The decentralized finance (DeFi) sector has experienced a sharp contraction since early October, with Total Value Lock (TVL) falling by more than 21%.

Coupled with waning interest from institutional investors, this decline has heightened concerns about Ethereum (ETH) demand and price trajectory in November.

Record double-digit TVL loss on DeFi protocols

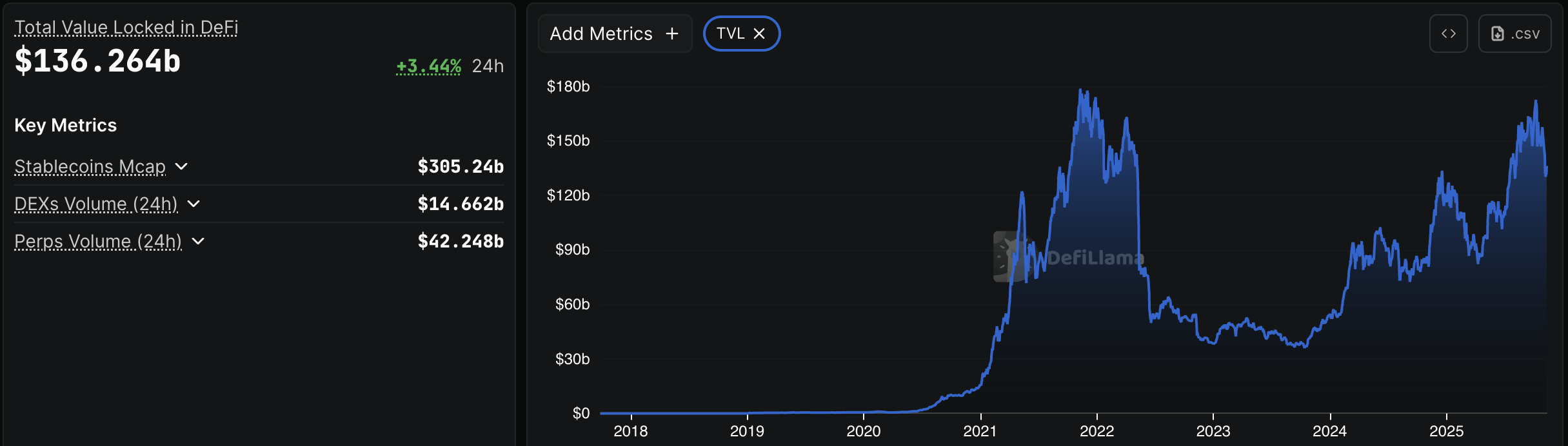

According to data from DeFiLlama, the total amount of DeFi TVL reached over $172 billion in early October. This marked the highest level since late 2021. However, this once-in-a-several-year peak did not last long.

According to the latest statistics, TVL fell to around $136.26 billion in November, wiping out more than $36 billion in value.

DeFi TVL. Source: Defilama

Major DeFi protocols have suffered significant losses over the past month. Aave, Lido, EigenLayer and Ethena reported declines in TVL ranging from 8% to 40%, highlighting a broader slowdown in the sector.

One of the main factors behind this decline is Ethereum’s price correction. After the market crash in October, ETH continued to face difficulties, with its price dropping to nearly $3,000 in early November.

Nevertheless, the weakness deepens. ETH-denominated TVL has been steadily declining since April. This occurred despite the ETH price increasing. This divergence suggests that ETH’s rise was driven by factors other than DeFi growth.

