Intensive exchange is moving from trading venues to regulated financial platforms. IPO funding, app innovation and more stringent surveillance have revealed structural changes in the way institutions and consumers access the market. At the same time, it shows how permanent Dexs surged beyond the $2.6 trillion deal in 2025, showing how decentralized rivals are gaining attention with uncustood leverage and speed.

This transition is important as it determines whether CEX is a systematic financial hub in terms of bank-like standards and investor capital flow subjectivity, or whether there is a risk of losing its position in a decentralized rival.

The momentum of the IPO indicates the shift in the exchange model

Latest updates

Kraken secured $500 million, speeding up IPOs and strengthening links with traditional funds. Meanwhile, Gemini is making revenues at $425 million after high demand.

Revolut is a scamCider the $75 billion dual London New York list to record their first debut at once on both the FTSE100 and the NYSE.

Background context

Valued at $75 billion with 65 million users, including 12 million in the UK, Revolut has raised $3.77 billion to expand to crypto, brokerages and banks. Furthermore, the UK rules change will allow large companies to participate in FTSE100 within five days of their listing, increasing demand for indexes.

Shift Markets reported that the exchange is matured to a multi-service hub. Additionally, the Animoca brand argued that these moves indicate that Cex will become a gateway for payments, identity, and tokenized assets.

Exchanges transform into super apps for global users

Kaiko has discovered liquidity concentrated in the top five venues, but Challenger has expanded regionally with new services.

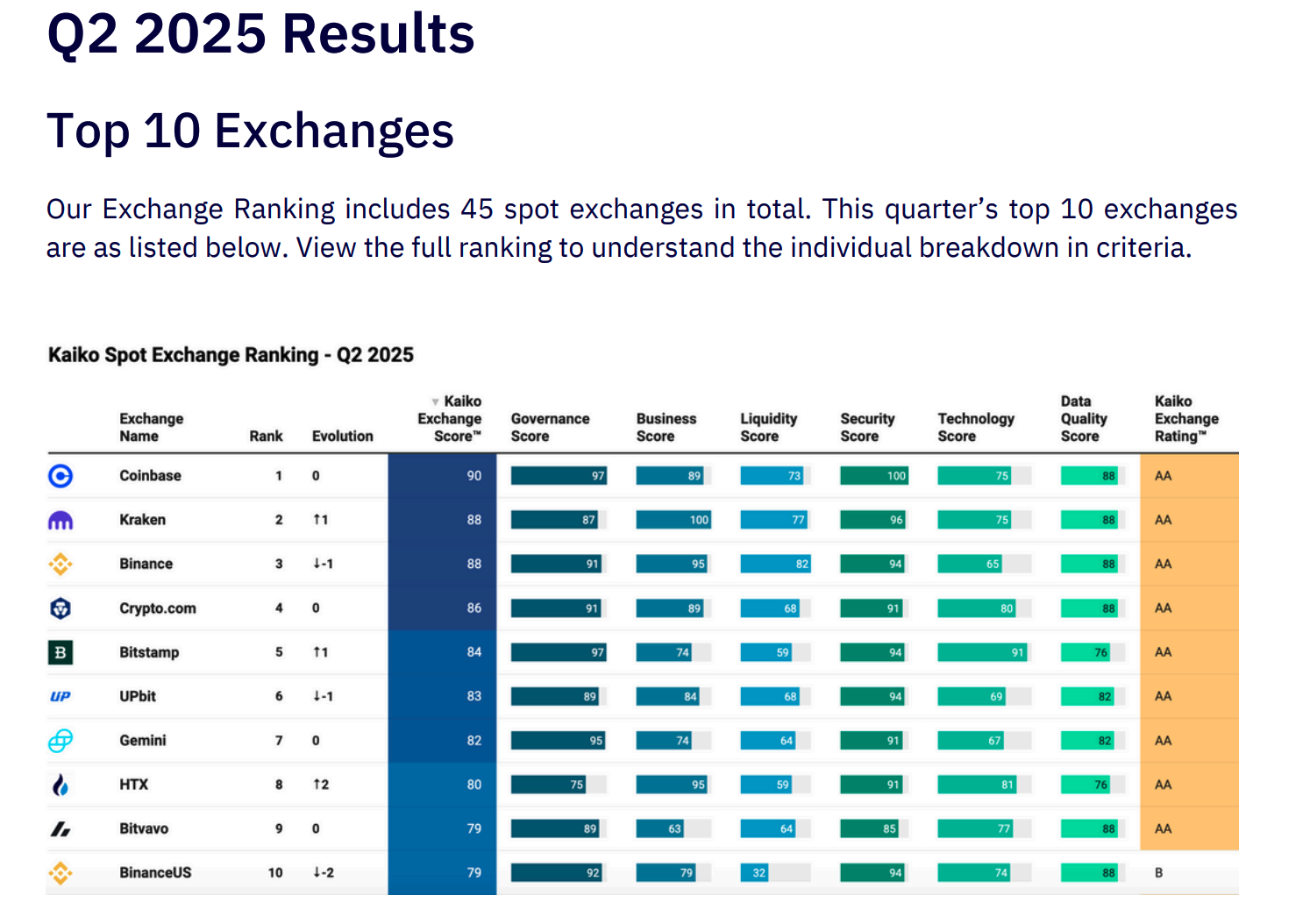

Kaiko Q2 2025: Coinbase, Kraken, Binance Lead Spot Market.

Coin Metrics reported that CEXS still dominates the volume, suggesting a complementary role, despite increased payments on the chain. As a result, Bitwise observed that agencies prefer regulatory exchanges for custody and risk management.

Behind the scenes

Coinbase launched the base app and merged with trading, payments and social feeds. In Asia, Line Next and Kaia have introduced Unify to embed Stablecoin payments. These moves show CEX chasing the super app model that reaches traders as well as everyday financial users.

