- Bitmex co-founders offloaded a hype worth around $5.1 million over the weekend.

- The most recent data shows he spent $374,999 to accumulate 1,630 Aave tokens.

- The move could indicate new attention to the top debt assets.

Crypto investors and traders are changing positions inside A wider bearish in general.

Arthur Hayes, former CEO and co-founder of Bitmex, continues to adjust his portfolio.

Hayes reduced exposure over the weekend It sells 96,628 hype coins worth around $5.1 million.

Hayes redeployed his revenue today. Lookonchain highlighted that the billionaire spent $374,999 to buy 1,630 Aave tokens a few hours ago.

Arthur Hayes (@cryptohayas) 374,999 spent $ usdc Buy 1,630 $ $230. etherscan.io/address/0x6cd6…

5:40 PM/September 23, 2025

The transaction has attracted attention from cryptocurrency analysts and traders, with many digging the reasons behind the swap.

Whale movement is essential to measuring sentiment in the broader market.

Aave became bullish after the revelation, increasing by more than 3% in the daily time frame to trade for $275 during this publication.

Moving from guessing to stability

The hype has seen considerable volatility in recent weeks, and has gained traction thanks to its impressive gatherings.

Earlier this month, it broke key resistance with a massive surge, from $42 to a record high of $58 on September 18th.

The incredible run has led analysts to predict large gatherings of assets.

Hayes predicted a 126x surge due to hype.

However, the Bitmex co-founder ended his position a month later.

He highlighted the unlocking of looming tokens that could increase sales pressure in high lipid ecosystems in the coming months.

On the other hand, switching to Aave could potentially reflect Hayes’ new approach to suit the Blue Chip Defi protocol.

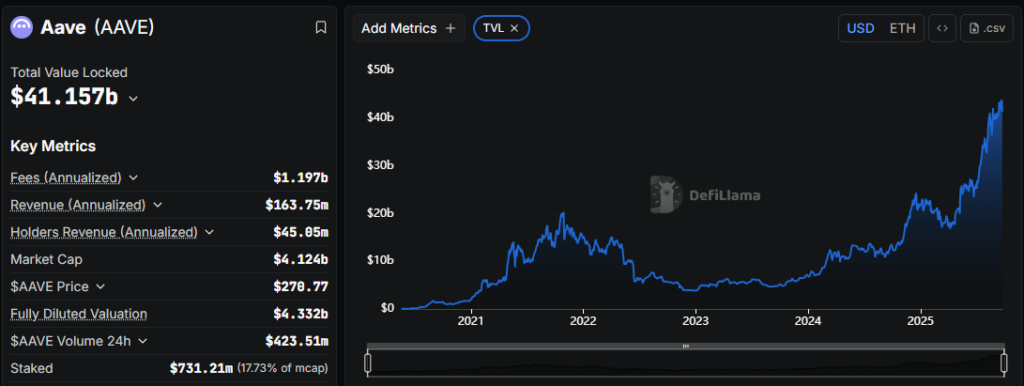

Aave is a leading borrowing and lending platform with over $41 billion in total locked value (TVL).

Blockchain even numbers Integrated Ripple Compliant RLUSD Stablecoin to ensure streamlined products.

Aave Price turns bullish

Although the accumulation may be smaller than Altcoin’s trading volume, Hayes’ purchases have updated new sentiments with Aave.

The transaction showed the appetite of Defi Blue chips. Aave swapped hands for $275, an increase of 3.06% over the daily time frame.

The Hayes purchase does not guarantee an extension of the price, but it could serve as a reference for other whales planning similar relocations.

Meanwhile, the hype has maintained bearish bias today.

Hyperliquid’s native token lost nearly 4% in the last 24 hours and hovered at $47.41.

Emotions decreased after haze contraction and dumping, contributing to lipid shortcomings.

Furthermore, DEX faces fierce competition as Binance’s Aster (Aster) gains unparalleled momentum to democratize the derivatives market.

Meanwhile, Hayes’ trading reminds us of the dangers of the next influencer when investing in cryptocurrency.

Most people may have invested in hype after the billionaire bullish bet.

However, Bitmex co-founder ended his position within a month, confusing holders about Alt’s future performance.

Was he promoting hype to his followers before using them as outlet liquidity?

The best thing to do is research before taking on digital tokens.