According to analyst James Cheque, the Bitcoin market cycle is not fixed at half of its events, as widely believed.

“In my opinion, Bitcoin has gone through three cycles and is not pinned around hulling,” Cke said Wednesday, referring to the blockchain reduction in mining rewards, which usually occurs every four years.

He said the market cycle is fixed in “recruitment and market structure trends,” with the market peak in 2017 and bottom 2022 as the transition point.

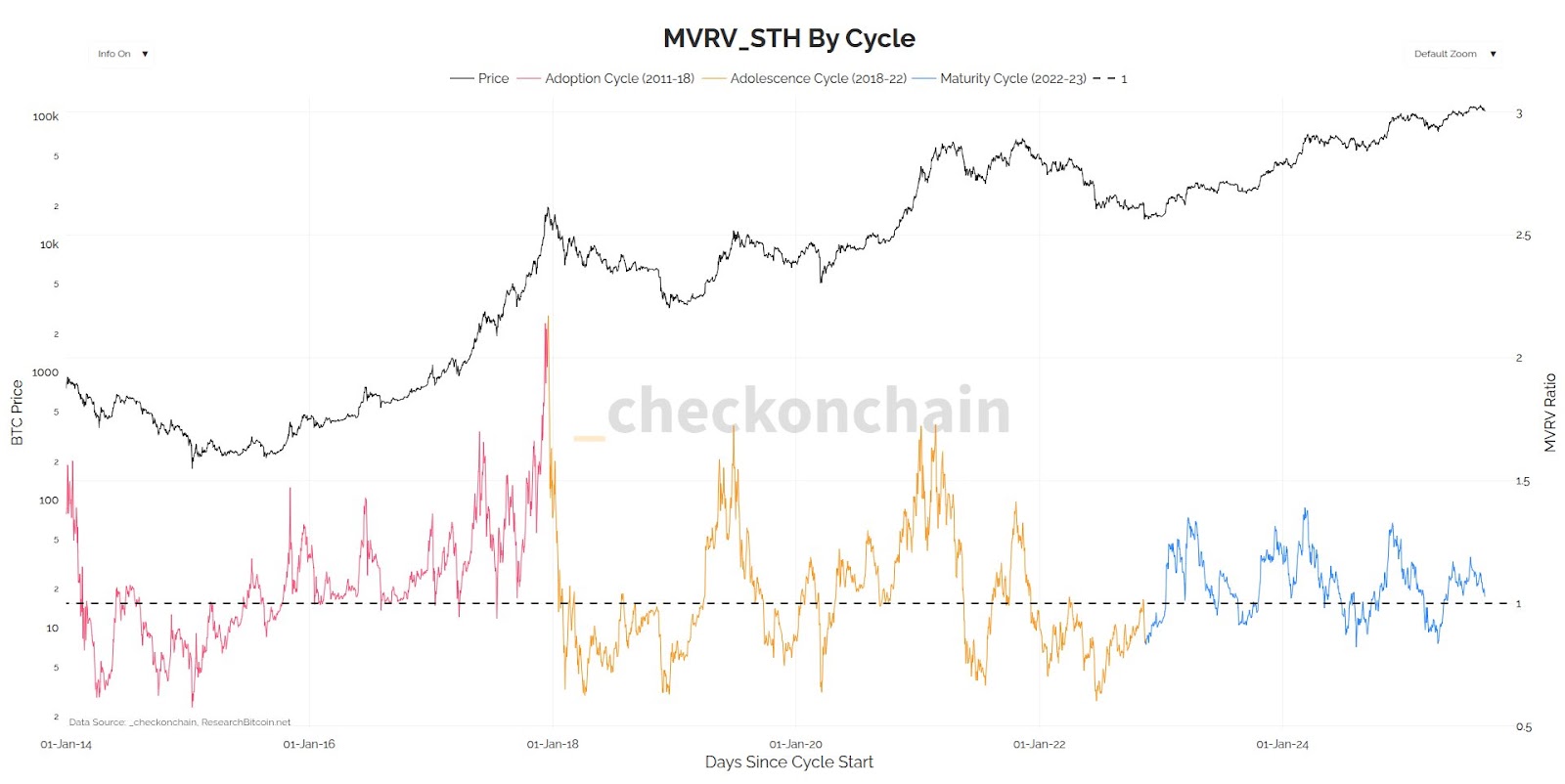

Check checks highlight three previous cycles as the “recruitment cycle” from 2011 to 2018. This is driven by “institutional maturity and stability” through early retail adoption, the “adolescent cycle” from 2018 to 2022, the “leverage wild west boom and bust” and the current “maturity cycle” from 2022.

“Things have changed after the 2022 Bear Market. People who have been repeating the past are likely to miss the signal because they are seeing historical noise,” he said.

