

What to expect from future price action

If Bitcoin continues to hold on top of the POC and sees a breakout on the volume, it could potentially be a push to a new all-time high. Until then, traders will need to closely monitor their volume. Spikes can mark the end of this accumulation stage and the beginning of a major movement.

read more: Punisher Coin Prediction: How this new Memecoin will surpass Doge, Pepe