Following the Binance listing announcement that sparked a buying frenzy, two altcoins have fallen, with one significantly outperforming the other.

Listing announcements on popular exchanges such as Binance and Coinbase tend to stimulate strong movements in the altcoins involved.

BANK and METR join Binance Spot with seed tag

Binance is preparing to list two new tokens, Lorenzo Protocol (BANK) and Meteora (MET), and the market is already taking notice of this announcement.

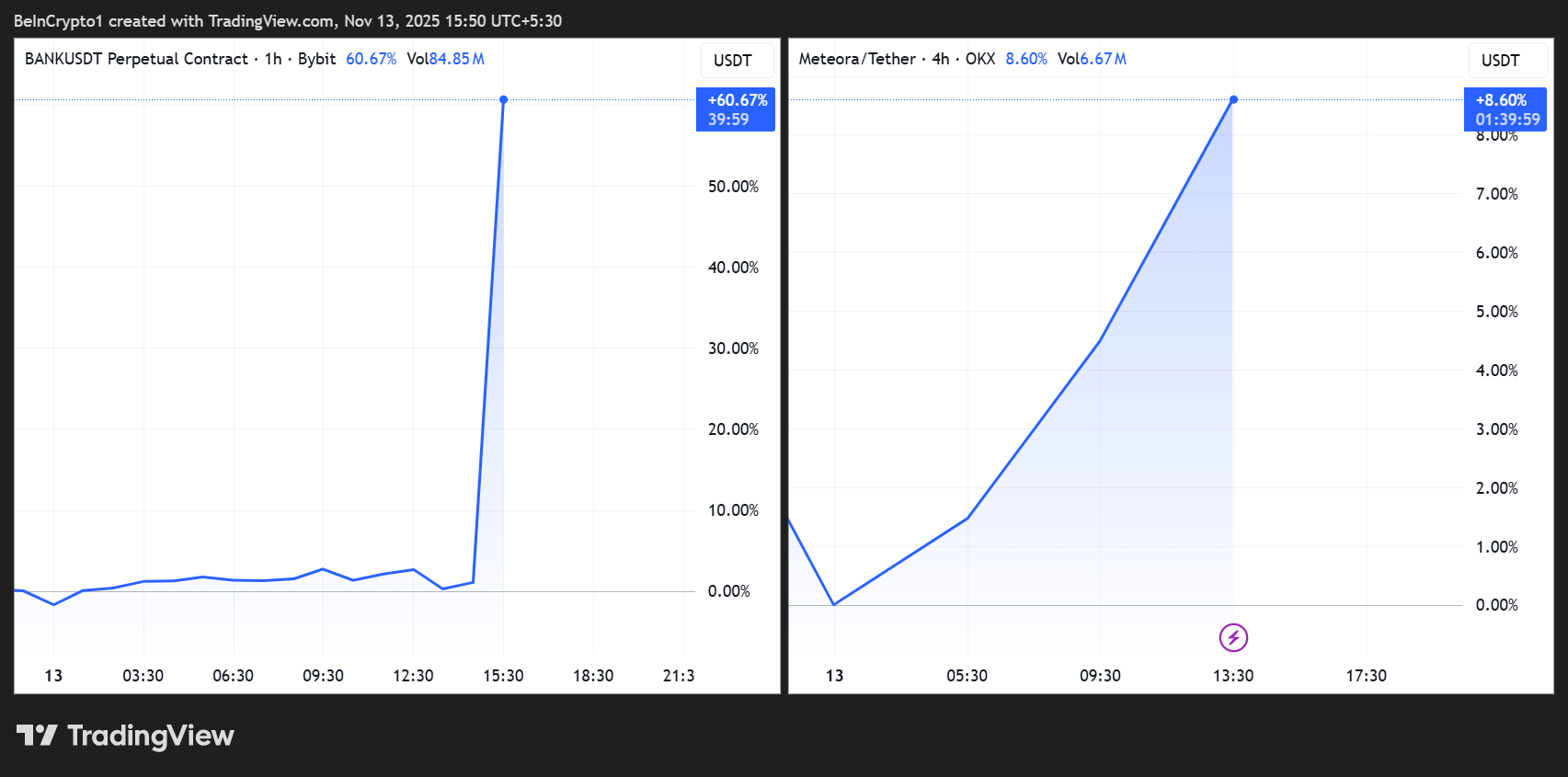

Ahead of its official listing at 14:00 UTC (just 4 hours from now), BANK has soared over 60%, while MET is up nearly 10%.

Price performance of Lorenzo Protocol (BANK) and Meteora (MET). Source: TradingView

The sudden move reflects strong speculative interest even before trading began on the world’s largest exchange. This is a typical reaction to such announcements, as traders expect increased liquidity.

Recently, Clearpool (CPOOL) price soared following the announcement of Upbit listing, surpassing a two-month high.

On the other hand, it is worth noting that BANK’s move above MET is likely related to recent developments in the Meteora token. The Coinbase exchange has listed MET and aPriori (APR), with spot trading available for both assets as of October 23rd.

This move caused the APR to jump 93%, but the MET quickly corrected and fell 15%. This is likely due to existing criticism and FUD due to airdrop allocation.

BeInCrypto reported that wallets associated with TRUMP meme coin insiders collectively received approximately $4.2 million in MET tokens during the airdrop, which were later transferred to OKX.

Additionally, Meteora founder Benjamin Chow has been named as a target in a class action lawsuit alleging misconduct related to early memecoin projects such as LIBRA and MELANIA.

Meanwhile, the price surge for BANK likely reflects initial accumulation by traders hoping for a liquidity-driven breakout after Binance’s spot trading begins. Notably, 63 million BANK tokens will be allocated to future marketing campaigns, which could increase awareness and short-term momentum.

What users should know about BANK and MET on Binance

Despite the FUD above, Binance’s listing announcement contained important insights for users.

- Binance has confirmed that spot trading for BANK/USDT, BANK/USDC, BANK/TRY, MET/USDT, MET/USDC, and MET/TRY pairs will begin at 14:00 (UTC).

- Users can already deposit their tokens and withdrawals will begin on November 14th at 14:00 UTC.

Both assets are tagged with a seed tag. This is the label used for newly introduced and therefore highly unstable projects.

Binance lists @LorenzoProtocol (BANK) and @MeteoraAG (MET) with seed tags applied.

Details 👉 https://t.co/zOjZxZKVpp pic.twitter.com/TAbp5T6qYk

— Binance (@binance) November 13, 2025

Binance reminded users that they must complete the Seed Tag Quiz every 90 days to access trading. This ensures that traders understand the potential risks associated with new listings.

Both BANK and METR were previously featured on Binance Alpha Market, a pre-listing token selection pool. Once spot trading begins, tokens will be delisted from Alpha and users’ balances will be automatically transferred to their spot account within 24 hours.

Spot algo orders are set to take effect immediately after listing, and trading bots and spot copy trading are set to take effect within 24 hours.

Binance also revealed that once listed on Spot, the trading volume of BANK and METR on Alpha will no longer count toward Alpha points.

Binance warned that both BANK and METR are relatively new and high-risk tokens that are subject to significant price fluctuations. Therefore, traders should DYOR (do their own research) and apply strong risk management before trading.

The post Binance Lists 2 New Altcoins — One Soars 60% Before Trading Starts appeared first on BeInCrypto.