South Korean retail investor capital is driving ether price momentum and corporate ether treasury company increases, according to industry insiders, as the world’s second-largest cryptocurrency trade remains just 7% below its all-time high.

According to Samson Mow, CEO of Bitcoin Technology Company Jan3, “the only thing” keeping the price of ether (ETH) and the companies in the ether treasury at current levels is Korean retail capital worth about $6 billion.

“ETH influencers are flying to South Korea to market just for retail. These investors have zero thoughts on the ETHBTC chart and think they are buying the next strategic play.”

sauce: Samson Mo

Upbit and Bithumb are two major centralized exchanges (CEX) used by Korean retailers.

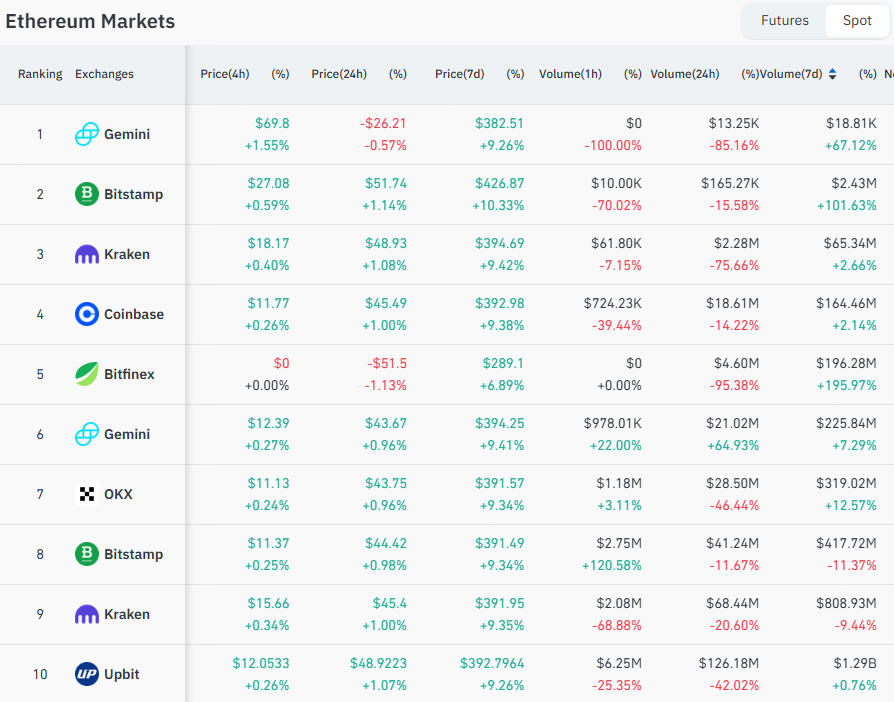

Looking at futures data, Upbit ranks as the 10th largest CEX in terms of Ether futures trading, with $129 billion worth of trading volume, according to Coinglass data.

CEXS by Ethereum futures trading volume. Source: Coinglass

Crypto futures trading typically exceeds the volume of spot trading and therefore has a significant impact on the price of the underlying asset.

