Sam “SBF” Bankman Fried, founder and former CEO of bankrupt cryptocurrency exchange FTX, said his “biggest mistake” during the $8 billion bankruptcy was handing control of the company to new management. The decision, he claims, cost him a last-minute opportunity to save the company.

Bankman Fried, who once led the $32 billion FTX exchange, is currently serving a 25-year sentence for seven felonies related to the November 2022 collapse of FTX and Alameda Research, which resulted in the loss of $8.9 billion in investor funds.

Looking back at FTX’s collapse, Bankman Freed’s “biggest mistake” was handing over the company’s leadership to current CEO John J. Ray III on November 11, 2022.

“The single biggest mistake I made was taking over the company,” SBF told news outlet Mother Jones in an interview published Friday.

Minutes after signing the cryptocurrency exchange, Bankman Fried received a call about possible outside investment that could have saved the company from bankruptcy, but it was too late to unsign, he claimed.

After being appointed as the new CEO, Ray filed for Chapter 11 bankruptcy on November 11, 2022, and hired the law firm Sullivan & Cromwell (S&C) to provide legal assistance in the proceedings.

Bankman Freed was arrested in the Bahamas on December 12, 2022, after U.S. prosecutors filed criminal charges. He was extradited to the United States in January 2023.

FTX collapsed due to misappropriation of user funds, resulting in billions of dollars worth of trading losses for its sister company, Alameda Research. The quantitative trading firm used FTX customer funds transferred without consent by Bankman Freed to fund trading losses in Alameda, now called Alameda Gap.

Related: Wall Street’s next crypto deal may not be an altcoin, but an IPO-ready crypto company

Sullivan and Cromwell recommended Ray to SBF as FTX’s new CEO

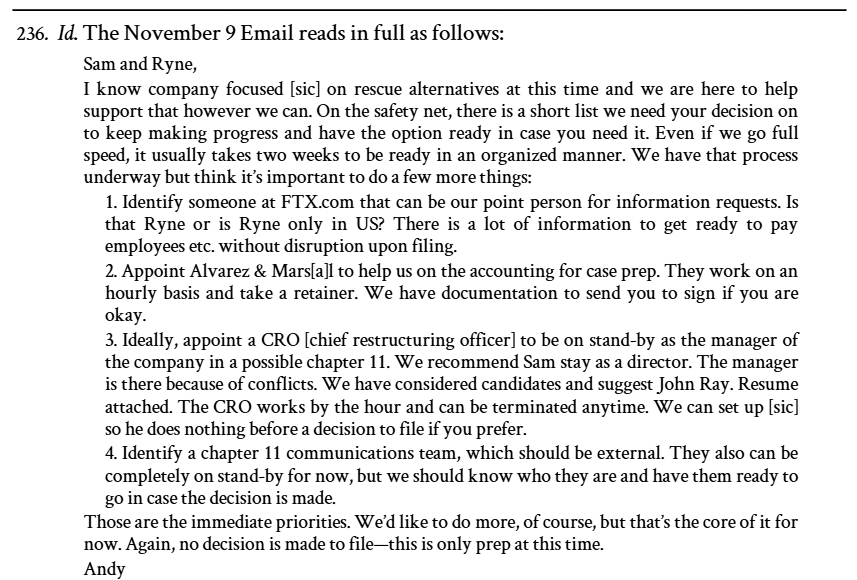

Two days before FTX filed for bankruptcy on Nov. 9, S&C attorney Andrew Diedrich emailed Bankman Fried to propose a plan to hire Ray as chief restructuring officer with “possible Chapter 11.”

Source: Documentcloud.org

On February 16, 2024, a group of FTX’s creditors filed a lawsuit against the law firm, alleging that the firm was involved in a multibillion-dollar fraud at FTX from which the company profited financially. The lawsuit sought damages for aiding and abetting fraud and breach of fiduciary duty, but was voluntarily dismissed in October 2024.

S&C has racked up $171.8 million worth of legal fees due to the FTX bankruptcy through June 27, 2024, according to court documents reviewed by Reuters.

Related: Melania Trump plugs meme coin amid $10 million team sale allegations

FTX users still waiting for more than $4.2 billion in repayments

Almost three years after the exchange’s collapse, FTX creditors continue to wait for full repayment.

FTX Real Estate began repaying creditors in February with a $1.2 billion payment, followed by a $5 billion distribution in May. With the September payment, the exchange repaid a total of $7.8 billion to creditors.

FTX is estimated to have recovered assets worth up to $16.5 billion that can be used to repay creditors, who will receive an additional $8.7 billion.

The exchange plans to pay back 118% of the value of their accounts to at least 98% of its customers as of November 2022.

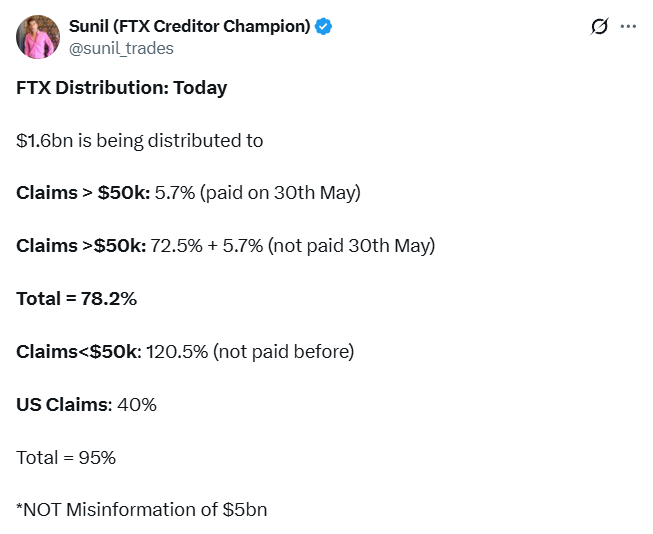

sauce: sunil

FTX creditor and customer special committee member Sunil revealed in an X post that FTX distributed the third repayment set worth $1.6 billion to users on September 30th.

The collapse of FTX triggered a wave of bankruptcies across the crypto industry, leading to one of the longest bear markets in crypto industry history. Bitcoin (BTC) has plummeted to $16,000.

Magazine: $2,500 document on FTX collapses on Amazon Prime…with help from mother