The BTC options market has become more aggressive in hedging against further price declines, revealing growing pessimism. The prevalence of put options and increased volume and open interest suggest that traders are bracing for a downside price move.

BTC options point to reduced risk due to price decline over the past three months. This data gained further attention as BTC fell to a five-month low of $97,000.

Once BTC fell below $100,000, we predicted a lower range based on previous drawdown levels, further increasing the dominance of put options.

Deribit’s implied volatility creates additional pressure on hedging indexIt has been on an upward trend since September. The index widened to its highest level since June, causing volatility in options positions.

BTC options suggest decline to $80,000

The recent market downturn has resulted in put option volatility, indicating three levels of expected price decline. A total of $1.58 billion in put options were opened at $90,000.

Other important levels indicate that BTC could fall to $85,000 and even $80,000. The largest contract by value is a put option with a notional amount of $85,000. $1.7 billion.

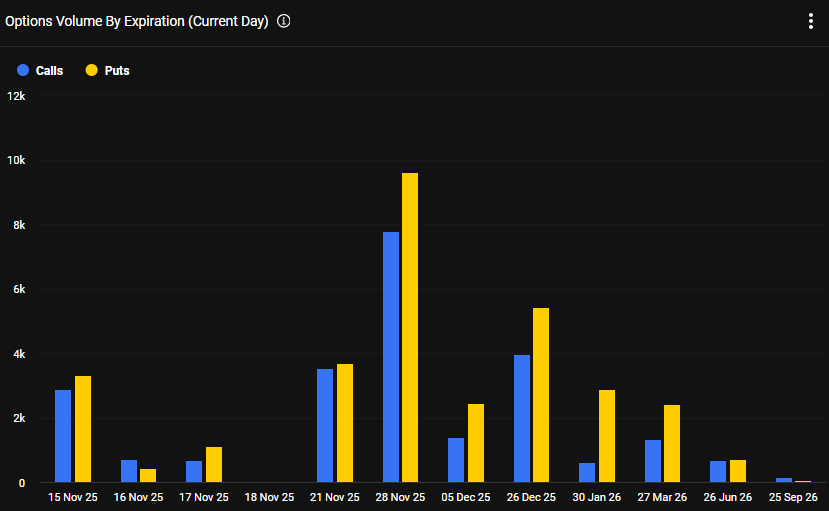

Deribit’s upcoming monthly BTC option expirations are dominated by put options. |Source: Deribit

Put options are also dominant in the November 28th monthly expiration event. Both weekly and monthly contracts until the end of 2025 have a slight preference for put options.

BTC traders are suggesting that a recovery is possible if the price crosses $110,000. Above that price, call options still dominate and are concentrated around the $140,000 level.

Over the past few months, Bitcoin has experienced dramatic recoveries and gains that seem unrelated to the options market. But the put-to-call ratio suggests that traders have been hedging against the possibility of a bear market since Oct. 6, when the stock reached an all-time high of more than $126,000.

BTC option expires below max pane

The weekly Deribit option expiry also occurred under bearish conditions. Derivit noted that the current weekly expiry was well below cumulative liquidity and occurred below the maximum pain price of $105,000.

🚨 Option Expiry Alert 🚨

BTC fell below 97,000 this morning and enters today’s expiration with open interest stacked in the 100,000 to 110,000 range.

The biggest pains are around 104,000 for BTC and 3,500 for ETH.

Positioning declined throughout the week as traders reduced their exposure. pic.twitter.com/S3mzkDdEh4— Deribit (@DeribitOfficial) November 14, 2025

BTC’s recent weekly contract had a notional value of $3.95 billion, while ETH had an additional $730 million. The put/call ratio for BTC was 0.61, indicating a bearish situation, while the ratio for ETH was lower at 0.59.

Both BTC and ETH continued to fall after option expiration, but market sentiment remains negative and traders are acting fearfully.

Put options have also gradually increased in the past few months, accounting for up to 30% of trades, a sign of risk aversion.

Options trading also failed to repeat its 2024 performance, suggesting further pessimism for the fourth quarter. While Deribit maintains high open interest of over $36 billion, direct derivatives trading has slowed due to high liquidation risk.