Ethereum price has been unable to break out of a two-month downward trend and is under new pressure. ETH briefly attempted to recover last week, but quickly lost momentum.

Weak investor support has dragged Ethereum lower, raising concerns about whether it can sustain a meaningful recovery in the short term.

Ethereum is losing support from investors

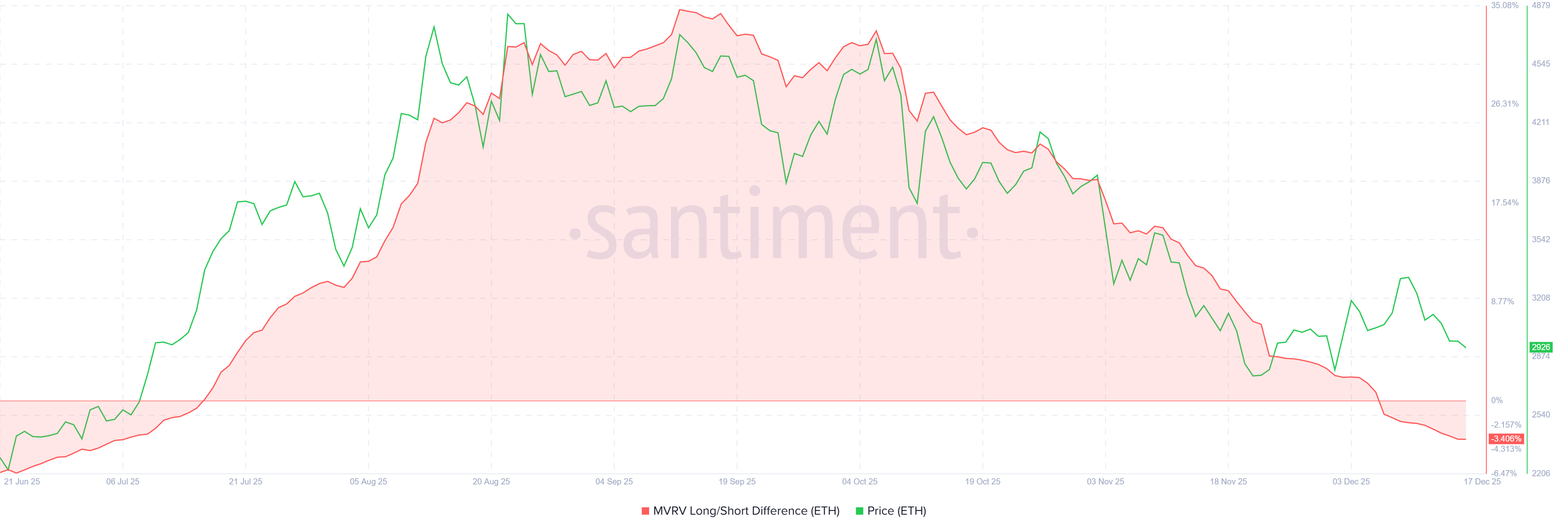

On-chain data shows that profit levels for both long-term and short-term holders are declining. Currently, the profitability of both groups is at similar levels, indicating a decline in overall market confidence. This convergence suggests that neither group is realizing meaningful gains at current price levels.

The MVRV long/short differential is below the zero line, reinforcing this trend. This reading indicates that neither long-term nor short-term holders hold dominant unrealized gains. If this indicator declines further, the interests of short-term Ethereum holders may prevail, increasing downside risk and reflecting fragile investor sentiment.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum MVRV long/short difference. Source: Santiment

