Publicly traded Bitcoin mining companies had a rough week, with nearly every major miner posting double-digit declines as the sector underperformed by a wide margin than Bitcoin itself.

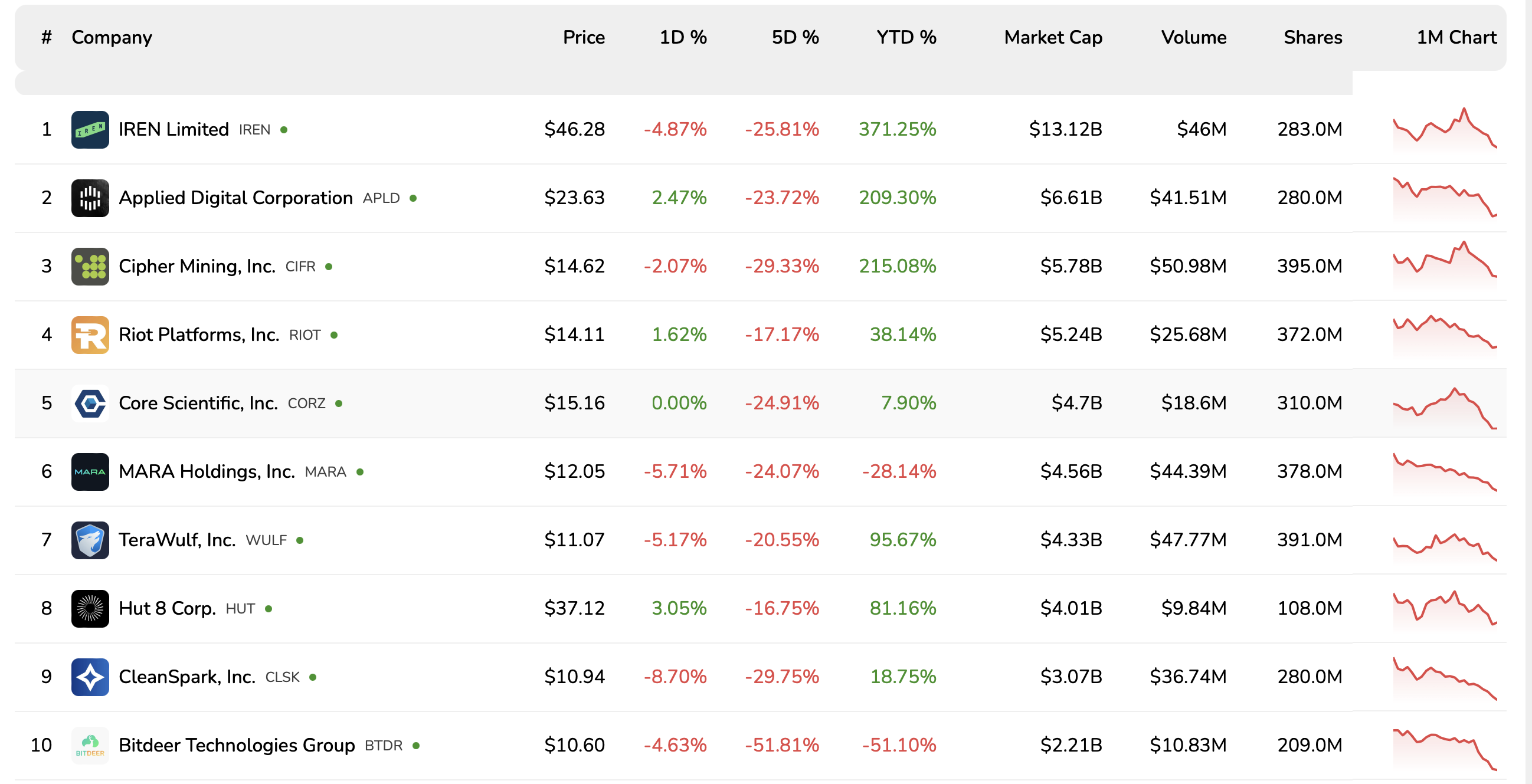

Over the past five business days, companies such as Cipher, Applied Digital, Core Scientific, CleanSpark, and Bitdeer have fallen between 23% and 52%, while other operators such as Riot and Hut 8 have suffered losses in the mid-teens.

Bitcoin (BTC) is trading at around $94,400 at the time of writing, down around 9% over the past seven days.

sauce: bitcoin mining stocks

Zooming out, Thursday’s Miner Mag report showed that public mining stocks have lost more than $20 billion in market value over the past month, and are down about 25% since mid-October, well below Bitcoin’s decline.

The decline came despite financial institutions including Jane Street, Fidelity and Barclays increasing their positions in several large miners.

Despite recent losses, some mining companies have outperformed Bitcoin on a year-to-date basis.

IREN, the largest public Bitcoin miner by market capitalization, is up about 370% since the beginning of the year, while Cipher Mining is up about 210%. By comparison, Bitcoin itself has only risen about 1.5% over the same period, according to TradingView.

Related: Bitcoin price boom after US government shutdown isn’t guaranteed: Here’s why

Bitcoin miners focus on AI and HPC

Even though some Bitcoin mining stocks have risen significantly since the beginning of the year, mining remains an increasingly difficult business. With block rewards halving roughly every four years, some miners are adopting new strategies to diversify their income, while others are exiting altogether.

The biggest change has been the shift to AI and high performance computing (HPC), which has led miners to repurpose power-hungry data centers into more stable, higher-margin workloads. Many miners consider HPC integration to be a critical part of their business, as their existing infrastructure is already optimized for energy and cooling.

BitFarms shares plunged on Friday after the company announced it would wind down its Bitcoin mining operations over the next two years, starting with the closure of an 18-megawatt site in Washington as it plans to convert its facilities into AI and HPC data centers.

Other miners are choosing a hybrid approach rather than withdrawing from Bitcoin mining completely. In June, Core Scientific signed a $3.5 billion deal with AI cloud provider CoreWeave to provide 200 megawatts of hosting capacity for HPC workloads.

In October, CleanSpark stock soared about 13% in a day after the miner announced its first foray into AI, and in early November, IREN signed a five-year, $9.7 billion deal to give Microsoft access to Nvidia GPUs hosted in its data centers.

magazine: How do the world’s major religions view Bitcoin and cryptocurrencies?