Ethereum Prices on the Edge: Risk $4,000 Support

Ethereum ($eth) is in a dangerous zone as it is slightly above the $4,000 mark. After a sharp drop that temporarily pushed the coin into $3,800, ETH managed to cover some ground, but the recovery appears vulnerable. With Bitcoin falling below $110,000, pressure across the crypto market is weighing heavily on Ethereum, causing the fear of another breakdown to $3,500.

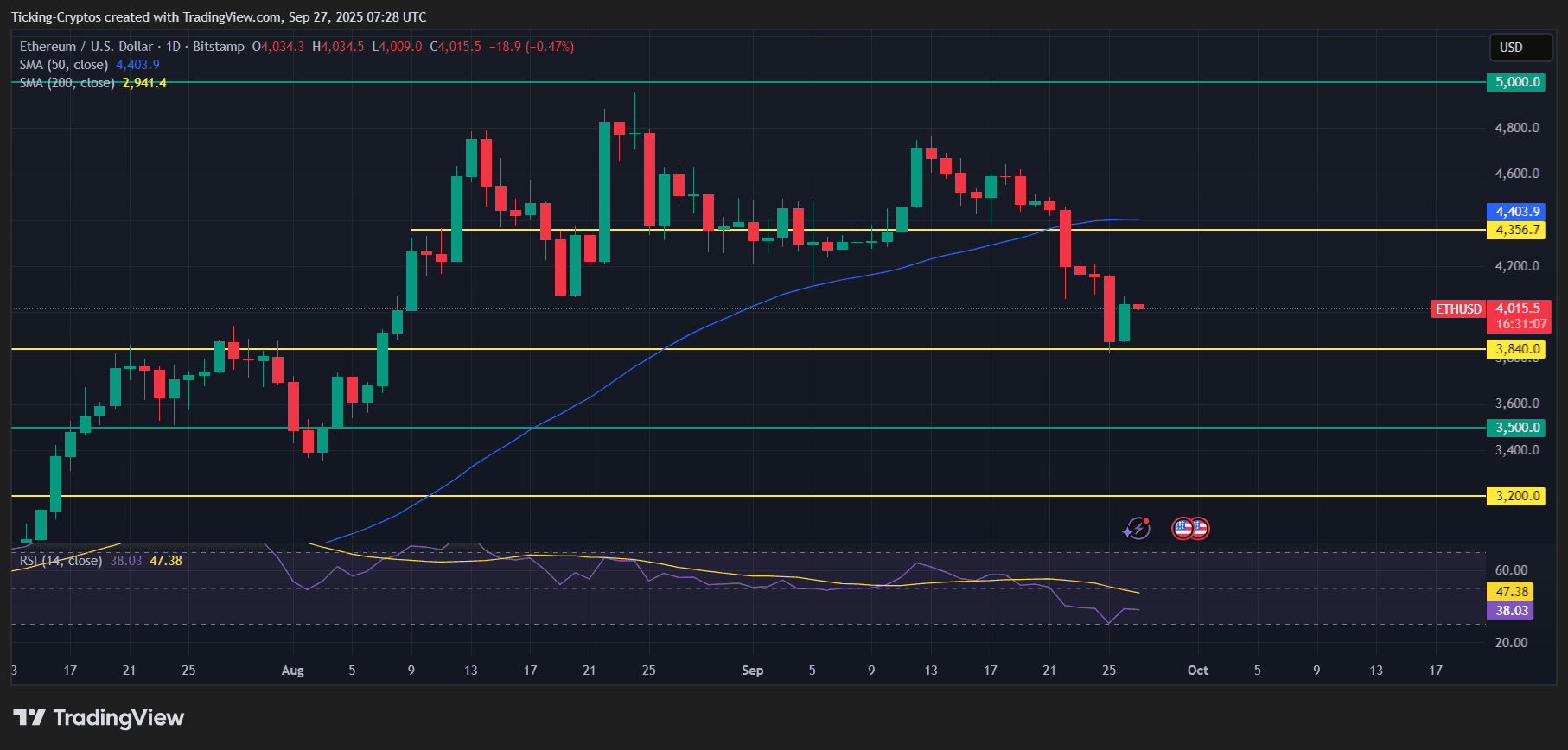

Ethereum prices for the past week – TradingView

Why is Ethereum crashing?

A few key factors are driving the current crash in Ethereum and the broader crypto market.

- Bitcoin crash: A sharp drop in Bitcoin under $110,000 has triggered panic sales across Altcoins. ETH is following BTC’s leads as the second largest cipher.

- Market-wide sell-off: The entire crypto sector is under pressure, and investors are taking risks amid the sheer squeeze of volatility and liquidity.

- Political uncertainty: Global tensions and unclear policies regarding cryptographic regulations lower risk assets.

- Ethereum’s technical weaknesses: The ETH chart shows clear indications of failure and important support levels have already been tested.

Technical Analysis: ETH/USD Price Chart

The Ethereum Daily Chart reveals a vulnerable setup.

- Key Support Levels: $ETH temporarily defeated support at $3,840, a level tested multiple times in recent months. Nearly below this zone the next drawback target is exposed $3,500There is a deeper risk $3,200 If sales are strengthened.

- Resistance zone: The advantage is that ETH faces immediate resistance $4,350-4,400close to the 50-day moving average. The Bulls need to regain this level to deny even more negative side pressure.

- Moving Average: 50-day SMA ($4,403) has already reversed to resistance, but 200-day SMA is far lower $2,941indicates how much space ETH should fall in an extended crash.

- RSI indicator: Currently I have an RSI 38the bearish momentum of the traffic light. A further decline in the territory sold could accelerate sales.

ETH/USD 1-Day Chart – TradingView

Ethereum Price Prediction: Will ETH prices drop to $3,500?

Market analysts warn that ETH can be revisited $3,500 If Bitcoin is not stable above $110,000, in the next few days. The close correlation between the two assets means that Ethereum is unlikely to be split in the short term. While some traders view $3,500 as a potential purchase opportunity, many fear that lower breaks can cause liquidation.

Outlook: Is this the beginning of a bigger Ethereum crash?

Ethereum price action is flashing warning signs. Fragile bounces starting at $3,800 can only be temporary if Bitcoin continues to fall and macro uncertainty persists. Unless ETH can be held above $4,000 And then play Resistance between $4,350 and $4,400the path with minimal resistance remains on the downside.

For now, Ethereum traders are volatility with a look at $3,500 as a key line of sand.