According to the Associated Press, the numbers also represent the “fastest accumulation of $1 trillion in debt outside of the COVID-19 pandemic.”

US debt tops $38 trillion; Bitcoin tops $110,000

The U.S. national debt topped $38 trillion on Wednesday, after the Associated Press reported that it was “the fastest time outside the coronavirus pandemic to accumulate $1 trillion in debt.” The national debt was $37 trillion in mid-August, but it has increased by $1 trillion in just two months. Bitcoin rose to $110,000 on the news, seemingly encouraged by the possibility of a safe haven as investors grow increasingly wary of government finances. The cryptocurrency had fallen to $109,000 by Thursday morning.

The current government shutdown is in its 23rd time.rd The sun only made the situation worse. Senate Republicans and Democrats remain at an impasse over how to structure the temporary spending bill. Democrats want to extend the health insurance tax credit, but Republicans say it would be too expensive.

A government shutdown cripples government agencies, federal employees lose paychecks, national programs are halted, and important financial decisions are postponed. The result, according to the Congressional Budget Office, was a drop in economic activity, as was $3 billion in gross domestic product (GDP) lost during the 2018-2019 government shutdown. All these downstream effects could accelerate it further to $39 trillion if nothing changes.

“The United States is bankrupt. The real debt is over $175 trillion,” said author and former Coinbase chief technology officer Balaji Srinivasan. “There is no solution. Write it off. National bankruptcy.”

Overview of market indicators

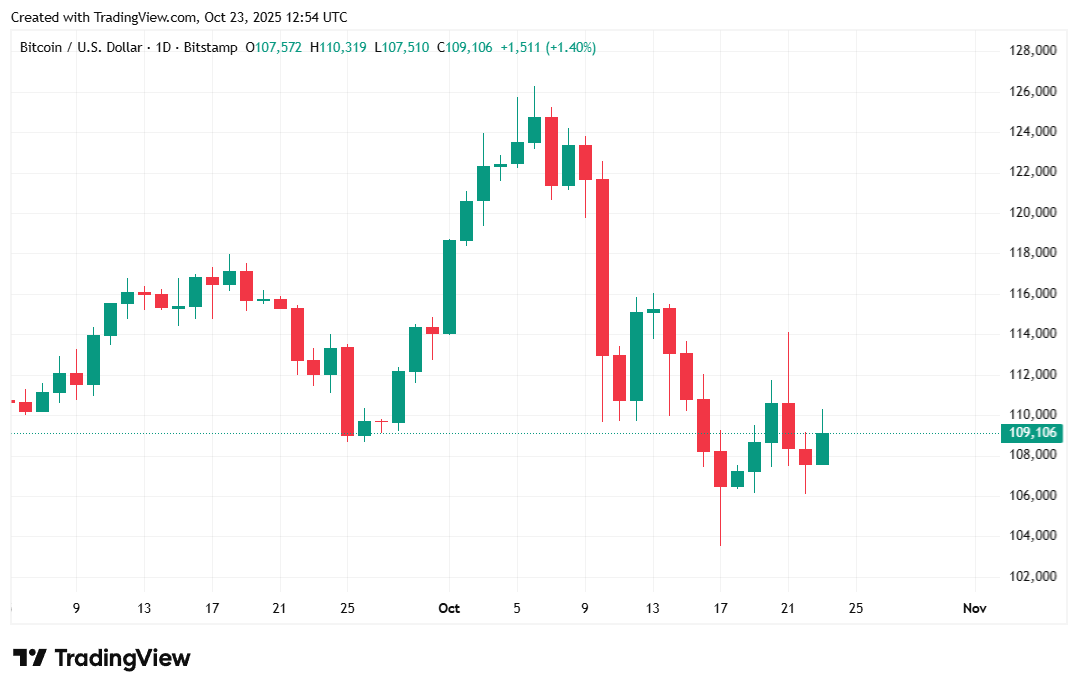

At the time of reporting, Bitcoin price was $109,158.01, up 1.01% on the day, but still down 2.14% on a weekly basis, according to data from Coinmarketcap. Intraday price movement ranged from $106,778.00 to $110,295.02.

(BTC Price/Trading View)

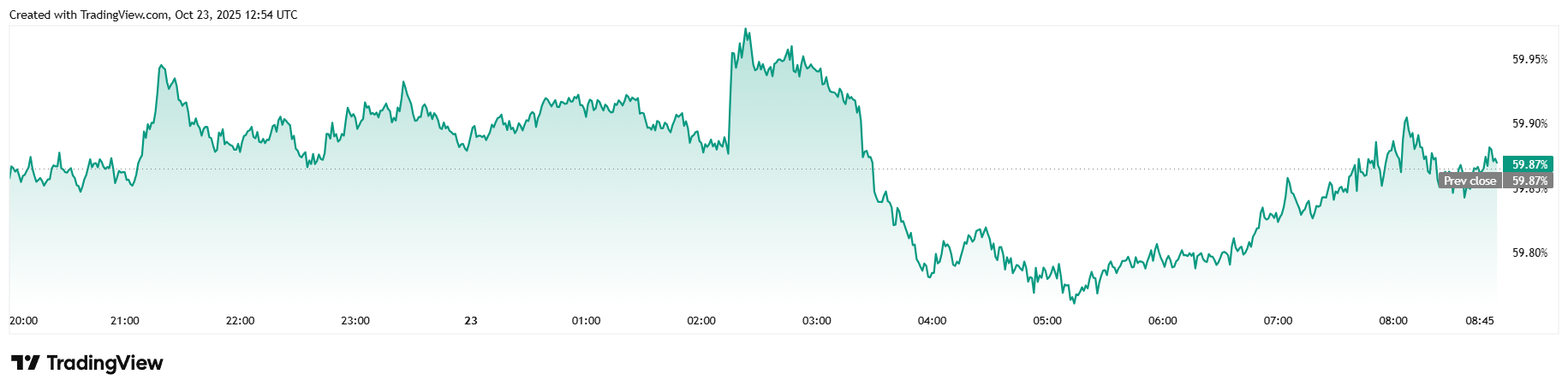

The 24-hour trading volume decreased by 32.87% to $70 billion, but the market capitalization, which fluctuates depending on prices, increased by 1% to $2.17 trillion. Bitcoin’s dominance remained almost flat, dropping 0.01% in 24 hours to 59.87%.

(BTC Dominance / Trading View)

According to Coinglass, the total value of open futures contracts decreased slightly by 0.66% in 24 hours to $68.96 billion. The day’s liquidations started low at $67.1 million, with losses relatively evenly distributed between shorts and longs. Short sellers lost $36.72 million, while long investors lost slightly less at $30.39 million.

Frequently asked questions ⚡

- Why did Bitcoin rise above $110,000?

Investors took refuge in Bitcoin as the U.S. debt soared to a record $38 trillion, signaling declining confidence in fiscal policy. - How fast is the US accumulating debt?

America added $1 trillion in just two months. This is the fastest pace outside of the COVID-19 era. - What’s causing investors’ concerns?

The 23-day government shutdown and political deadlock have heightened fears that economic tensions will deepen further. - What does this mean for Bitcoin’s outlook?

Analysts expect upward pressure to continue as more investors treat Bitcoin as a hedge against U.S. debt and inflation.