Bitcoin has recently faced a rise in volatility, with prices being denied near the $118,000 supply zone. The market is currently located in a critical area where order flows and liquidity pockets determine the next direction movement.

Technical Analysis

By Shayan

Daily Charts

In the daily time frame, Bitcoin was rejected from the supply zone for $118,000. This is consistent with the descending channel structure.

After multiple failed attempts to maintain momentum above $120K, prices have been pulled back sharply, and are now above the $111,000-$110,000 demand zone.

This pullback tested its 100-day moving average at $111K. This emphasizes its importance at a level that has consistently provided structural support. As long as Bitcoin is held above this demand cluster, the wider upward trend remains. However, the decisive breakdown here could reveal deeper liquidity between $107,000 and nearly $105,000, if demand is expected.

4-hour chart

On the four-hour chart, Bitcoin shows the clear aftermath of liquidity sweeps ranging from $117K to $118,000. That breakout attempt quickly reversed, causing a sudden sale to the demand zone of between 111.5K and 111K. For now, bids are intervening to stabilize prices at this level.

If buyers defend this zone successfully, Bitcoin could either retreat towards a broken, ascending trend line or even retest the $115,000 resistance. Conversely, if you don’t own $111K, you’ll see even more weaknesses, opening the door to a slide heading towards a $100,000-$107,000 demand block.

Emotional analysis

By Shayan

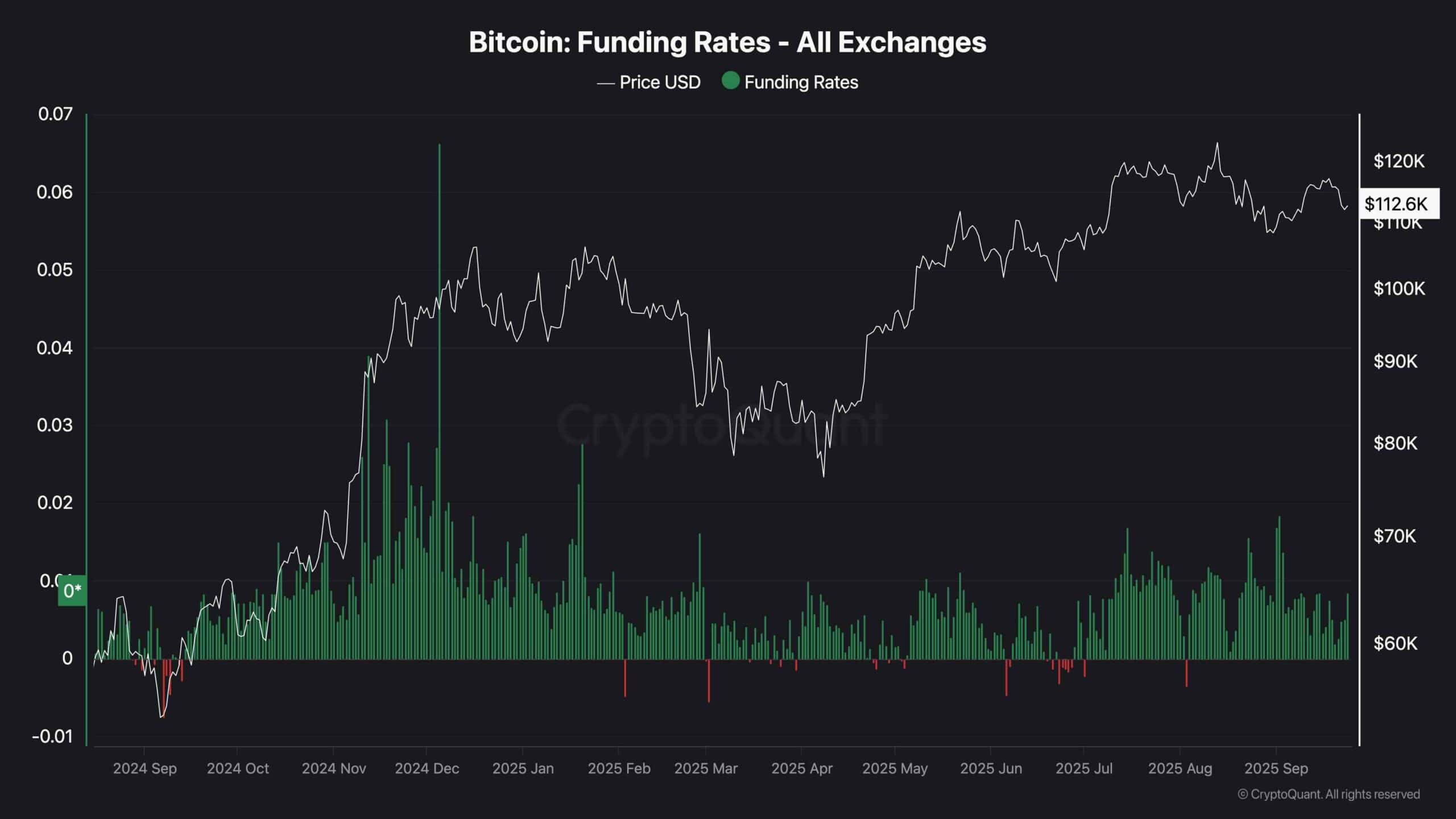

Looking at the funding rate behavior around the two latest peaks in Bitcoin, there is a clear difference in market dynamics. In December 2024, when Bitcoin was pushed towards the $120,000 level, the funding rate surged to extremely positive value, reflecting an overheated market dominated by aggressive long positions. This unsustainable level of leverage created a setup that could cause even minor changes in emotions to cause a cascade of liquidation, and subsequent sharp fixes confirmed this vulnerability.

In contrast, the August 2025 rally brought Bitcoin back to the same area, nearest all-time, but with a much more moderate funding rate. This suppression shows that traders are not reckless about leverage compared to their December 2024 run. The price measures still reached similar highs, but the more serious and uncontrolled corrections highlighted a healthier market structure, as there is no extreme funding pressure.

In the current environment, fundraising rates are beginning to rise again after a relatively quiet period, indicating that buyers are gradually returning to the market. This increase still doesn’t resemble the overheating levels in December 2024, but shows a potential influx of new confidence and fresh long positioning. When managed within sustainable boundaries, this rise in demand will help Bitcoin consolidate beyond the $110,000 area, bringing momentum for another attempt to regain upper resistance levels.