Bitcoin, the main coin, has been able to post a modest 0.28% gain over the last 24 hours.

Price action appears to be restrained, but key on-chain metrics suggest that demand is quietly built beneath the surface, laying the foundation for a stronger rise in the short term.

Exchange reserves will plummet to YTD LOW

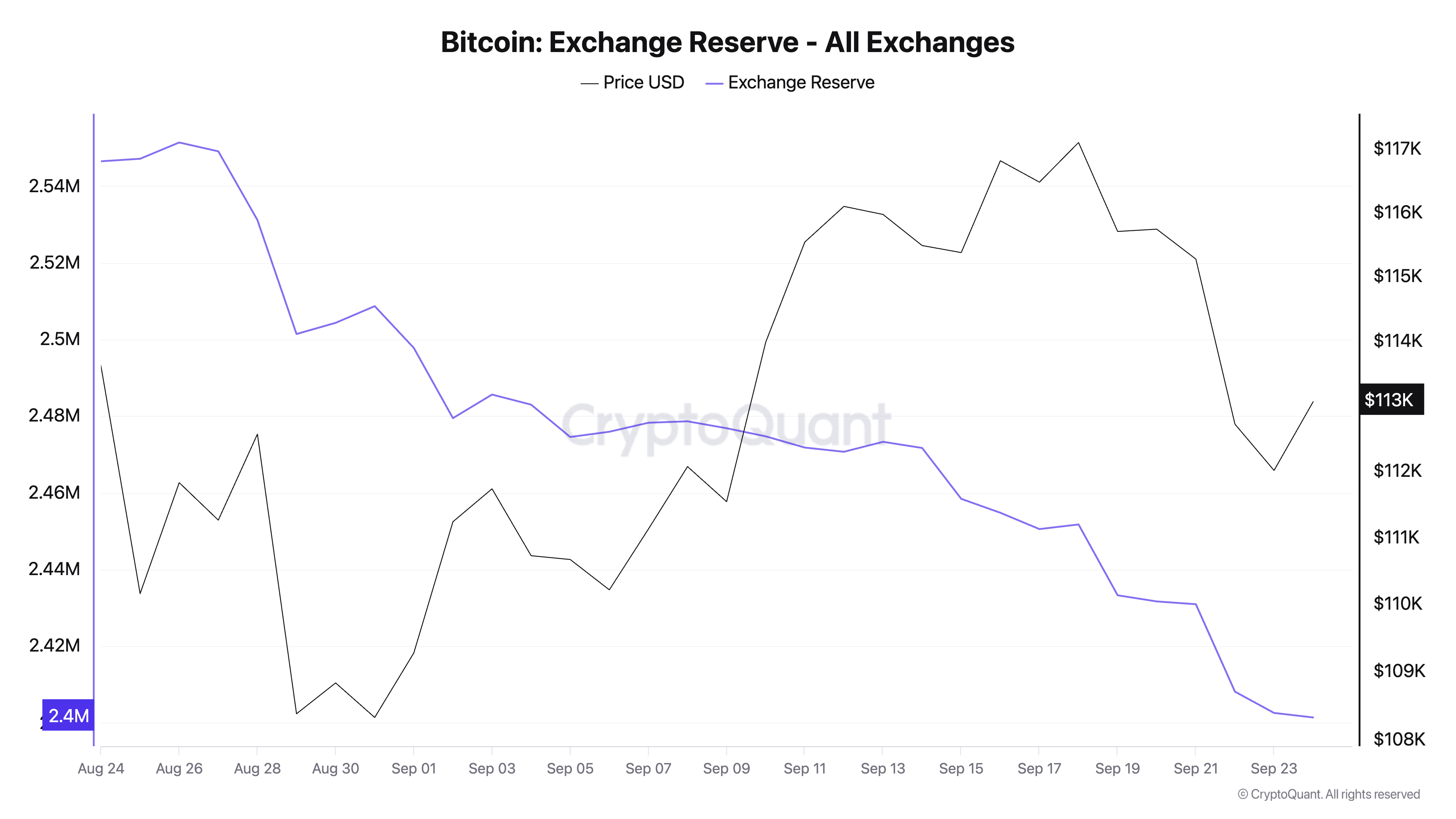

One of the most notable signals is BTC’s Exchange Reserve, which continues to fall. According to Cryptoquant, Tuesday hit a year-to-date low of 2.4 million people.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

Bitcoin Exchange Reserve. Source: Cryptoquant

BTC’s Exchange Reserves measures the amount of coins held on a centralized trading platform. The sustained decline indicates fewer coins available for immediate sales, suggesting investors are moving their assets to refrigerated or holding them for the long term.

Despite the lack of price performance, the BTC exchange highlights that the stable dip over the past few weeks has shown signs that the broader market is weakening emotions, yet traders are still maintaining their beliefs.

This quiet withdrawal from the exchange suggests that holders will continue to feel confident in BTC’s long-term outlook and reduce immediate sales pressure.

