Social media was abuzz this week after Bitcoin blocks 932129 and 932167 were mined without any immediately visible pool tags. This led to speculation that a lone miner had made a fortune, leading to a familiar “Bitcoin lottery” story that briefly captured the market’s attention.

But the excitement had less to do with the block itself and more to do with what the block’s apparently mislabeled label revealed about how Bitcoin mining attribution works. It also reveals how quickly beliefs become entrenched.

sauce: bitcoin archive

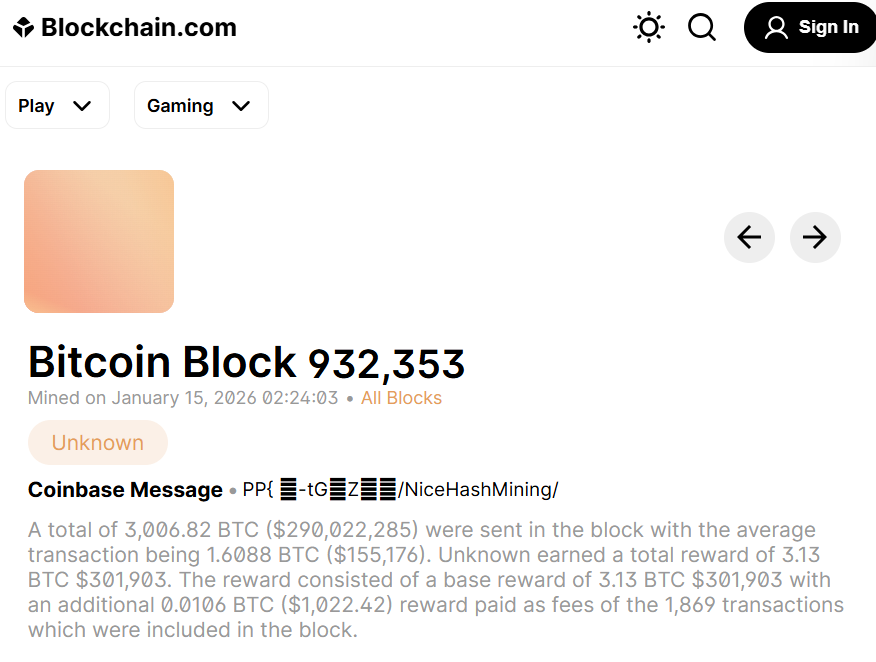

Amidst the speculation, NiceHash emerged as the miner behind both blocks. Rather than operating a traditional mining pool, NiceHash operates a hashrate marketplace that connects miners with buyers of computing power.

The blocks initially appeared untagged in the mempool explorer, leading many observers to assume they had been mined independently by a single miner. In fact, the company confirmed that both blocks were mined by NiceHash as part of internal testing for its upcoming product.

In exclusive comments to Cointelegraph, NiceHash AG CEO Sasa Ko said this misunderstanding stems from the way block metadata is displayed, rather than an attempt to obscure attribution.

“The only misunderstanding here is that the block was tagged with NiceHashMining but not labeled by mempool,” Koh said. “We didn’t want to cause any speculation.”

Koh confirmed that the blocks were mined during internal testing related to the new product, but declined to share technical details ahead of launch.

“While we cannot reveal the details yet, we are working on a new set of products that will provide complete functionality in addition to our existing markets,” he said.

NiceHash mined two more blocks on Thursday. sauce: Blockchain.com

Block tags are metadata and do not guarantee any protocol. If a familiar tag is not visible, the market can quickly jump to the wrong conclusion. This episode highlights how much Bitcoin narrative formation still relies on assumptions rather than verifiable on-chain signals.

Related: Bitcoin Mining 2026 Prediction: AI Turnabout, Margin Pressure, and Fight for Survival

Solo mining is still possible, but less common

This short “lucky miner” story also reignited the debate about solo mining, a setup in which individual miners work independently rather than contributing hashing power to a pool. Solo miners receive rewards for the entire block if successful, but due to the stochastic nature of mining, payouts are highly unpredictable.

“Solo mining is possible and a lot of fun,” says Ko. “Nicehash’s Easy Mining was responsible for 17 of the 36 total solo blocks mined in 2025.”

sauce: Bitcoin documentation

But institutional mining operations cannot rely on chance, he added. These companies typically operate large infrastructures and employ sophisticated strategies designed to reduce variance and generate more predictable revenue streams.

Bitcoin mining for institutional investors has become increasingly difficult with each halving, squeezing margins and squeezing profitability, while forcing operators to diversify their revenue streams into areas such as artificial intelligence and high-performance computing.

Related: Bitcoin is currently 56.7% green: Here’s how to make it even cleaner