The Fed’s money print shift could fuel a surge in Bitcoin prices.

Bitmex co-founder Arthur Hayes predicts that Bitcoin will return to $76,500, above $110,000, if the central bank switched from tightening to easing.

“$btc hits $110k before retesting $76.5k. y?fed goes from QT to QE for the Treasury,” Hayes said. I wrote it On Sunday X.

Hayes dismisses the potential negative impact of tariffs on Bitcoin prices. He believes inflation is “temporary.”

Markus Thielen, founder of 10x Research, is also predicting potential Bitcoin rebounds. The analyst wrote on March 23rd Report That Bitcoin price has reached its lowest point in the recent recession and may be ready for a recovery.

He said the Fed’s incredible stance on inflation and Trump’s flexibility over tariffs are two catalysts that could reduce market concerns and boost investor confidence.

“The Fed signalled that it may appear to be short-term inflationary pressures in the past, laying the foundation for future mitigation possibilities,” he said.

Tyren reported that the relaxed political situation and favorable economic forecasts were bullish on Bitcoin indicators.

Analysts also looked at support factors such as Bitcoin holder behavior and ETF performance. Thielen believes Bitcoin will not enter the deep bear market as Bitcoin holders are likely long-term investors.

Elsewhere, the return of inflows to US-based spot Bitcoin ETFs is considered a positive indication, indicating a decline in sales pressure from investors focused on arbitrage.

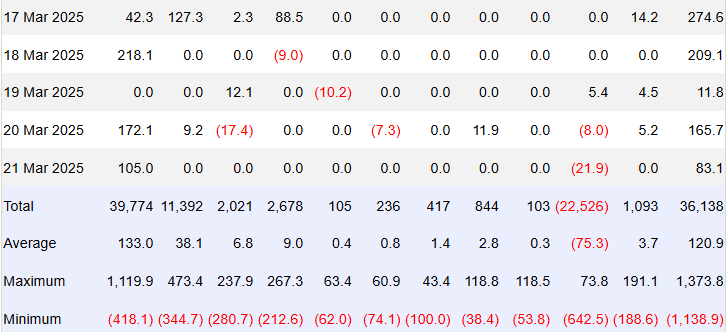

data Investors from Farside show that US registered Spot Bitcoin ETFs collected net inflows of around $744 million last week. BlackRock alone has raised approximately $537 million in new investments.

Bully, Tierren admits the lack of a “clear catalyst” for immediate parabolic gatherings.

Bitcoin was trading at around $87,000 at press, up 3.5% over the last 24 hours per Coingecko. The market capitalization of the total crypto market capitalization rose slightly to $2.9 trillion.