Latest inflation data suggests that the Fed is likely to remain conservative in its interest rate cuts.

summary

- US Services inflation remained high in August, removing hopes for higher interest rate cuts

- The Fed could cut interest rates by 25 basis points, as expected

- It could hurt Bitcoin more than expected interest rates

Latest inflation data undermines the possibility that the Fed will cut fees more than expected. On Thursday, September 4th, Bitcoin (BTC) was trading at $109,444, reporting a 2.4% decline in service with a high inflation rate. Additionally, Altcoins lost even further, with their top 20 tokens down 2.7%.

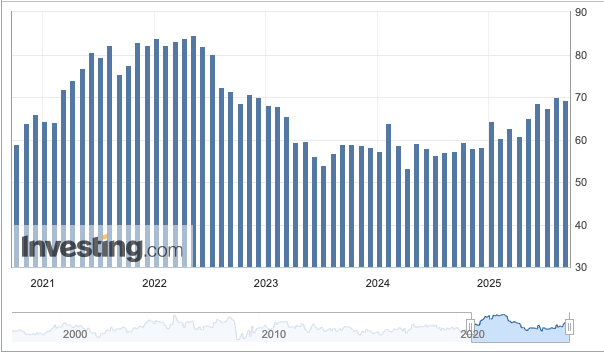

Crypto Markets responded to the ISM Service Price Index, which was 69.2 in August. Service inflation was below the expected 69.5 and 69.9 levels the previous month. Still, this figure remains at the level last seen in 2023, with readings above 50 meaning prices are rising.

You might like it too: If Bitcoin control is classified as 57%, you get altcoins: the decline of the Fed’s story?

US Non-Manufacturing Prices | Source: Investing.com

An increase in inflation numbers could make the Federal Reserve more cautious when determining interest rates at its September 17th meeting. Still, a 25 basis point rate reduction remains the most likely outcome, with Polymarket Traders casting an 86% chance.

You might like it too: Program to drop the Federal Reserve, which has increased scrutiny of banks

The chances of a major rate reduction for Trump is less likely

The new inflation data probably means Donald Trump is pushing for massive interest rate cuts. The president has been seeking near-low interest rates since he was elected. However, since July, Trump has set a new 1% target, which has changed significantly from the current 4.25% to 4.50% range.

Still, Trump has more ways to bypass the Fed. For one, the Treasury Department, which is under Trump’s direct control, continues to buy its own Treasury Department on September 3, and more recently $2 billion.

You might like it too: Bitcoin and crypto markets at risk of conflict after official Fed warning