The digital asset plummeted to $80,000 early Friday, but the New York Fed president’s speech may have prevented Bitcoin from plummeting further.

Bitcoin’s Lazarus Moment, courtesy of the Fed

John Williams isn’t a name that many people will recognize, but when he says it, the market listens and often the market responds. Mr. Williams is President and CEO of the New York Fed, one of the most powerful positions at the US Federal Reserve. On Friday, he spoke at the central bank’s 100th anniversary conference in Santiago, Chile, where he hinted at a rate cut in December.

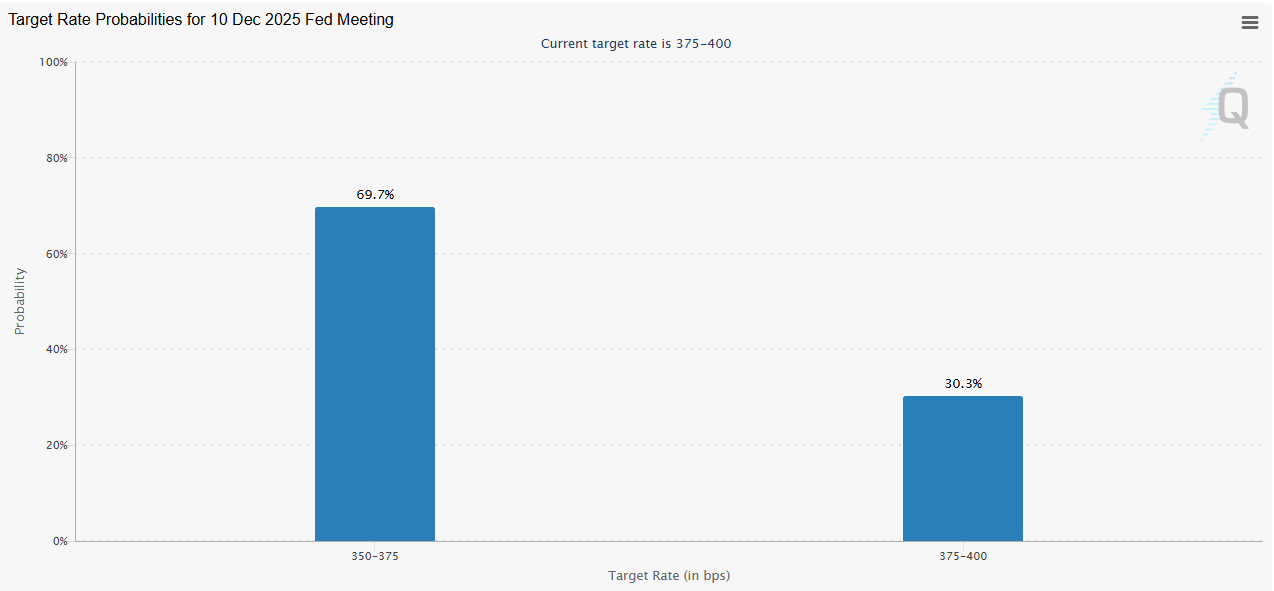

(New York Fed CEO and President John Williams hinted at the possibility of a rate cut in December in a speech on Friday.)

“We fully supported the FOMC’s decision to lower the target range for the federal funds rate by 25 basis points over the past two meetings,” Williams said. Then he dropped the bomb. “We believe there is still room for further adjustments to the target range for the federal funds rate in the near term.”

(Forecasts for December rate cut nearly double after John Williams speech/cmegroup.com)

This last sentence is largely credited with lifting a sinking stock market, and perhaps also preventing Bitcoin from falling below the $80,000 threshold. The reason may have something to do with the fact that the New York Fed occupies a privileged position among central banks. The Federal Reserve has 12 regional branches, whose presidents serve on the Federal Open Market Committee (FOMC), the elite group responsible for determining interest rate policy. However, only the New York branch has a permanent seat at FOMC meetings. The remaining 11 participants will take turns.

read more: Has Bitcoin fallen again due to rising unemployment?

New York is the financial capital of the world, and Mr. Williams has the unique privilege of being able to pinpoint market trends. At a time when “risk-off” is the prevailing sentiment, his speech was enough to border on “risk-on.” Perhaps he would have saved stocks from Friday’s bloodshed, and while Bitcoin is still in the doldrums, with liquidations reaching $1 billion in the past 24 hours, the situation could have been much worse without Williams’ speech.

“Hard turns and unpredictable terrain were an inevitable part of our journey,” Williams said. “We must accept that shock and uncertainty will continue to define our future.”

