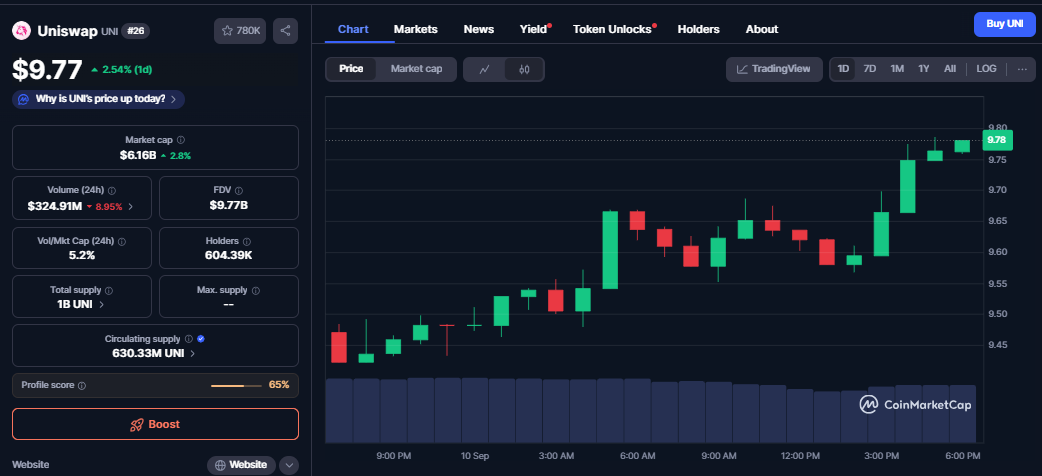

Today, Ethereum Price trades for nearly $4,605 and combines resistance zones of between $4,638 and $4,665. Buyers defend the $4,520-4,547 area, with short-term EMA stacked up and keeping price action constructive. The key question is whether ETH can be expanded to $4,700 or whether sellers will be forced to hold back movements and retest another support band between $4,476-$4,370.

Ethereum prices hold trendlines rising

ETH Key Technical Level (Source: TradingView)

The 4-hour chart shows ETH in honor of its upward trendline, building higher lows from early September. The Super Trend Indicator has turned bullish over and is currently resting at around $4,639, consistent with immediate resistance. A breakout above this level exposes $4,700 and potentially $4,820, but if you don’t clear it, you’ll end up risking a pullback to the $4,476 and $4,370 zone.

The momentum remains in good balance. RSI sits in her mid-50s and avoids over-acquired extremes while maintaining an upward bias. The 100-EMA and 200-EMA offer trendy ink cushions close to $4,493 and $4,370, reinforce the wider bullish construction of ETH as long as these levels continue to hold.

