summary

- The BNB chain reached 51.6 million active addresses each month on September 17, with prices and revenues rising by more than 23% over the past month.

- Binance founder Changpeng Zhao is planning a billion-dollar finance company to support the best institutional projects, soaring.

- The BNB token hit $1,000 on September 18 amid speculation about the possibility that Zhao could return to Binance.

The BNB chain has had record-breaking activities with 51.6 million addresses each month, along with revenue growth over the past month. BNB hit $1,000 as Zhao outlined plans for the $1 billion treasury company and spurred rumors about a return to Binance.

The BNB chain is the blockchain behind Binance’s native tokens (BNB), reaching a new milestone on September 17th, reaching 51.9 million monthly active addresses, exceeding the previous highs recorded in September 2024, reaching a new milestone, according to token’s terminal data.

Active users of BNB Chain monthly | Source: Token devices

Over the past 30 days, the costs collected by the chain have reached $13.2 million, reaching a jump of more than 24% compared to the previous period, with revenues reaching $1.4 million, an increase of 23%, indicating that they are interacting with the network.

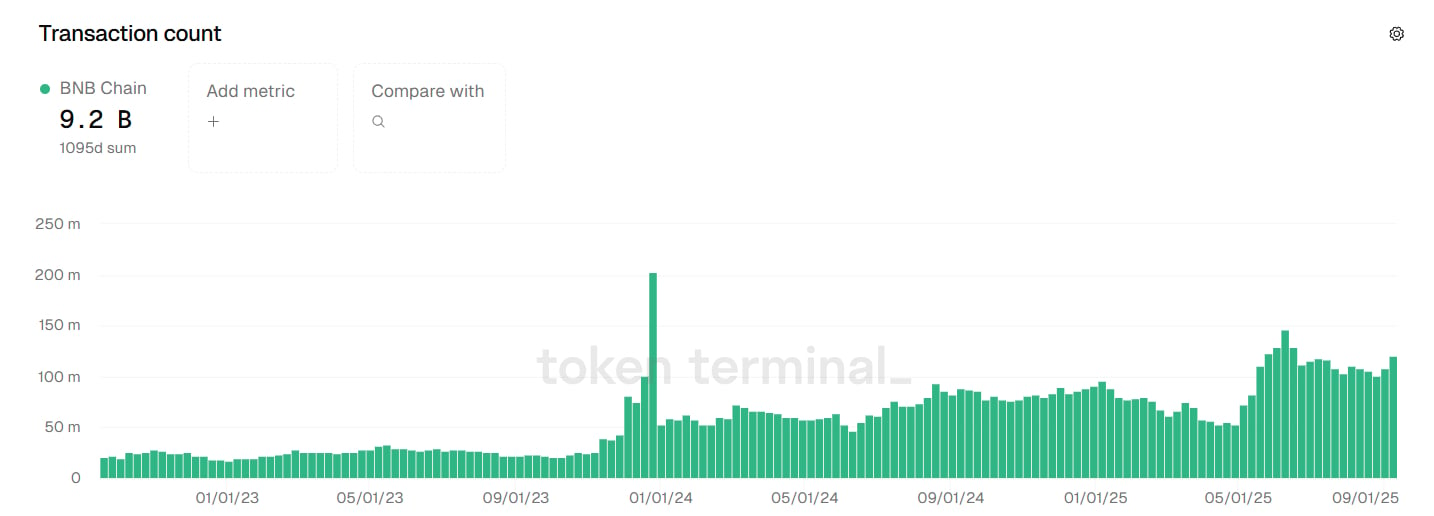

BNB Chain Transaction Count Weekly | Source: Token Terminal

According to the token terminal, the BNB chain is also continuing to strengthen its top three layer one network position with transaction counts. Internet computers lead with 41.22 billion transactions, while Solana is 354.5 billion, with a BNB chain, with transactions counting 9.2 billion.

As of September, the network supports over 1,095 projects across sectors, including Defi, Gaming and NFT, with the total BNB chain value at $7.688 billion, down about 65% from its 2021 peak.

Speaking to Crypto.News, EMEA leads at BNB Chain, Marwan Kawadri and Marwan Kawadri, growth is attributed to a large user base of 4 million active users and unique addresses of over 625 million, with over $11 billion worldwide liquidity in TVL and Stablecoin Circulation.

Kawadri added that the transaction will be “confirmed in under 150 milliseconds” as the team aims to reach a “CEX-like experience.”

“Overall, the BNB chain aims to be the payment layer and financial infrastructure for all assets. It is not particularly limited to any particular transaction scenario. The direction and initial form of this chain is still evolving continuously and we will explore and build this together with our community.”

Marwan Kawabi

As the token recently hit a new all-time high of $962, growth in activity on the chain is consistent with an increase in BNB’s market value. Part of this momentum appears to have been linked to an announcement from Binance founder Changpeng Zhao. In an interview with Leon Lu, founder of B Strategy, ChangpengZhao outlined the plans for the upcoming BNB Treasury Company.

You might like it too: BNB Chain Target Speed Limit 150ms Finality and 20k TPS Ambition

As Crypto.News previously reported, Zhao described BNB as a “true utility coin,” highlighting its multi-chain compatibility and use in trading discounts, yields, launch pools, launch pads, and Binance Alpha Ecosystems. He also highlighted the role of BNB across both centralized and decentralized platforms including cross-border payments and Dapps around the world, noting that ecosystems may be undeveloped in regions such as Southeast Asia, Europe, the Middle East and Africa.

Return as CEO

The planned BNB finance company is expected to raise $1 billion with support from YZI Labs. Zhao said the initiative will focus on institutional demand and will focus support on strong and well-positioned projects. “We’ve probably been particularly approached by over 50 companies in BNB. We only do that for a very small number of data companies. Basically, it’s a very top and powerful company,” Zhao said on the podcast.

Speculation has also grown about Zhao’s chances of returning to Binance. On September 17th, the founders of Binance updated their X profile and changed from “ex-@binance” to “@binance.” Zhao resigned as CEO almost two years ago in November 2023 after a $4.3 billion settlement with the US Department of Justice, a $4.3 billion settlement over anti-money laundering violations.

The report also suggests that DOJ could soon raise compliance restrictions for Binance. This has fueled rumors about his potential returns, but Zhao says he has no plans to resume his CEO role.

Data from Crypto.News shows that BNB hit a record high of $1,000 on September 18th, setting a new historic milestone for the BNB chain ecosystem. As of press time, tokens have grown 3.7% over the last 24 hours, trading at around $989, up over 10% over the past week.

read more: BNB chain adding over 100 US stocks, ETFs and funds via Ondo Finance