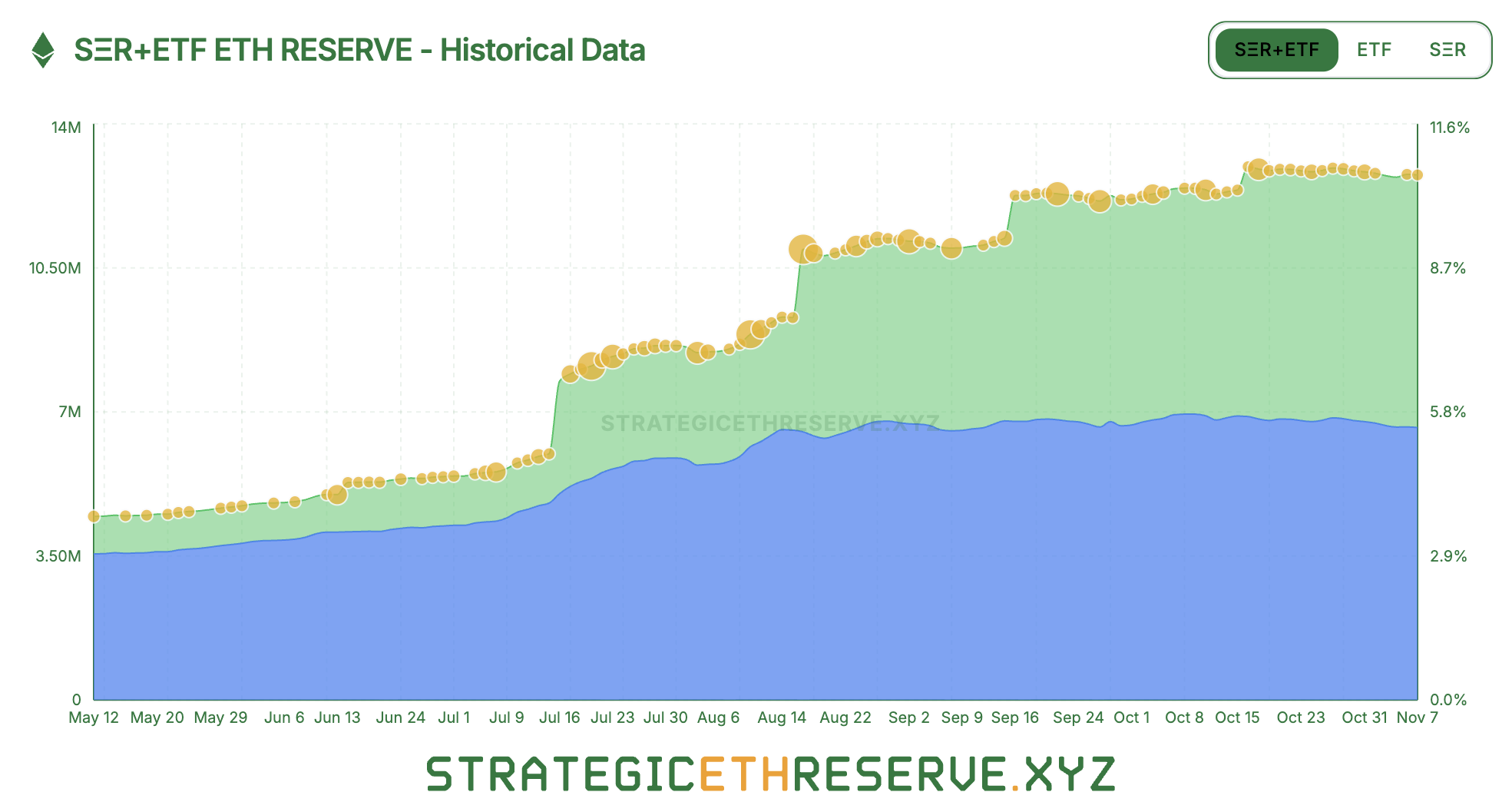

In particular, two major factors drove ETH demand: digital asset treasury funds (DATs) and exchange-traded funds (ETFs). In 2025, ETFs recorded strong inflows while large institutional investors increased their exposure to ETH.

But this accumulation is also slowing. According to figures from Strategic ETH Reserve, combined DAT and ETF holdings fell from 12.95 million ETH in October to 12.75 million ETH in November.

ETH holdings through ETFs and DATs. Source: Strategic ETH Reserve

Additionally, BeInCrypto reported last week that the ETH ETF had an inflow of $12.1 million on November 6th after six consecutive days of outflows. Nevertheless, this trend reversed the next day. According to SoSoValue data, on November 7, outflows were $46.6 million.

Weaker demand on both the retail and institutional fronts could make Ethereum vulnerable to further downward pressure. Nevertheless, recent macroeconomic boosts have led to a slight recovery in ETH. As of this writing, ETH is trading at $3,609, representing a 6.6% increase compared to the past day.

Ethereum price performance. Source: BeInCrypto Markets

Analyst Ted Pillows pointed to $3,700 as a key level for Ethereum.

“ETH is currently approaching a key resistance level. If Ethereum closes the daily candlestick above the $3,700 level, it could move higher towards the $4,000 level,” Pillows posted.

The analyst noted that if Ethereum fails to break out of this level, it could see a pullback toward the $3,400 support area.

The post Over $36 billion in DeFi value disappears — what does that mean for Ethereum? The post appeared first on BeInCrypto.