Overview of market indicators

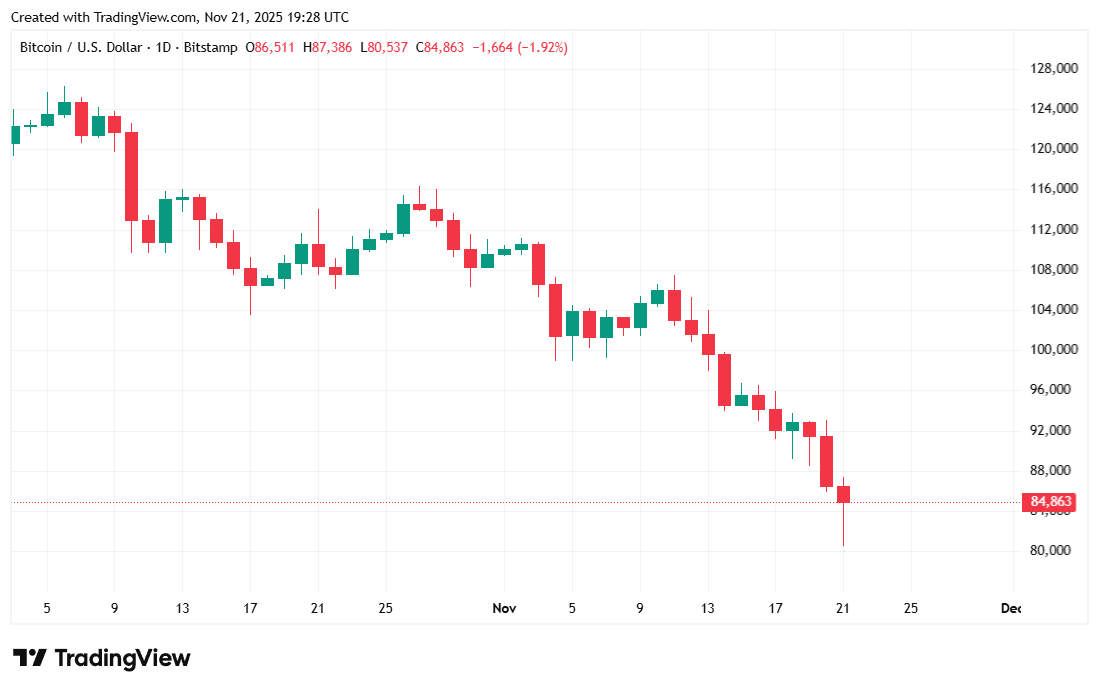

At the time of reporting, Bitcoin price was $84,791.82, down 2.27% from the past day and down 11.43% from last week, according to data from Coinmarketcap. The cryptocurrency traded as high as $88,126.81 before falling to $80,659.81 within 24 hours.

(Bitcoin Price / Trading View)

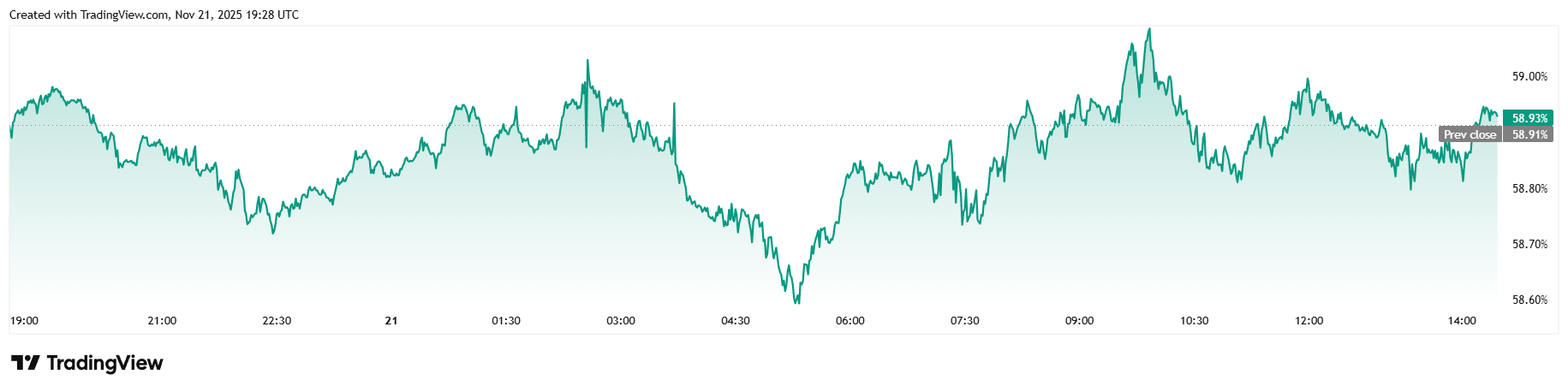

Due to the overall market decline, the daily trading volume increased by 35.13% to $131.37 billion, and the market capitalization decreased to $1.69 trillion. Bitcoin’s dominance increased by 0.15% to 58.93% as many altcoins underperformed compared to BTC.

(Bitcoin Dominance / Trading View)

According to Coinglass, total open interest in Bitcoin futures took a noticeable hit, dropping 8.80% to $59.03 billion. Liquidations were the talk of the day, jumping to $885.67 million as of this writing. Long investors caught off guard by Bitcoin’s falling price lost $773.37 million in liquidation margin. However, short sellers did not escape unscathed, suffering a small loss of $112.31 million.

Frequently asked questions ⚡

- Why did Bitcoin rebound after crashing to $80,000?

New York Fed President Williams’ speech hinted at the possibility of a December interest rate cut, and the market returned to a slightly “risk-on” direction. - What exactly did Williams say?

He said interest rates “still have room for further adjustment”, a comment widely interpreted as supporting further rate cuts in the near term. - Why does Williams’ opinion matter so much?

The New York Fed is the only permanent member of the FOMC, and his views have a significant impact on monetary policy expectations. - How is Bitcoin currently performing?

BTC has been hovering around $85,000 since the massive liquidation, but analysts say Williams’ comments likely prevented a further plunge below $80,000.