Exchange at crossroads: regulations, risks, reputation

Wideer impact

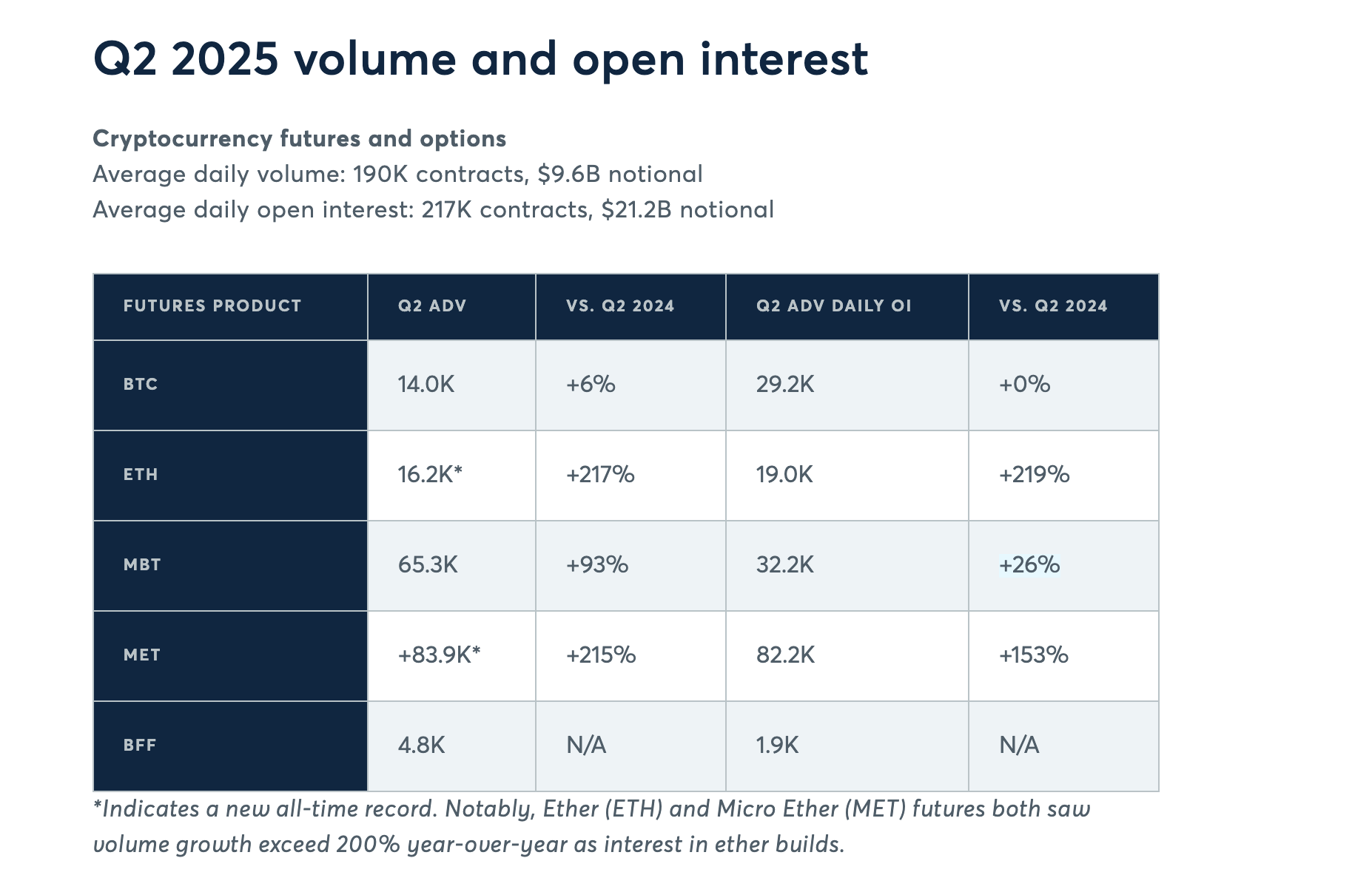

The CME highlighted the increased institutional demand for derivatives and supported exchanges that consolidate spots, futures and tokenized assets.

CME Q2 2025: ETH and microether futures surged.

The PWC outlined convergence rules for custody, capital and disclosure, warning that CEX could be deemed systematically important in the face of bank-like surveillance. This increases costs but also increases reliability.

Risks and challenges

Competition with cross-border fragmentation, high compliance spending, and decentralized exchange remains headwinds. However, payments, tokenization, and diversification into identity may support revenue.

Additionally, analysts warn that legal perceptions of chain settlements and harmonious custody rules will determine which model to extend. Additionally, DEX’s market share continues to rise, reminding investors that regulatory delays can speed up the transition of users from CEX.

Expert opinion

“Exchanges can no longer trade venues. They need to act as a bridge between centralized and decentralized worlds,” says Bitget CEO Gracy Chen, in Animoca’s study.

“(The data) shows how exchanges evolve from liquidity hubs to cultural and financial gateways,” said Ming Ruan, head of research at Animoca Brands.

“CEX is at the inflection point. What adapts is similar to a full-service financial institution,” said a Kaiko analyst.

From IPOs to super apps and stricter rules, CEXS is redefineing its role in global finance. Investors were able to see new capital in IPOs and listing channels. Regulators may need an exchange immediately to meet bank-level standards.

Even as Dex adoption grows, users still rely on CEX as their main gateway. The future of the sector relies on combining innovation and surveillance to provide simple and secure access to both the crypto and traditional markets.

Post-CEXS vs DEXS: Which model governs the next cipher cycle? It first appeared in Beincrypto.