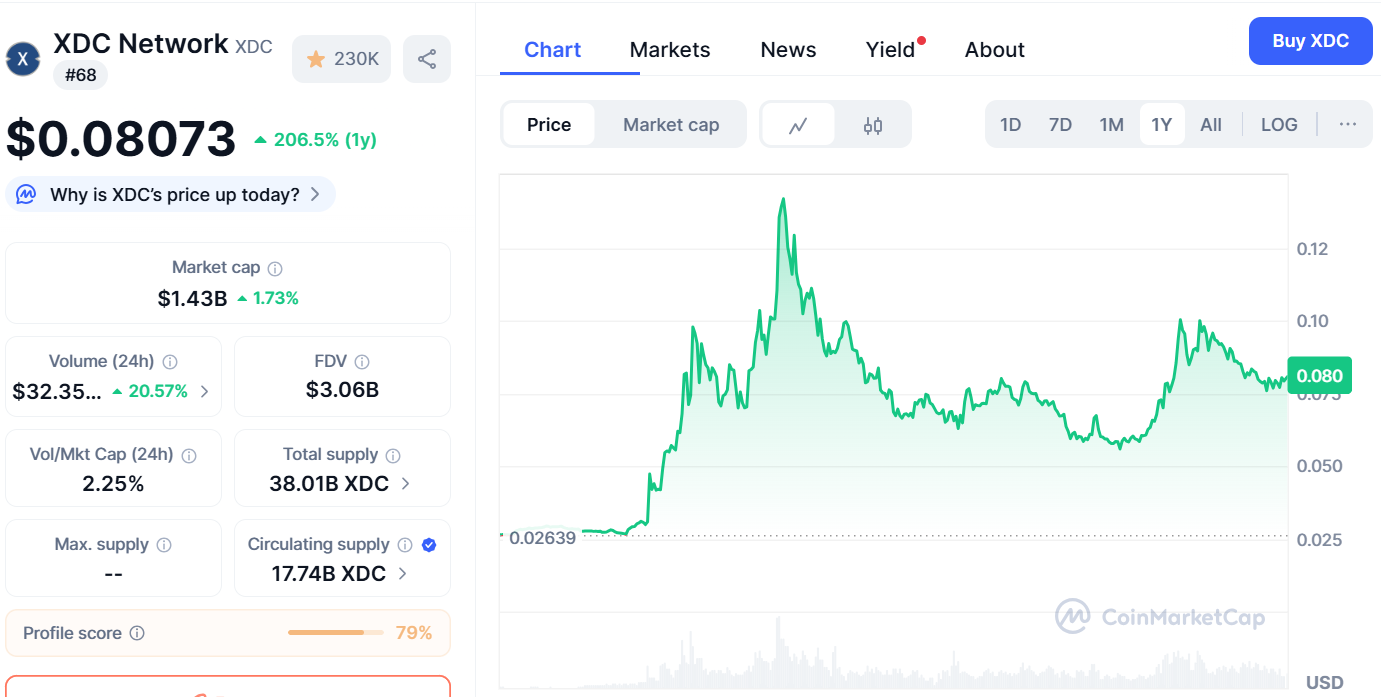

Exchange flow emphasizes accumulation

ETH chain accumulation (source: Coinglass)

On-chain data supports bullish undertones. Spot Netflows showed consistent leaks, with $77.6 million withdrawal from the exchange on September 18th. This trend indicates investors’ preferences for reducing the available supply and often de-exchange ETH.

Despite the occasional surge in inflows, the dominant flow structure since August is negative, providing steady supply-side constraints. Analysts argue that this magnitude of sustained outflow can create a foundation for pushes above resistance levels.

Stablecoin growth strengthens the role of Ethereum

Ethereum L1 + L2S Stablecoins now exceed the $171 billion distribution ATH

– We own 152.8B (+78% previous year) on Ethereum Mainnet alone. It remains an undisputed hub of Stablecoin fluidity.

– The L2S total accounts for over $18 billion, with Arbitrum ($8.8 billion) and bases ($3.9 billion) leading the claims.

– …pic.twitter.com/5krzqa5a3f-Francesco Andreoliᵍᵐ (@FrancesCowiss) September 17, 2025

Fundamentals add even more weight to Ethereum’s bullish case. Data shows that Ethereum Mainnet and Layer 2 stubcoins outweigh the $171 billion distribution, with Mainnet alone holding $152.8 billion. This represents a 78% increase from the previous year, highlighting the position of Ethereum as the dominant hub of Stablecoin’s liquidity.

Growth is accelerating across the scaling network. Arbitrum accounts for $8.8 billion and Base holds $3.9 billion. Emerging L2s like Mantle and Linea also record triple-digit growth. The scale of liquidity concentrated in Ethereum not only strengthens its ecosystem, but also strengthens trust in ETH as collateral and settlement assets for the entire defi market.

Technical outlook for Ethereum prices

Important levels of short-term Ethereum:

- Upside Target: If bullish momentum continues, then $4,638, $4,700, $4,820.

- Disadvantages support: As a recent defense zone of $4,547, $4,476 and $4,370.

- Trend Support: $4,200 for a wider structural floor if sales pressure accelerates.

Outlook: Will Ethereum rise?

The immediate direction of Ethereum depends on whether the buyer is able to pierce the ceiling between $4,638 and $4,665. On-chain spill combined with record-breaking Stablecoin liquidity fixed in Ethereum suggests a strong fundamental background.

As long as S exceeds $4,500, analysts are cautiously optimistic. A drop below $4,476 slows down bullish papers and allows for deeper integrations at nearly $4,370, while a breakout of over $4,665 could impact the rally on $4,820 and potentially $5,000. For now, Ethereum prices continue to be bullish amid the broader upward cycle.

Disclaimer: The information contained in this article is for information and educational purposes only. This article does not constitute any kind of financial advice or advice. Coin Edition is not liable for any losses that arise as a result of your use of the content, products or services mentioned. We encourage readers to take caution before taking any actions related to the company.