The next wave of stablecoin adoption may not be driven by people. Paxos Labs co-founder says AI agents could become the “X-factor”, instantly shifting liquidity to the most efficient issuers and turning market fragmentation into an advantage.

With the passage of clearer regulations regarding stablecoins in the US, the stablecoin market has soared past $300 billion and has become one of the central stories of cryptocurrencies. However, fragmentation across issuers and jurisdictions remains a challenge.

As new entrants enter the increasingly diverse field, from dollar-backed giants like Tether and Circle to synthetic assets like Athena and PayPal’s PYUSD aimed at consumer payments, questions are being raised about whether fragmentation could cause problems for the industry.

“Fragmentation is a double-edged sword,” Bhau Kotecha, co-founder and director of Paxos Labs, told Cointelegraph. With various competing models issuing stablecoins tailored to their businesses, there is a risk that “liquidity silos and user confusion will result, hindering adoption.”

But he believes AI agents – autonomous programs that can make decisions and perform tasks such as trading and transferring funds without human input – could solve the problem.

He said the AI agents will “instantly switch” to the stablecoin that offers the best economics.

“This means that fragmentation is not necessarily a deterrent; it can actually be a market-level optimization measure, with AI ensuring that liquidity flows to the most efficient issuers. Over time, this could compress fees and force issuers to compete on fundamentals.”

The rise of AI agents in cryptocurrencies

Kotecha is not alone in highlighting the importance of AI agents in stablecoin adoption.

In a Sept. 2 Bloomberg interview at the Goldman Sachs Asia Leaders Conference in Hong Kong, Galaxy Digital CEO Mike Novogratz said AI agents will be the primary users of stablecoins, driving a surge in trading volumes.

In the “not-too-distant future,” AI agents will be using stablecoins to handle everyday purchases, he said, pointing to grocery stores that understand your diet, preferences and budget and automatically fill your cart.

He added that these agents are likely to rely on stablecoins rather than wire transfers or payment apps like Venmo, and that he expects an “explosion of stablecoin transactions” in the coming years.

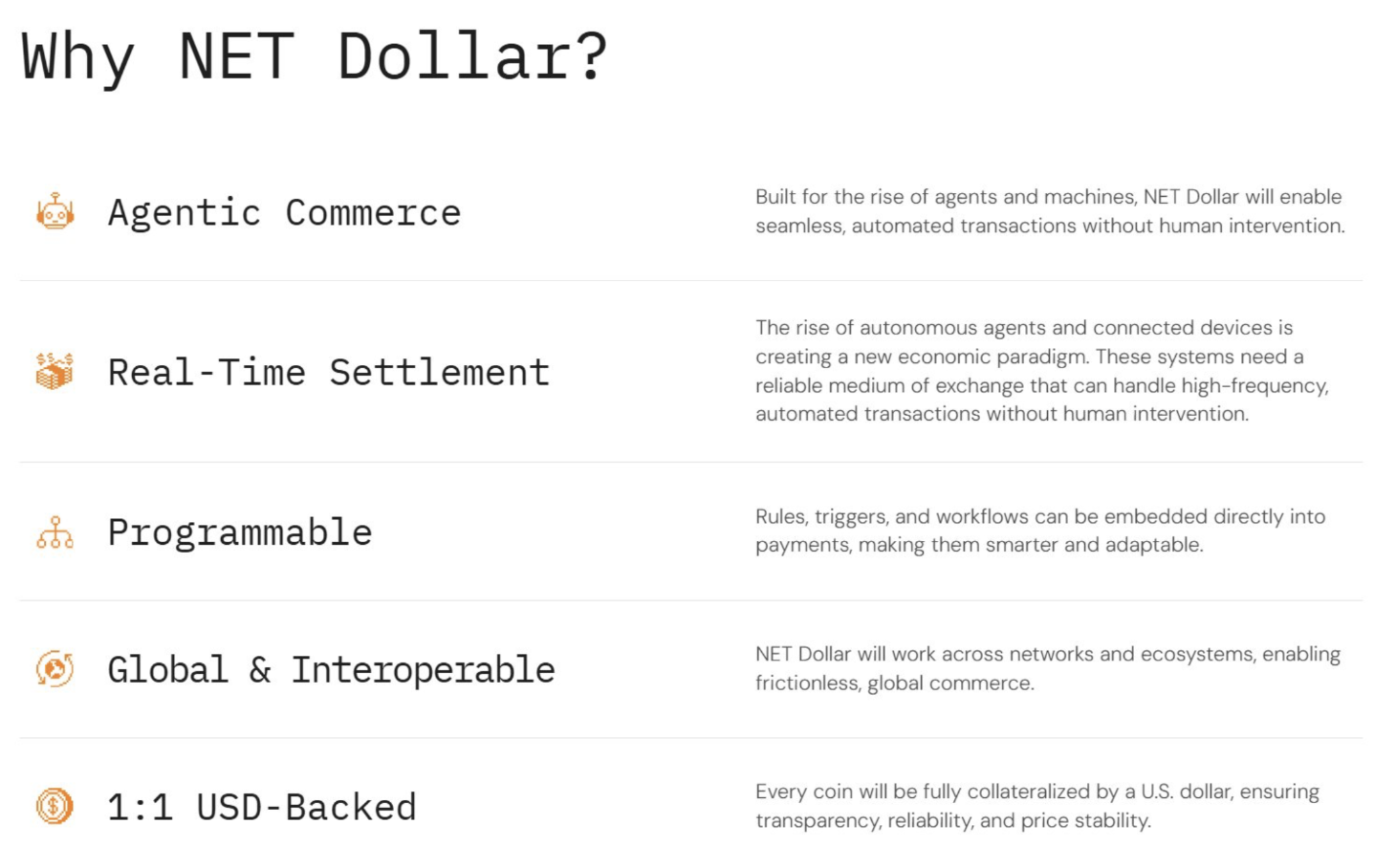

One company already pursuing this vision is Cloudflare, a global cloud infrastructure company. On September 25th, Cloudflare announced that it is working on developing NET$, a stablecoin that supports instant transactions by AI agents.

Cloudflare said its vision for the stablecoin includes a personal AI agent who can take immediate action and book the cheapest flight tickets or buy products as soon as they go on sale.

Features of NET dollar stablecoin. sauce: cloudflare

The news from Cloudflare comes after several cryptocurrency thought leaders expressed their thoughts on the importance of AI agents and their impact on cryptocurrencies.

On August 13, members of Coinbase’s X development team wrote that AI agents are poised to become “Ethereum’s biggest power users,” thanks to the little-used web standard HTTP 402 “Payment Required” that was first introduced 30 years ago.

Anoma co-founder Adrian Brink wrote in late August that the rise of AI agent systems is inevitable. However, to ensure users have control over their data and assets, an intent-based blockchain infrastructure is required.