Related: Japan’s new PM may be a boon for risk assets, crypto markets

Ether’s ‘Kimchi Premium’ boosts Korean retail investor engagement

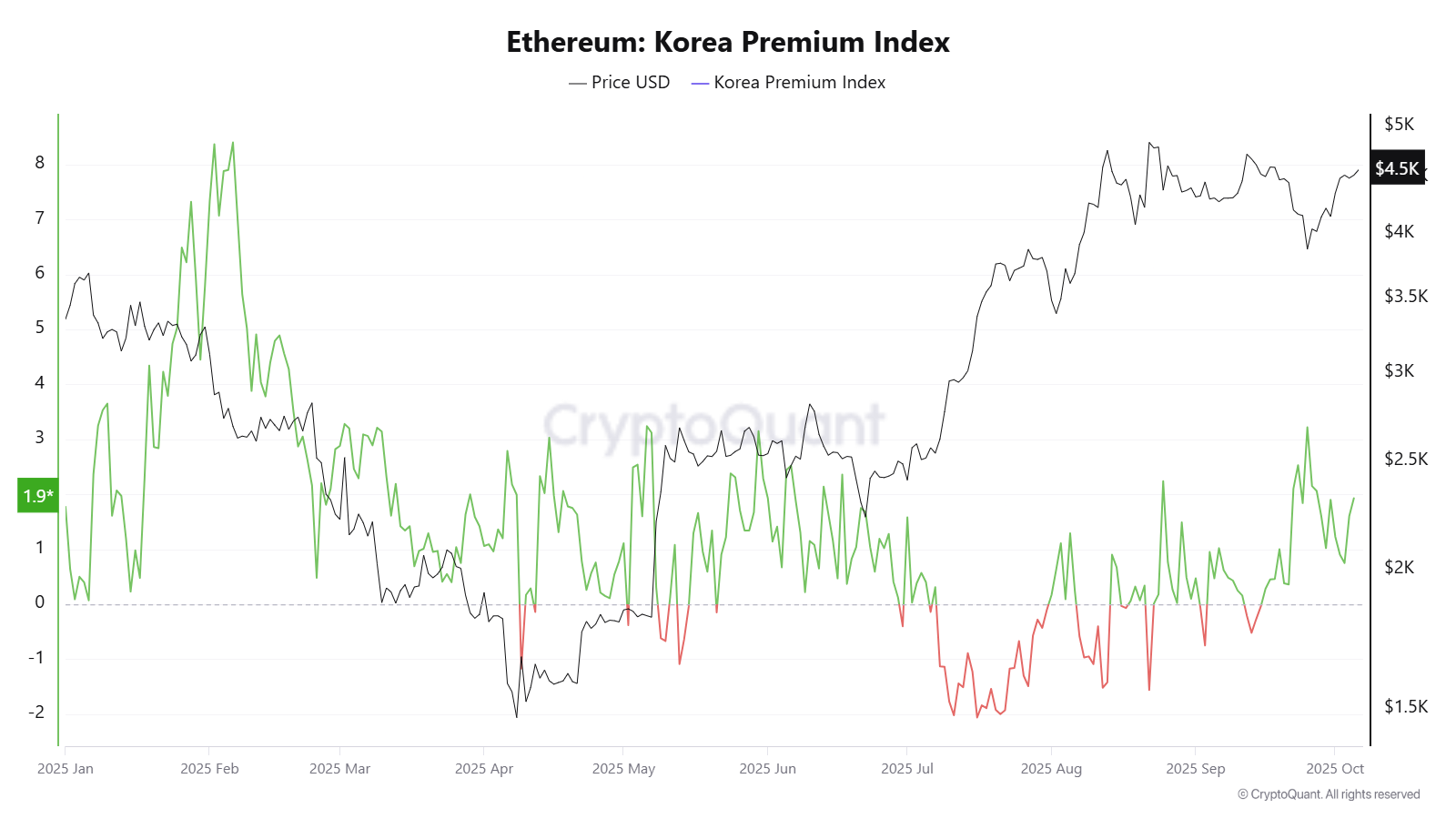

Ether’s “Kimchi Premium” also shows growing demand from Korean retail investors. This explains why the prices of cryptocurrencies are higher on Korean exchanges than on other exchanges.

Ether’s Kimchi Premium rose to 1.93 on Sunday, according to blockchain data platform Cryptoquant.

Ethereum: Korea Premium Index, chart with year. sauce: encryption

This indicator measures the Ether price gap between South Korean exchanges and other exchanges.

According to Marcin Kazmierczak, co-founder of Blockchain Oracle Oracle Firm Redstone, Korean retail investors are important participants in the crypto market, as reflected in Ether’s “Kimchi Premium.”

However, Kazmierczak said this is just a small part of the overall momentum in the ether.

“Characterizing them as the primary support for Ethereum significantly understates the network’s diverse global capital base, which includes substantial U.S. investment through ETFs, corporate treasuries, and the vast rebellious ecosystem that relies on ETH.”

Kazmierczak added that Ethereum’s strength lies in its “boundaryless nature” that combines Korean retail with global institutional participation.

Related: Aging boomers and global wealth by 2100

Mow’s insights come as many other industry watchers are questioning the sustainability of the ethereal financial company.

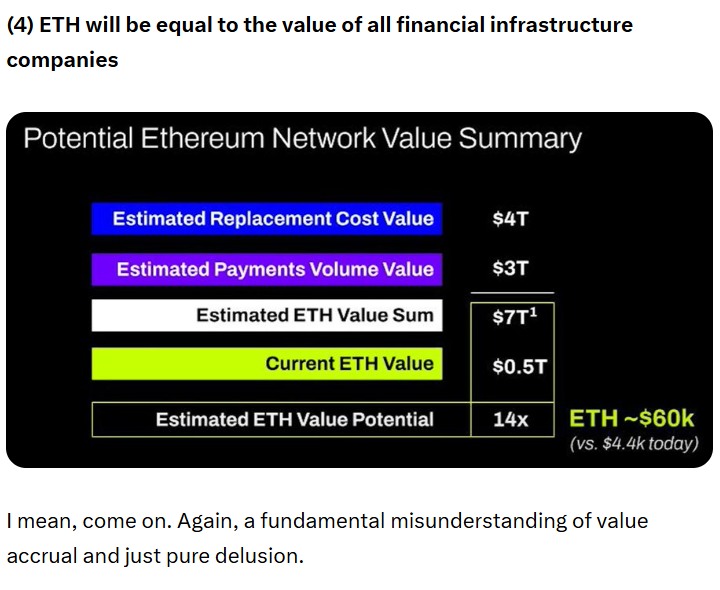

In September, Mechanism Capital founder Andrew Kang criticized Bitmine founder Tom Lee’s ether thesis, claiming that ether’s value from stubcoins and real-world asset (RWA) tokenization was overstated.

sauce: Andrew Kang

“Ethereum’s valuation comes primarily from financial illiteracy. To be fair, it can create a decently large market cap,” Kang said in X Mail on September 24, adding, “The valuation that comes from financial illiteracy is not infinite.”

“Broader macro liquidity” is maintaining momentum in ether prices, but “major organizational changes” are needed to rescue it from “indefinitely poor performance,” Kang said.

magazine: Fewer Users, Sex Predators Kill South Korea’s Metaverse, 3AC Sues Terra