Falcon Finance launched the FF token with high expectations, but the assets lost up to 76% of their value in early trading. They even sold by influencers and teams, tanked the tokens and turned it into one of the less successful airdrops.

Falcon Finance launched FF tokens in 2025 with one of the much-anticipated airdrops. However, with the initial transaction, the FF slides up to 76%, as it sells from influencers and in some cases to liquidation of some of the team’s allocations.

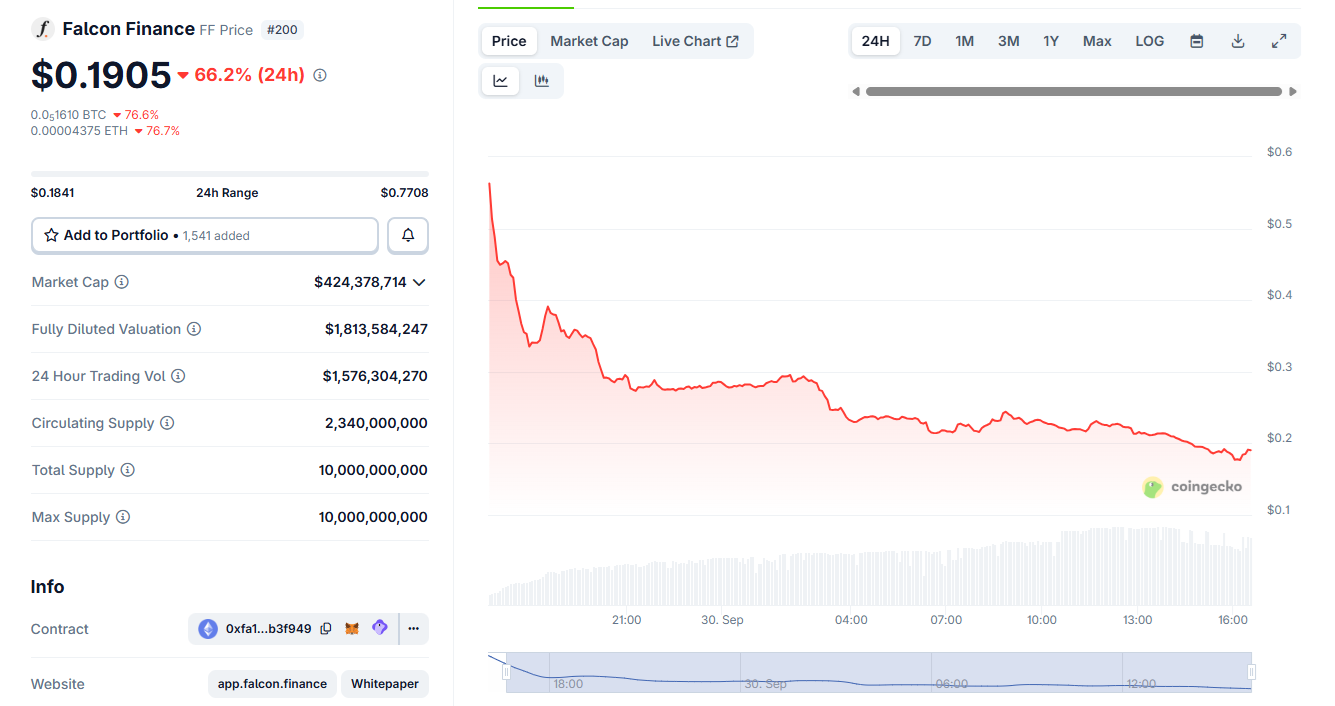

The FF token was one of the biggest losers of the day after the first recipient was sold. |Source: Coingecko

As cryptopolitan It has been reported Previously, the token launch was to fuel the next stage of growth of the project. Falcon Finance also had a seal of approval from the world’s Liberty FI. investment $10 million for the project.

Falcon Finance was supposed to be one of the key Stablecoin publishers that produced USDF Stablecoin. The newly released FF token had a governance feature, so it was sold early by airdrop recipients.

Falcon Finance FF token erases up to 76%

At the end of the first trading day, the FF fell to $0.17. The token was traded temporarily for $0.75, which quickly led to rapid sales.

The token launched its trading trajectory based on the initial hype from support for Trump’s WLFI project. However, this was not enough to inspire FF holders, leading to immediate sales pressure.

Even in a diversified exchange, FF recognized as much profit as possible for the top whales, and discharged liquidity to just $8,000 in some pools.

FF was trading with market makers participation that could not interfere with price slides. One reason for the allocation was the uneven launch of the billing page. The FF allocation was also much larger for participants in the Kaito ecosystem. Other airdrop claims also did not make token transmission work or delay.

This allowed the first recipient to sell quickly, crashing the price while the airdrop claims were not yet fully processed. Even the Binance Alpha Airdrop was delayed, leading to unfortunate price performance.

Why do traders think FF is a scam?

The FF arrived after some airdrops that achieved “UP only” milestones, especially the Aster. However, FF airdrops did not encourage retention. Despite the selection of vesting options, FF was freely distributed to Colwallet.

Furthermore, fewer tokens than expected were distributed and branched out from the beginning. Calculation Airdrop claim. FF was also released at relatively high full dilutions.

That being said, Falcon Finance remains here, with its founder Andrei Grachev in attendance. tokeen2049 An event in Singapore. Grachev is also the founder of market maker DWF Lab, a partner at WLFI. For some, the connection became skeptical as they were moving away from the Falcon Finance project.

The project’s token has fallen, but the fear of rug pulling is exaggerated. The post-air tracks resemble those of Pump.Fun, initially sold by early whales.

FF is also the token behind USDF assets. In September, USDF supply expanded rapidly, reaching over $20 billion. For now, USDF is only traded in decentralized markets, but wide acceptance on exchanges could boost Falcon Finance.