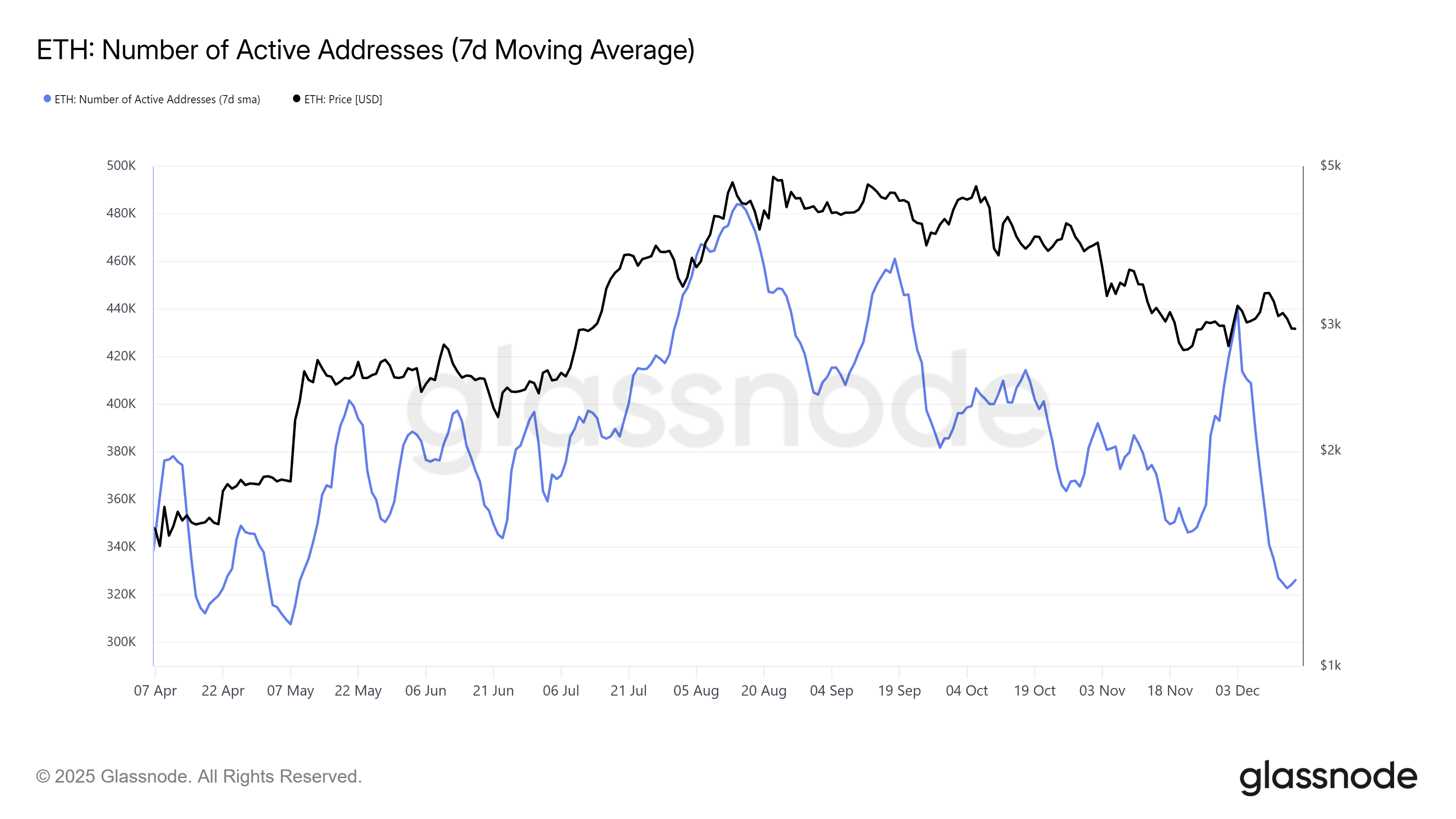

Ethereum’s macro activity has weakened significantly. Active addresses on the network have fallen to a seven-month low. This decline highlights a decline in participation by ETH holders, indicating a decline in network engagement amid continued price weakness.

The drop in activity suggests investors see limited incentive to trade as price movements stagnate. Declining network usage often reflects waning trust. Without new demand or catalyst-driven activity, Ethereum may struggle to regain momentum in the short term.

Ethereum active address. Source: Glassnode

ETH price falls below $3,000 again

ETH is trading at $2,929, falling below $3,000 for the third time this month. Ethereum price’s breakout attempt early last week failed to sustain. This rejection strengthened the downtrend and suggested limited buying interest at higher levels.

Bearish indicators suggest that Ethereum may retest the $2,762 support level. This zone has historically served as an important floor. Although downward pressure exists, further declines are likely to be limited unless broader market conditions deteriorate significantly.

ETH price analysis. Source: TradingView

The outlook may change due to changes in investor sentiment. Getting back $3,000 in support is still essential. A sustained move above this level could challenge ETH to $3,131. Such a recovery would invalidate bearish theories and signal a break from the downtrend.

The post Ethereum Price Falls Below $3,000 Amid Decline in Holder Conviction appeared first on BeInCrypto.