Bitcoin price (black) compared to James Check’s acquisition of cryptocurrency market cycle. sauce: James Check

Harving Cycle Theory is still on track

Check’s analysis violates the general theory that the market cycle for Bitcoin (BTC) typically lasts for four years, fixed at half of that event, causing a supply shock due to a decrease in block rewards and increased demand.

This is when the Bull Market Peak Year comes the year after the Harving Event, as was done in 2013, 2017 and 2021, and appears to be on track to repeat the pattern in 2025.

It also states that Bitcoin is “literally the only other endgame asset alongside gold,” meaning that the current cycle could be extended.

The end of the four-year cycle?

There are many recent forecasts that the traditional four-year cycle is over, and this bull market could extend into next year due to institutional participation.

Related: Is the four-year crypto cycle dead? The followers are growing loudly

Earlier this month, Bitwise Chief Investment Officer Matthew Hogan spoke about the cycle that doesn’t end officially until 2026 has seen positive returns.

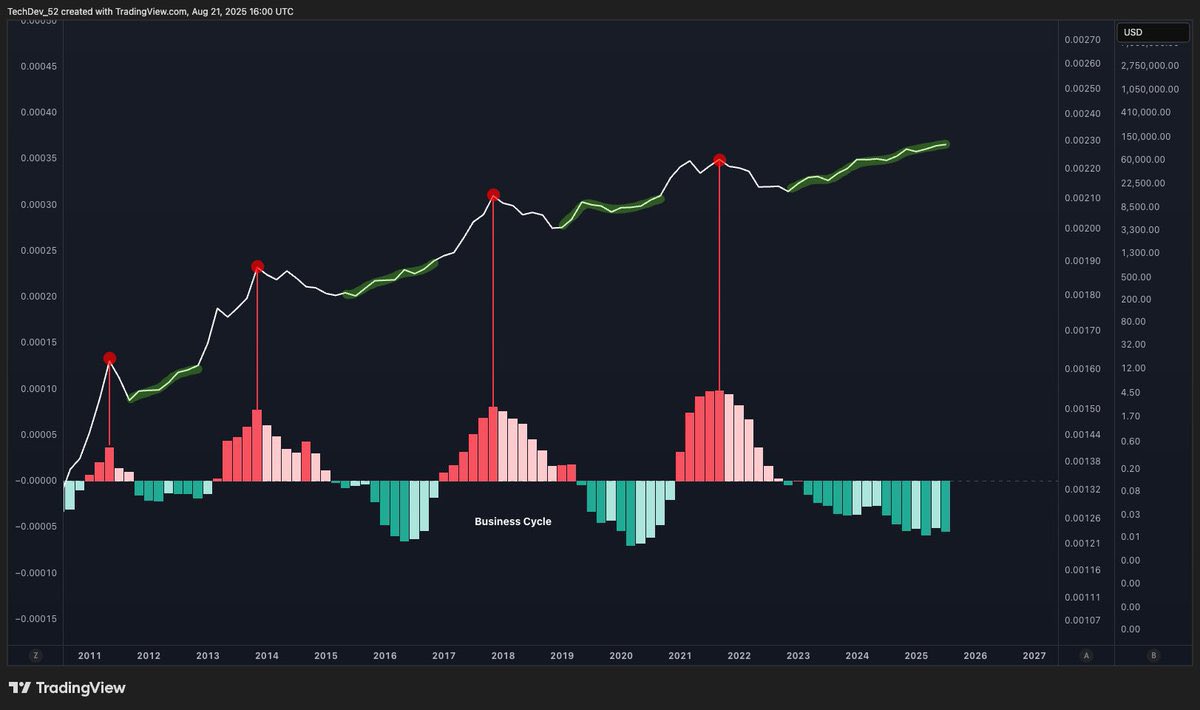

Entrepreneur TechDev told 546,000 followers on X on Tuesday, “The dynamics of the business cycle are everything you need to understand Bitcoin,” indicating peaks and troughs from previous cycles.

Macroeconomic factors such as dollar liquidity and ETF inflows may have expanded the bullish stage. sauce: TechDev

The analysis suggests that the shift to the bear phase is driven by fluidity dynamics rather than half the cycle of the traditional four-year period, with the only difference this time being the extended bull phase.

The current cycle is over, GlassNode says

GlassNode analysts said on August 20 that Bitcoin is still tracking traditional cycle patterns. On Tuesday they reiterated that recent gains acquisition and sales pressures “indicate that the market has entered a later stage of the cycle.”

On the other hand, position trader Bob Lucas had a more practical view on the market cycle.

“I often hear “There’s no more Bitcoin cycle.” The reality is that we are always cycled. We cannot help ourselves. We pump it up until it explodes.

magazine: Bitcoin is “funny internet money” during the crisis: Tezos co-founder