Republic Technologies, formerly known as Beyond Medical Technologies before moving to blockchain infrastructure, has secured a $100 million convertible debt facility to expand its Ether holdings. The company said this will allow it to expand its ETH treasury while minimizing shareholder dilution due to favorable financing terms.

The company announced on Monday that the financing comes with terms unusual for a crypto-related company, including 0% interest, no ongoing interest payments, and no obligation to post additional collateral in the event of a decline in the price of Ether (ETH).

These features mean Republic doesn’t have to spend cash on debt servicing and can’t default by missing interest payments. This is a common problem for highly leveraged digital asset companies.

Republic said that most of the funds will be allocated to purchasing ETH and expanding the Ethereum verification infrastructure, generating small but steady rewards for contributing to the security of the network.

sauce: republic technologies

Republic compared the deal to recent funding by other Ether-focused companies. For example, BitMine Immersion (BMNR) has raised $365 million, but it has 200% stock options, which, if exercised, could significantly dilute value for existing shareholders.

Dilution occurs when new shares are issued, reducing the ownership percentage of existing shareholders.

In contrast, Republic’s financing includes 50% of warrants priced at market rates, still dilutive but much lower than many comparable deals in the digital asset industry.

Related: ARK Invest resumes crypto buying, adds BitMine and Bullish stocks

ETH treasury continues to accumulate despite price fluctuations

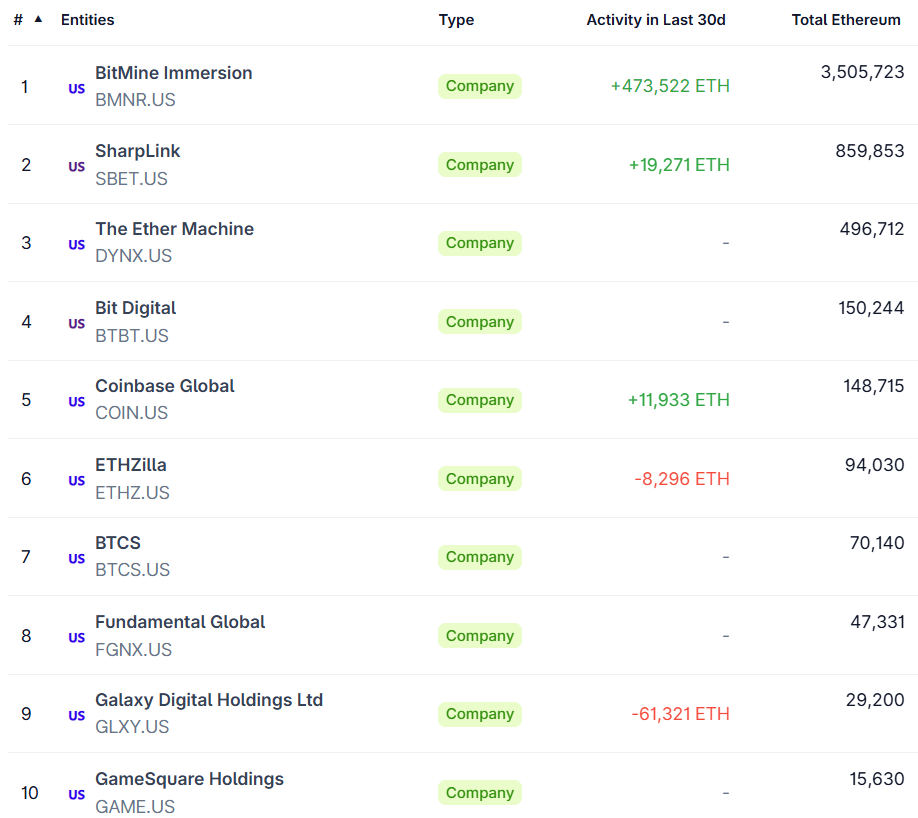

Republic is part of a growing group of publicly traded companies building large ether vaults, a trend that mirrors Michael Saylor’s Bitcoin (BTC) accumulation strategy. According to CoinGecko data, 18 listed companies collectively hold about 5.45 million ETH, worth about $17.3 billion.

The value of these holdings fluctuated significantly as the price of ETH fluctuated. ETH was worth about $3,100 on Monday, a significant drop from its all-time high of about $4,900 in May.

BitMine, the largest treasury company, announced on Monday that it has increased its holdings of ETH and now controls 2.9% of the token’s supply. The company aims to raise its ownership ratio to 5%.

BitMine’s latest pre-acquisition ETH financial rankings. sauce: CoinGecko

“We do not believe crypto prices have reached the peak of this cycle,” Bitmine Chairman Tom Lee said, adding that key catalysts such as favorable regulation and growth in tokenization will continue to drive the industry forward.

Related: Ether foreign exchange reserves fall to three-year low as ETFs and corporate bonds absorb supply