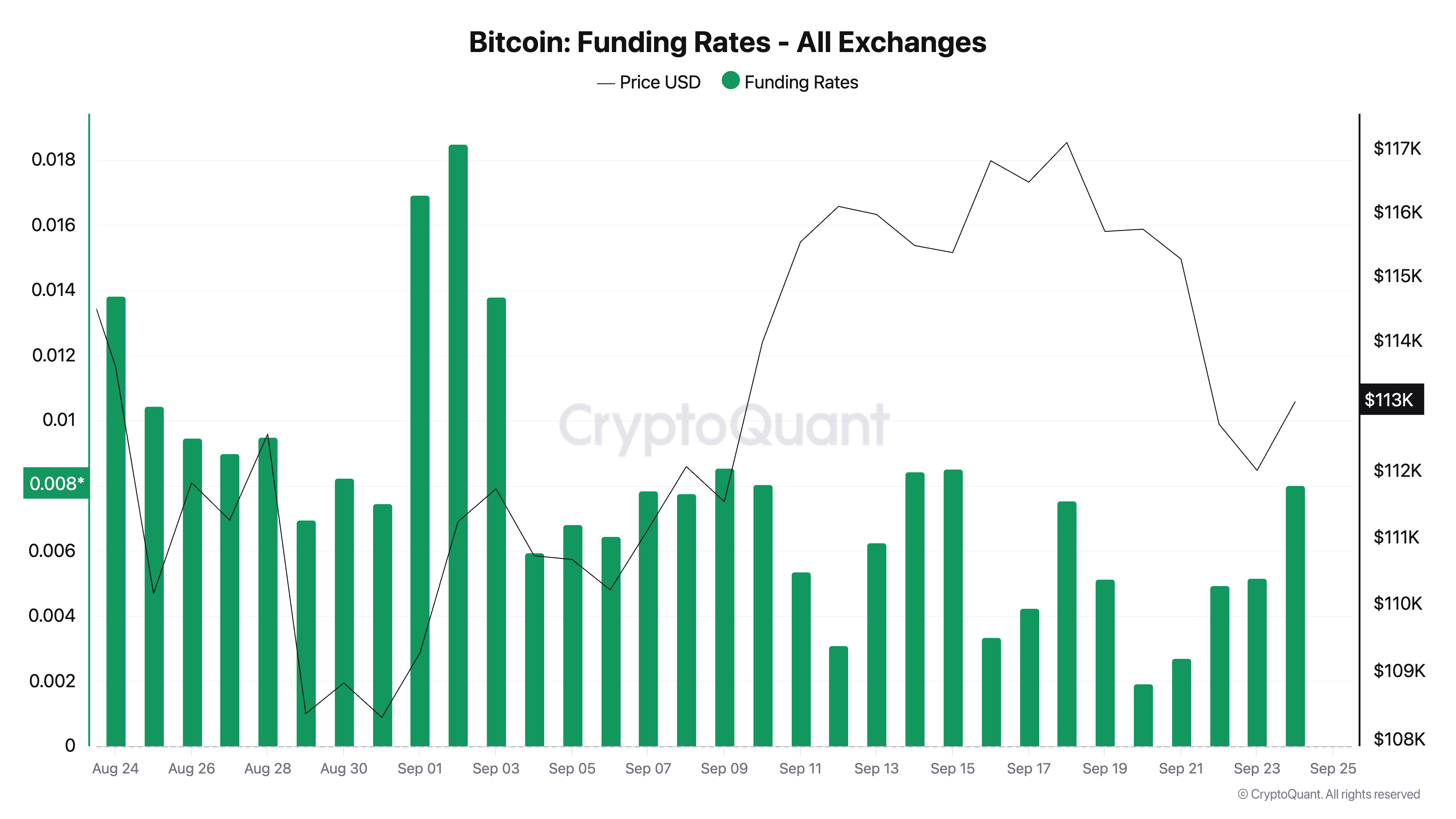

Furthermore, BTC’s funding rate across major exchanges remains positive, indicating that futures traders continue to be bullish. At press, this is 0.079.

Bitcoin funding rate. Source: Cryptoquant

Funding rates are used in perpetual futures contracts to match contract prices with spot prices. If the rate goes positive, the longer traders are paying for shorts, indicating that most traders are bullish. Conversely, negative rates indicate that shorts are paying for long distances, suggesting a bearish slope.

Currently, BTC’s funding rate remains positive, but moderate. This indicates that traders hold a slight bullish bias but do not take on aggressive leverage. Such positioning reduces the risk of sudden liquidation and suggests cautious optimism. This could provide the stability necessary to build on recent profits.

Bitcoin support is retained – Will the climb up to $115,000 be next?

If buyers are using this fundamental support, BTC can extend the climb at a near stage and rally at $115,892.

BTC price analysis. Source: TradingView

However, as the market weaknesses deepen, the current gatherings will stall and BTC will consolidate or trigger flooding under the support floor for $111,961.

The reason why bitcoin’s small profits are hidden is that bigger breakouts first appeared.