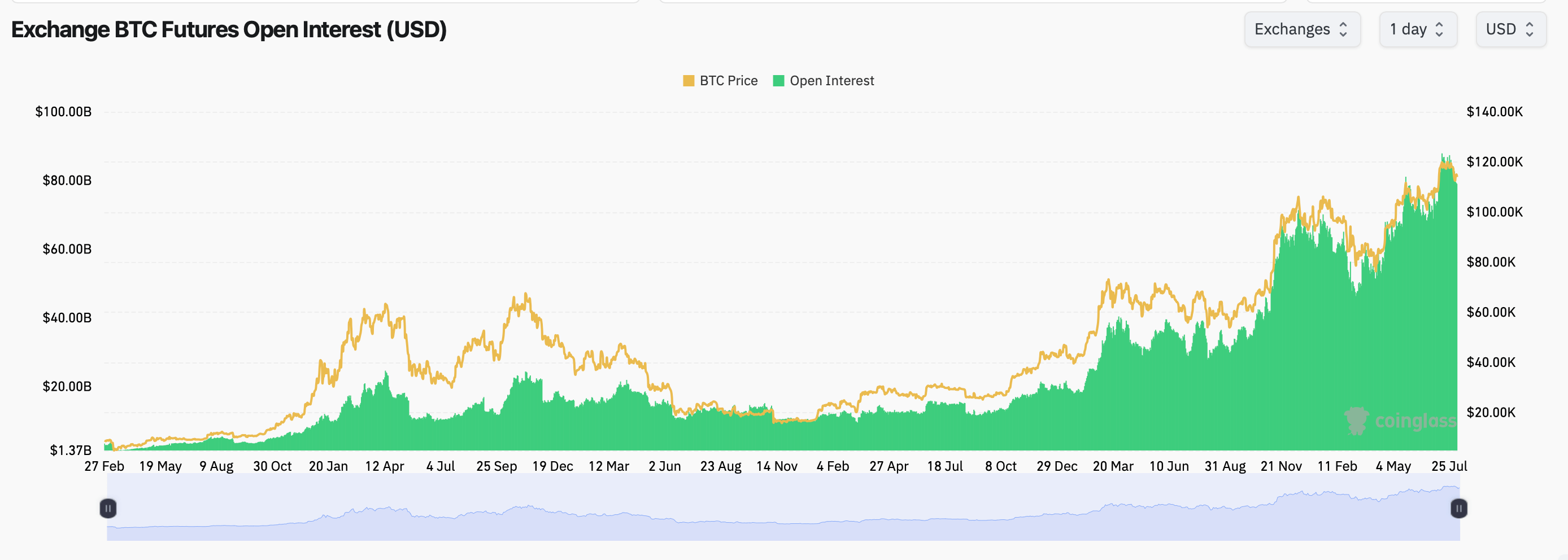

Bitcoin derivatives activity has risen to an unprecedented level, with futures across major exchanges reaching $79 billion, and options placement shows options placement that leans significantly towards the call.

Bitcoin derivatives market at record level for traders to move

According to Coinglass data, the total public interest (OI) on BTC futures is 692,490 BTC, which is equivalent to $79 billion. CME leads at 139,350 BTC ($158.8 billion), accounting for 20.1% of the market.

Binance is closely followed by 121,580 BTC ($13.87 billion), accounting for 17.55% of the total OI. Bibit will hold 79,250 btc ($9.04 billion), OKX will maintain 37,480 btc ($4.27 billion), and Gate Commands 69,010 btc ($7.87 billion). Kucoin, Bitget, Whitebit, Bingx and Mexc conclude the top 10 exchange.

Open interest data from Bitcoin Futures Coinglass.com.

Futures oi has made a steep climb in 2025 along with the price of Bitcoin and is currently hovering around 5% in the $120,000 range. CME agency-heavy contracts and Binance’s retail-driven flow remain important drivers for build-up, with CME’s OI changing flat in one hour, but increasing by 0.20% in four hours, while Bybit saw a 0.02% increase in the last hour.

Open interest will rise as well at the forefront of options. The total BTC option OI is close to $60 billion, reflecting 232,476 BTC (61.43%) and 145,957 BTC (38.57%) in PUTS. This bullish skew suggests that traders are positioned for even more potential ups.

However, in the last 24 hours we have seen more defensive flows. The optional volume showed 39.64% (19,711 BTC) (19,711 BTC) and 60.36% at PUTS (30,018 BTC), indicating short-term hedging activity despite long-term bullish bias.

Deribit commands the Bitcoin Options market. Its only largest position will be on the December 26th, 2025 call, which will grant the buyer the right to buy BTC for $140,000. The contract has opened about 10,727 BTC. Behind the call will be on the same September 26th, 2025 strike (9,912 BTC) and the December 26th, 2025 call for $200,000 (8,614 BTC). On the bearish side, traders stack around 6,489 BTC on August 8th to protect them if prices fall below $110,000.

Over the past 24 hours, Delibit’s busiest deal has been short-dated put options. This is a contract that will pay off if Bitcoin drops. The August 29 contract with the $112,000 strike changed hands at around 2,068 BTC, and August 15th $115,000 traded around 1,632 BTC. The heavy demand for these downside hedges increases implicit volatility in the short term, indicating that traders are preparing for potential pullbacks.

The expiration dates for the options were revealed around August 29th, September 26th and December 26th, with important concept values piling up on both calls and PUTS. August 29th holds the heaviest balance and is heavily weighted to puts, but with robust call interest on strikes of $120,000 and $124,000.

Deribit’s optional volume trend has been steadily rising, with noticeable spikes amid the recent price surge. The exchange maintains a dominant share of global BTC option activity, and continues with Binance’s new presence.

Marketwatchers note that rising OIs in both futures and options often precede periods of sophisticated volatility. By combining BTC’s prices with the highest ever high, traders appear to be split between profits from hedges and seeking further increases.

The current composition of the derivatives market – high conceptual exposure, bullish oi skew, and short-term put heavy volumes – suggests that traders are measuring the potential for short-term turbulence, while still remain long-term sentiment.