Immunefi, a blockchain security company known for managing bug bounties across decentralized finance (DeFi) protocols, plans to raise $5 million through a public sale on CoinList, a platform that facilitates the sale of crypto tokens.

The sale, which will run from November 12th to November 19th, will offer approximately 374 million IMU tokens, representing approximately 3.74% of the total supply, at a price of $0.01337 each. According to CoinList’s Nov. 5 announcement, this means a fully diluted valuation (FDV) of $133 million, more than 70% lower than the previous private round, which valued the token at $500 million FDV.

Commenting on the token discount, Immunefi CEO Mitchell Amador said in a comment to The Defiant that the company is running a community sale “at a deep discount, but with a small allocation cap in order to build a community that believes in and supports IMU’s mission from the beginning.”

Amador also added that “Only the CoinList sales tranche will be 100% unlocked at TGE, with the remaining supply being released in stages and over multiple years.”

IMU Tokenomics

Founded in 2020, Immunefi has become a major player in securing decentralized finance, securing over 650 protocols including Ethereum, Aave, Chainlink, and Optimism. The company says its network has prevented more than $25 billion in potential losses and currently protects $180 billion in crypto assets.

Proceeds from the token sale will support the rollout of Immunefi’s new “Security OS,” an AI-powered hub designed to proactively detect and prevent exploits. The system is trained on what the company touts as “the largest private dataset of exploits, bug reports, and bug fixes.”

IMU tokens are designed to reward researchers and community members who share threat information. Users can also earn or stake tokens in exchange for vulnerability reports and security audits.

“The community can stake tokens to support the protocol’s security initiatives and receive rewards in return. In both cases, staking increases on-chain visibility and provides economic benefits to advance our shared goal of a more secure on-chain economy,” Amador explained.

Of the 10 billion IMU tokens, 47.5% will be allocated to ecosystem growth and community rewards, 26.5% to the team, 16% to early backers vested over three years, and 10% to reserve funds “for future needs and unforeseen opportunities to accelerate the growth of the platform,” Amador said.

Sales on CoinList exclude residents of the United States, Canada, China, the United Kingdom, and certain other jurisdictions.

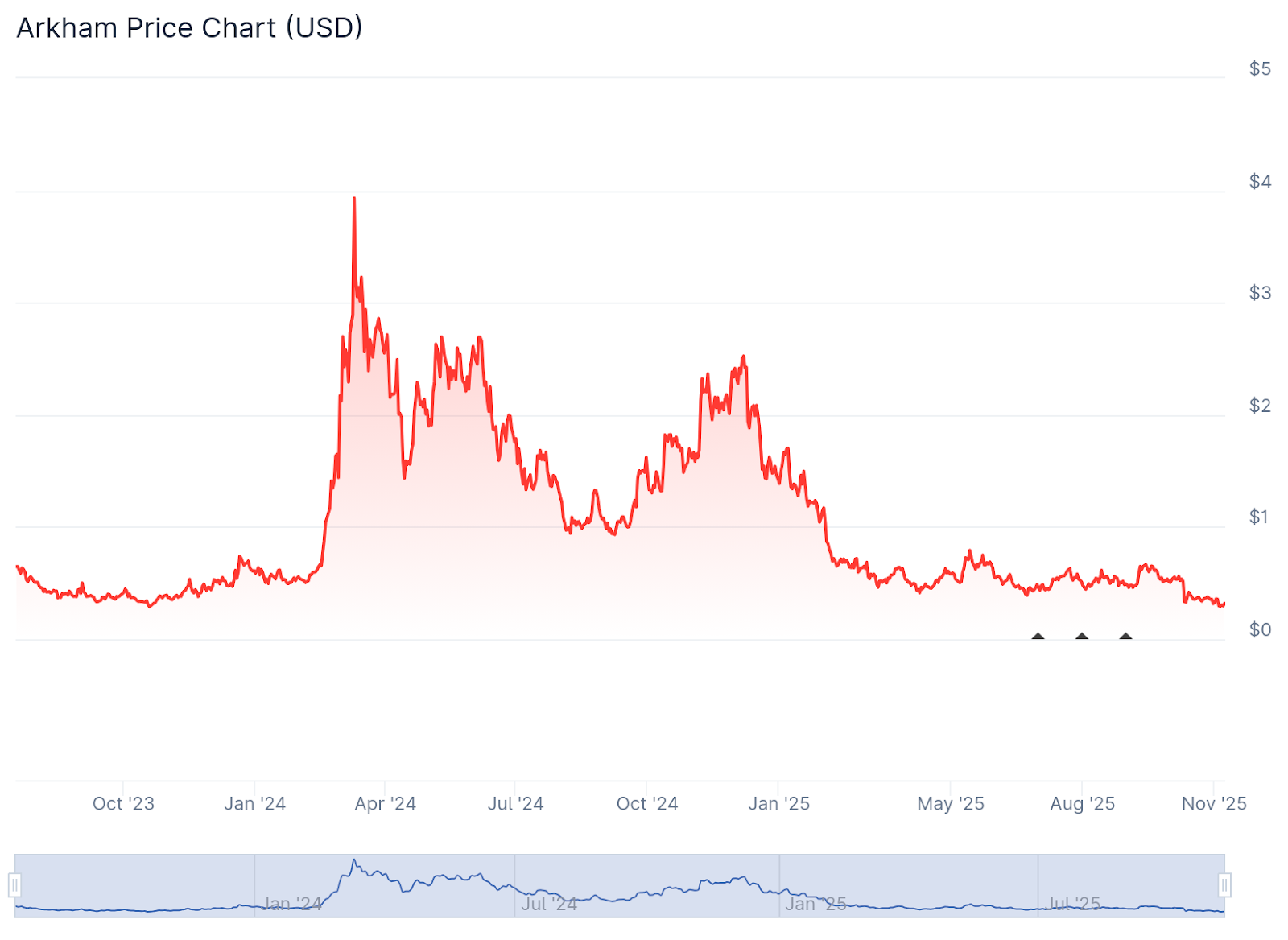

Other Web3 security companies are also launching tokens as part of their growth strategies. In 2023, another blockchain forensics firm, Arkham Intelligence, introduced the ARKM token through a sale on Binance Launchpad, which has fallen by around 85% over the past year.

At the time of writing, ARKM is down more than 90% from its all-time high of $3.98 in March 2024, according to CoinGecko data.

The large allocations to team members, early investors, and their foundations were subject to a multi-year unlocking schedule, which meant a steady flow of new supply into the market, putting pressure on prices.