After multiple failed attempts to exceed $100,000 resistance, Bitcoin has been integrated within tightening ranges and shows signs of distribution. The market is sandwiched between two liquidity zones. Buyers over $10,000 and sell sides are under $100,000, but prices are slowly heading towards a lower boundary.

As seen with RSI, momentum fades as seen with RSI declines in both daily and 4H time frames, suggesting that bearish pressure is gaining control.

Shayan Market

Daily Charts

Bitcoin remains stuck in a broader integration pattern, forming a descending triangle just below the main resistance level. The RSI holds around 46, and the price still outperforms the key trend line drawn in orange. This structure reflects classical reaccumulation or distribution stages.

If the Bulls are convicted and unable to regain $108,000, the ascending trendline is more likely to be a magnet. Additionally, the orange 100-day MA and the blue 200-day MA are still heading up, but narrowing near the $95,000 area, indicating a slower trending intensity.

The daily range of $10,000 to $100,000 is important. So far, buyers have absorbed dips into the $101,000-$103,000 zone, but the highs have been lower and they are unable to flip through the $100,000 area, suggesting that the market may be preparing a deeper liquidity sweep.

4-hour chart

In the 4-hour time frame, price action formed a distinct descending channel. The lower highest value indicates consistent bear pressure, but the $103.5,000 support has been repeatedly tested.

This is often a bearish continuation pattern, with momentum leaning towards the negative side as it has an RSI of around 41. They were unable to break the Fair Value Gap (FVG) to around $10,000 and did not test it, making sure sellers are effectively defending premium levels.

Currently, market participants can expect to quickly sweep the marked double-seller side liquidity levels of around $102,000 and $103,000. Breaks and closes below these levels can run towards major daily demand in the $100,000 area. Meanwhile, an up breakout above $110K must be started convincingly from the retrieval of the FVG zone to overturn short-term emotions.

On-Chain Analysis

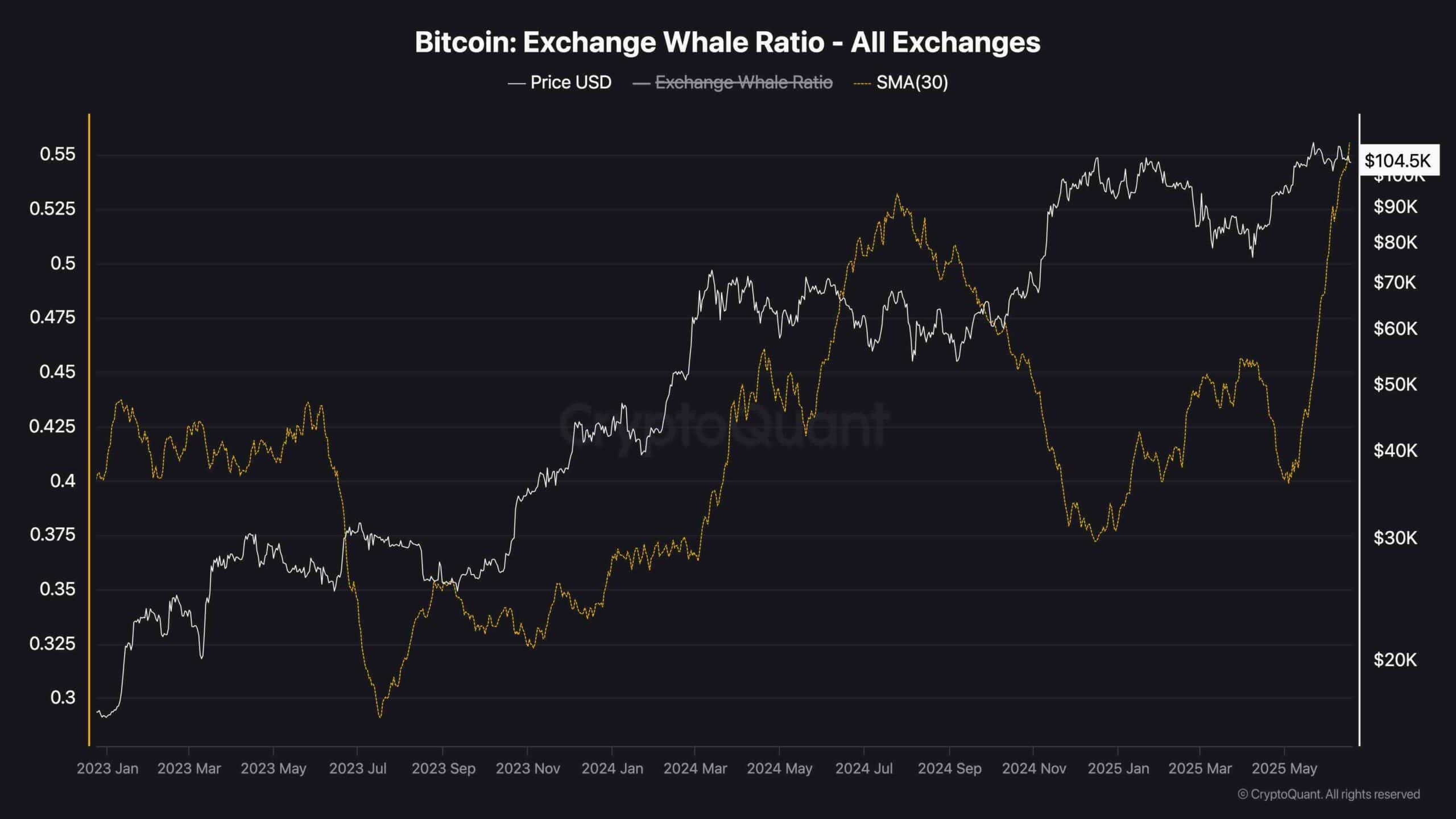

Replace the whale ratio

The replacement whale ratio has skyrocketed above 0.55, being the highest point in more than a year and is usually considered a warning signal. This metric measures the percentage of the top 10 inflows to the total inflow of exchanges. Historically, an increase in whale ratio means that large holders are becoming more and more active in exchanges, and may be preparing for sale. This shift often precedes corrections or sharp volatility, especially when retail activity is cooled.

Combining this with stagnant price actions below important resistance suggests a careful distribution of current whale behavior rather than a positive accumulation. If the whale ratio remains rising and BTC trades sideways or drops further, it will bolster cases of liquidity sweep below $10,000 before potential continuity increases.