Ethereum prices show signs of strength after the US Federal Reserve cut by 0.25% yesterday. This reduction was expected and most assets were largely moved as they were already priced in the market. But Ethereum stood out. Over the past 24 hours, it has earned around 2.2% and has traded for over $4,600.

More importantly, the chart shows Ethereum, which will form a “cup and handle” setup with a few clicks under the breakout zone. If this move continues, the breakout points to a new target of nearly $5,430. At the same time, on-chain data reveals that sales pressures fall to six months’ lows, giving more weight to bullish breakouts.

Sales pressure is low for 6 months

The most obvious indication of a decline in sales came from “used coin age bands.” This metric tracks how many coins left in the wallet sold on the blockchain. When numbers drop, it means that fewer holders are cashing out.

On September 17th, the total number of coins spent on all bands was around 257,000 ETH. To date, the number has dropped to just 42,700 ETH, reaching its lowest level at almost 83.5% in six months.

Ethereum used the Coin Age Band. Source: Santiment

Such a sudden drop suggests that many holders who could sell have been suppressed instead. This sudden reduction in supply pressure allows ETH prices to increase the room for higher travel as demand continues to increase.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Profit and Exchange Flows confirm a drop in sales pressure

The sharp drops of used coins are not alone. The other two on-chain metrics – Nupl and Exchange Flow – show the same direction.

NUPL, or net unrealized profits and losses, track the number of wallets indicating paper profits or losses. On September 16th, Nupl made a local low one. Since then I’ve curled over $0.50, but now it’s almost the same level as you’ll see on September 11th. This pattern has led to Ethereum’s prices rising to nearly 6%.

Still in the belief zone: Ethereum nupl: glassnode

Penetration in Nupl at a higher price level means fewer wallets are dependent on easy profits. It usually happens because short-term traders may already be on sale, leaving a stronger holder who is less likely to sell coins during all gatherings.

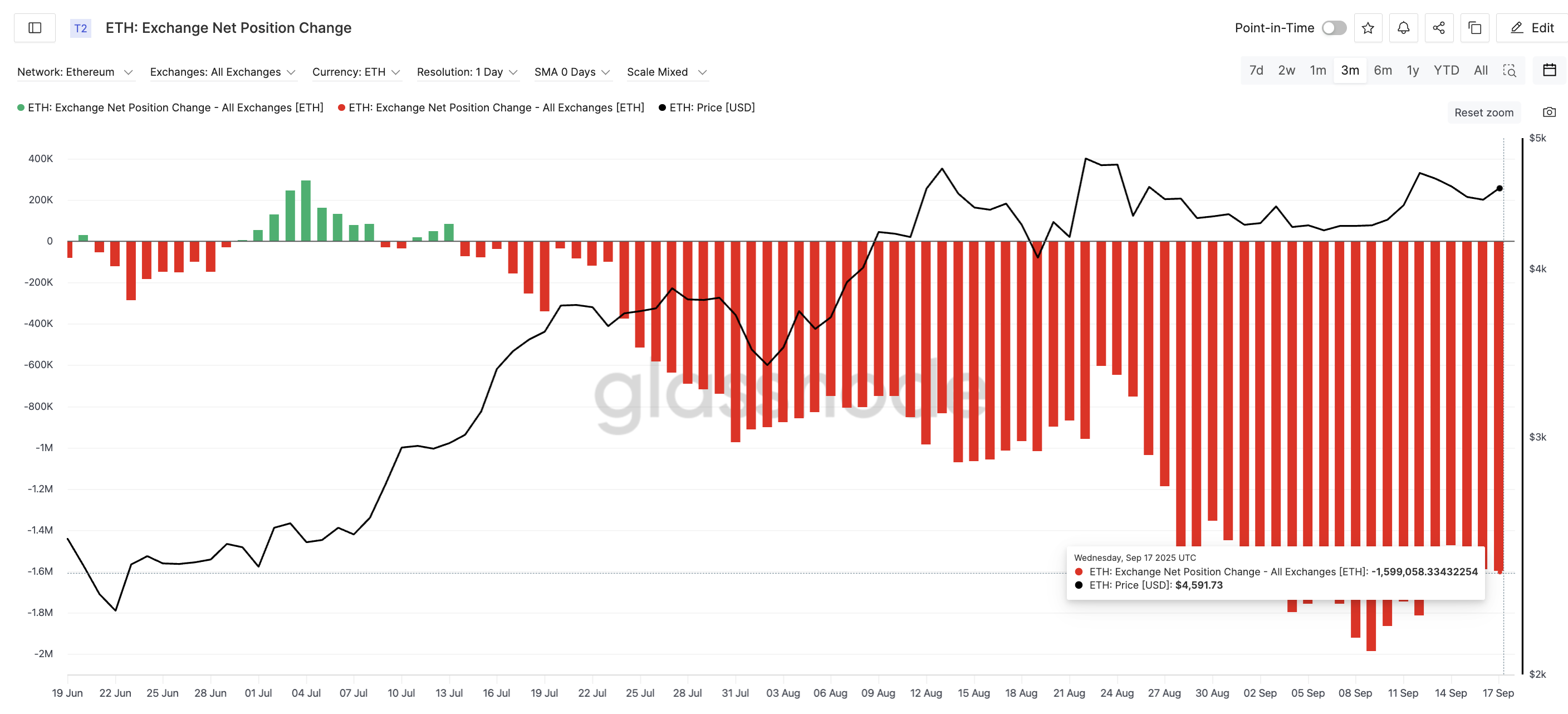

This view is supported by changes in exchange net positions and indicates whether the coin is moving to exchange. More coins for exchange often means more sales, while spills mean accumulation.

Since September 14th, the spill has grown from about -147,600 ETH to -159,000 ETH, an 8% increase. This makes sure more Ethereum is off the trading platform. This is a sign of stable purchasing pressure.

Ethereum buyers keep stepping on: GlassNode

These trends reveal the same story: weak hands are coming out, sales pressures fade, and buyers are quietly in control.

Ethereum Price Chart refers to a $5,430 target

Ethereum is now broken from bullish cup and handle formations. Getting out of the handle means selling pressure has eased as few short-term holders were selling to the assembly in many cases.

The neckline for this pattern is close to $4,765. Once Ethereum prices close beyond that line, the breakout target has risen to $5,430.

Ethereum Price Analysis: TradingView

Another important indication is Chaikin Money Flow (CMF). This tracks whether money is in and out of the market. The CMF rose from -0.18 on September 15th, approaching the zero line as a handle breakout occurred. Once that crosses into positive territory, make sure you have new money in it along with the chart breakout.

Support remains at $4,489 and $4,424. If Ethereum falls below $4,213, bullish setups will be disabled and buyers may have to wait for a new pattern to form.

Post Ethereum prices will flash targets over $5,400 as key metrics drop for six months and first appear on Beincrypto.