Ethereum prices Make headlines again and climb aggressively as you approach the important psychological barrier of $4,000. After weeks of consolidation, ETH exploded with a strong breakout, leaving a major zone of resistance and holding new bullish momentum. On the daily charts, ETH prices print strong hikin ash candles backed by rising volume and overheating RSI, indicating that, at least for now, the Bulls are fully controlled.

But is this breakout sustainable, or are we witnessing the final leg of an overly extended gathering? In this article, we will analyze Ethereum price structure, momentum indicators, Fibonacci targets, and perhaps the next move. Whether the ETH price can really break the $4K mark– Or if there is a fix.

Ethereum price forecast: Why are Ethereum prices soaring now?

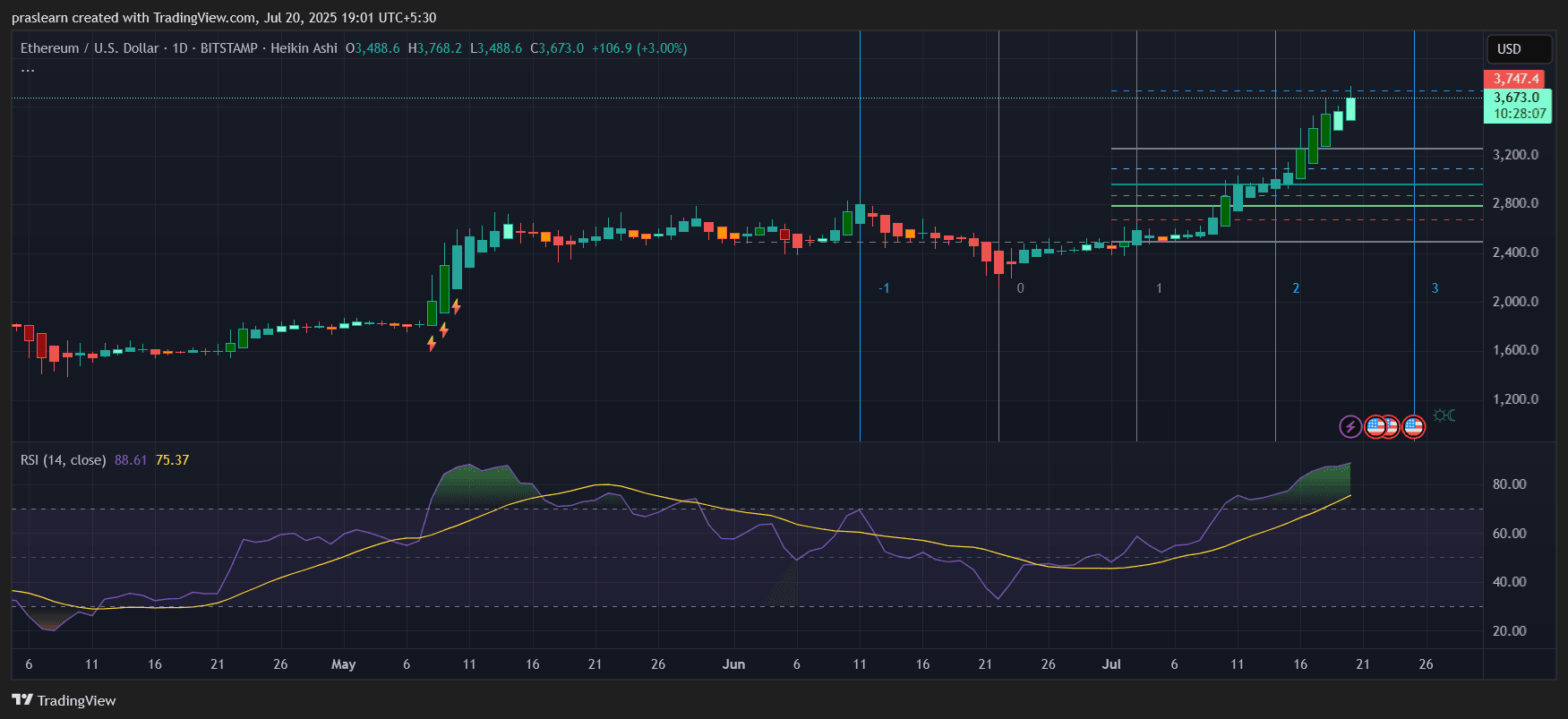

eth/usd daily charts – TradingView

The price of Ethereum (ETH) is currently on fire, with its price rising to $3,673, an increase of 3.00% on the last daily candle. Daily Chart (Heikin Ashi) shows a strong, consistent bullish trend, with multiple consecutive green candles and a minimal wick of negative. The momentum has clearly changed, with Ethereum challenging a major resistance level close to $3,747.4.

The main catalyst appears to be broader market optimism following the speculation of new ETFs and a surge in defi activity. However, the chart shows that this is not just a hype, but a technically powerful move with confirmation from the indicator.

What does RSI say about Ethereum’s strength?

Relative Strength Index (RSI) Currently 88.61well above the traditional excess threshold of 70. This extreme reading is rare and shows incredible momentum, but there are also potential short-term cooling.

Historically, once Ethereum’s RSI reaches these levels, pullback or integration will continue within 5-7 days. However, excessive conditions during strong breakouts often lead to A strong continuation If the volume supports trends.

This is the historical context:

In May 2021, ETH’s RSI reached 88, followed by a 10% rise before the 15% revision.

A similar setup suggests that Ethereum could be a hit $3,950-4,000 Before facing resistance.

Fibonacci levels and breakout zones

Looking at Fibonacci’s retracement levels drawn from previous swing heights and lower swings, Ethereum has broken several past retracement zones.

- $2,800 – The previous 0.618 level is broken in large numbers

- $3,200 – Passed without resistance

- $3,488 – Local breakout level

- $3,747.4 – Next key target zone

If Ethereum price breaks above $3,750there is the next Fibonacci expansion target $4,150matches the number of psychological rounds $4,000.

Price forecast calculation:

Let’s use a simple Fibonacci extension.

If your Swing Low is $2,400 and your Swing High is $3,488, the difference is:

$3,488- $2,400 = $1,088

Fibonacci 1.618 Extension = $2,400 + (1.618×$1,088) = $4,162

This projection refers to possibilities $4,150 to $4,200 Target in the coming weeks.

Is this a blow-off top or is it the start of a new rally?

Ethereum prices are currently traded Elliot wave pattern wave 3usually represents Strongest bullish legs. The chart shows clear impulsive movements without a strong retreat, confirming bullish control.

The lack of bearish divergence against RSI and current candle strength support the case Continuing Rallyat least $3,950 to $4,150.

However, traders should note the following:

- ETH is too much bought

- Pullbacks available to $3,200 or $2,950

- Strong support is available in between $2,850~$3,200

Ethereum price forecast for July 2025

Given the current momentum, strong hikin reed structures and RSI-backed breakouts, Ethereum prices could continue on the upward journey.

Short-term forecast (next 7-10 days):

- A bullish scenario: ETH reaches $3,950 to $4,150

- Integration scenario: ETH stabilizes between $3,200 and $3,600

- Bearish Reversal: ETH is below $2,950

Should you buy ETH now?

Technical supports bullish continuity. However, when RSI is very high, short-term pullbacks are natural and healthy. If you are considering entering, consider waiting for a dip near the $3,200 zone, or riding the waves with a loss of stop.

Ethereum prices look strong, and chart setups may indicate the start of a major bullish phase. If it convincingly beats $3,750, $4,150 It could be your next destination.