Bitcoin, which briefly fell below six digits a day earlier, was trading above $103,000 by 11 a.m. ET on Wednesday, but the real action is happening in the derivatives pit.

From futures to options: Bitcoin derivatives arena remains active

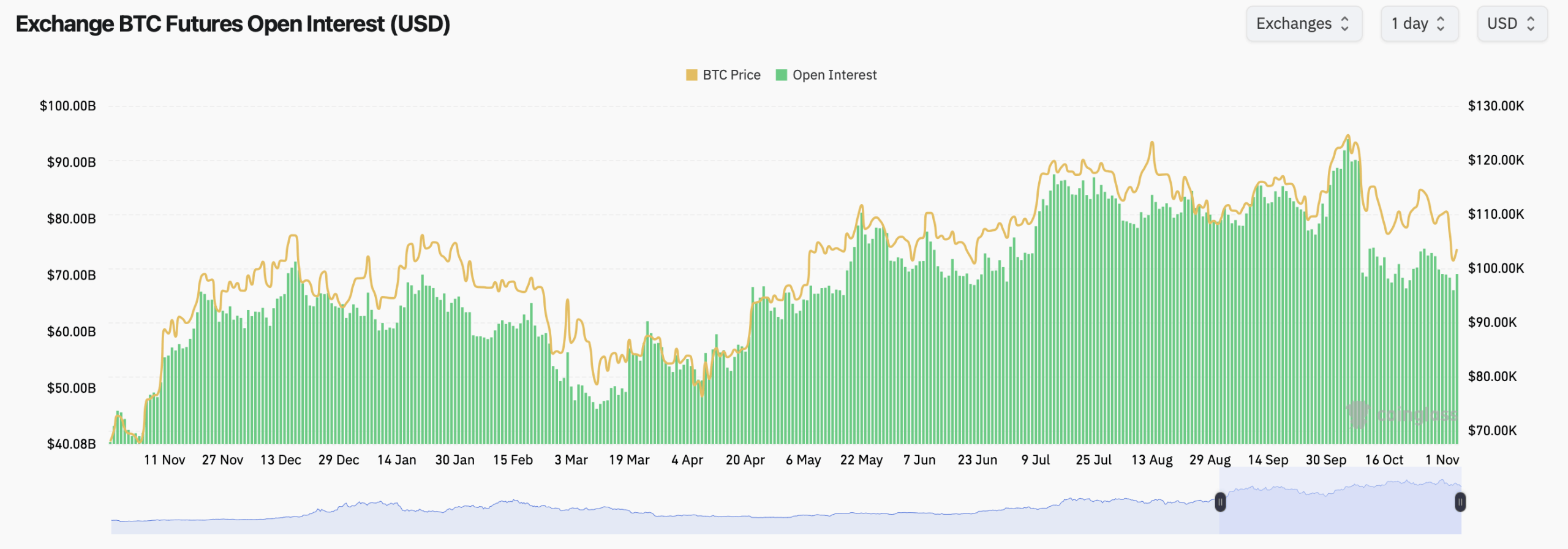

According to data from Coinglass, total Bitcoin futures open interest (OI) stood at 677,750 BTC, worth about $70.24 billion, up 3.47% in 24 hours. CME continues to lead OI with $14.35 billion, closely followed by Binance with $12.45 billion.

CME’s dominance accounts for 20.42% of the total futures exposure, while Binance accounts for 17.72%. Meanwhile, OKX recorded the sharpest rise of 4.12% in 24 hours, indicating fresh capital inflows. Bybit, Gate, and Kucoin showed mixed results. Bybit’s OI fell by 2.03%, Gate by 0.42%, and Kucoin by 2.97%.

Bitcoin futures open interest as of November 5, 2025, according to Coinglass.com

However, MEXC grabbed attention with an explosive rise in OI of 17.45% on the final day, while BingX recorded a rise of 9.32%. These changes suggest that smaller venues are attracting short-term leveraged plays as traders reposition positions following Bitcoin’s weekly spot market decline of 7%.

On the options side, Deribit remains dominant and accounts for the majority of Bitcoin options open interest. The total OI for BTC options is just over $50 billion, with calls accounting for 61% and puts accounting for 39%. Past day statistics show that calls account for 60.73% of the volume, indicating a cautiously bullish bias despite recent volatility.

The hottest bets on Deribit are centered around December’s big expiration date, with traders rushing into call options targeting $140,000 per coin, along with big put positions near $85,000 and moonshot calls at $200,000. In layman’s terms, traders are covering all their bases, hedging against the decline while securing a ticket to a possible rocket ride through the end of the year.

Deribit’s maximum pain level is around $105,000, while Binance’s maximum pain curve is currently pointing at $110,000. This suggests that option writers may want Bitcoin to stay close to these zones to cause maximum discomfort to speculators.

In other words, the Bitcoin derivatives market is still very active. With CME and Binance dominating the futures market and Deribit running the options table, maximum pain levels suggest volatility will reduce towards mid-November. With re-leveraging and rising open interest, traders are clearly gearing up for Bitcoin’s next big swing. The question is which way to go?

Frequently asked questions ❓

- What is the current futures open interest in Bitcoin? Bitcoin futures OI is led by CME and Binance, totaling $70.24 billion across exchanges.

- What is the call to put ratio for BTC options?Calls accounted for 61% of option OI, indicating a slightly bullish trend.

- What are the main BTC option exercises on Deribit?The most active strikes are $140,000, $120,000, and $85,000.

- What is Bitcoin’s current maximum pain level?On Deribit it’s about $105,000 and on Binance it’s about $110,000.