Bitcoin prices have recovered from recent DIP, which temporarily tested investor convictions. Beyond key support, Crypto King continues to bolster its long-term uptrend.

However, the historical trend suggests that BTC may need slight modifications before pushing towards the new history high (ATH).

Bitcoin needs to fall to rise

Bitcoin’s path to new records may require a 8.7% drop in the coming days. The $101,634 level holds a 38.2% Fibonacci retracement line, which has historically served as a launch point. Each bounce from this FIB level at previous gatherings caused a rapid surge in BTC value.

A similar setup may be in place now. When Bitcoin traces this important level, it could provide the next powerful rally base. Historically, such movements have helped reset market momentum and have also set the foundation for sustainable growth that potentially leads BTC beyond its current highs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Bitcoin’s historic support level. Source: TradingView

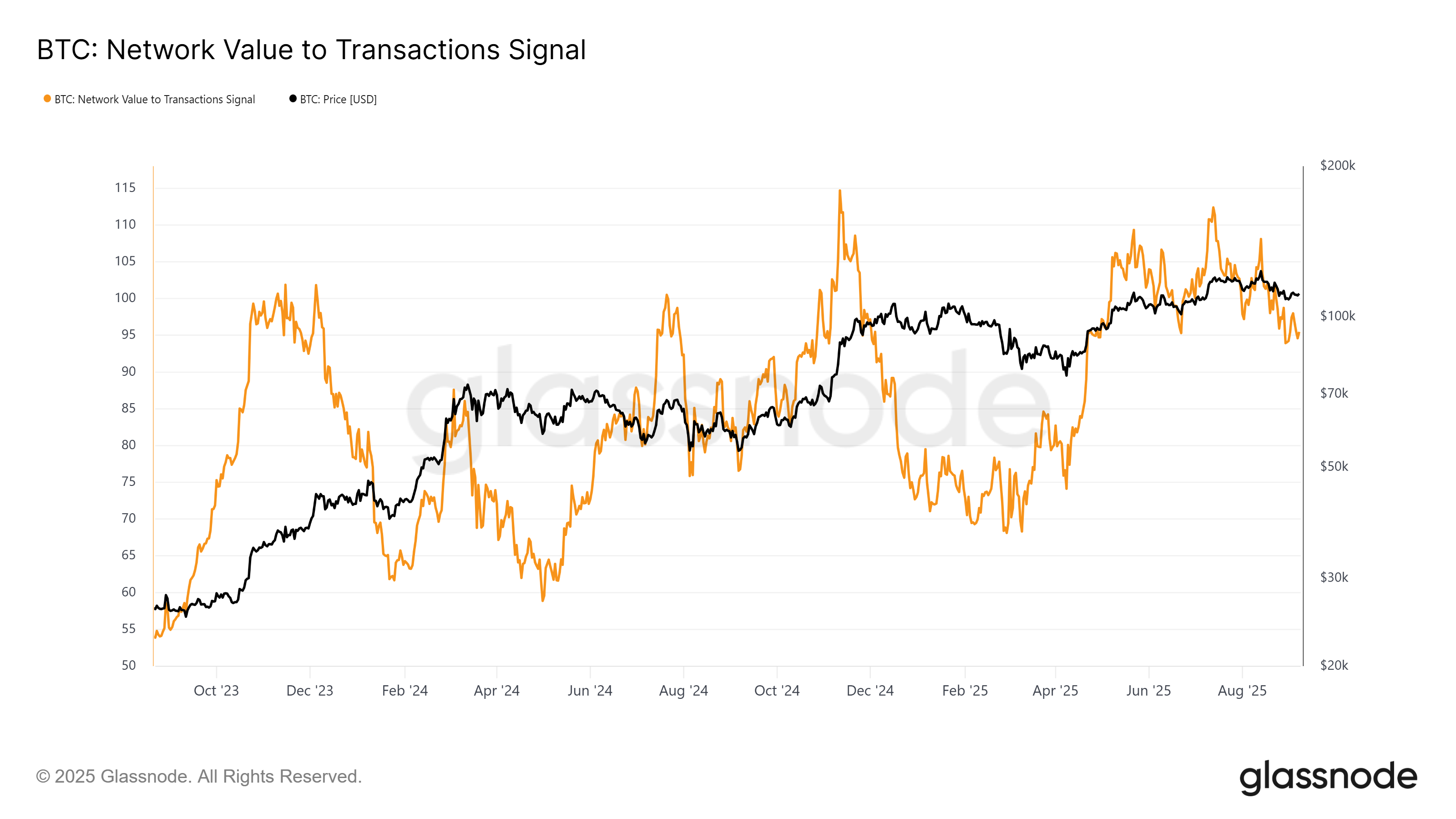

The wider momentum is paying attention. Network values and transaction (NVT) ratios are often used to assess whether Bitcoin is overvalued compared to on-chain activity, but are declining. Typically, NVT rises coincides with overheating conditions and precedes price declines. Instead, the indicator cool-off suggests calm activity.

This cooling market will reduce the likelihood of a more dynamic and rapid decline, making it difficult for BTC to touch Fibonacci’s retracement level. Without this dip, the historic playbook would not unfold as expected, potentially slowing down Bitcoin’s move towards a new ATH.

Bitcoin NVT signal. Source: GlassNode

BTC prices could continue to increase the rise

At the time of writing, Bitcoin traded for $111,340, surpassing the $110,000 support. This resilience strengthens the four-month uptrend line and signals potential short-term profits. The momentum is unharmed, and BTC is focusing on higher levels.

If it lasts, Bitcoin can rise above $112,500 and head towards $115,000. However, to reach the new ATH, history suggests that BTC may need to drop to $101,634 first, setting the stage for a stronger breakout.

Bitcoin price analysis. Source: TradingView

On the back, if you escalate as profits, BTC could slip faster towards retracement levels. However, if fear-based sales dominate, the price risk falls below $100,000, negating bullish outlook and extending the revision phase.

Post-Bitcoin may need to drop 8% to $101,000 before the new all-time high.