A surge in staking activity by mega-ether holder Bitmine Immersion (BMNR) has strained the Ethereum network, causing wait times to become a validator to be the longest since mid-2023.

There are over 2.55 million ethers Ethereum$3,278.43 – worth approximately $8.3 billion – currently awaiting activation, with an estimated waiting time of over 44 days before new validators start earning staking rewards.

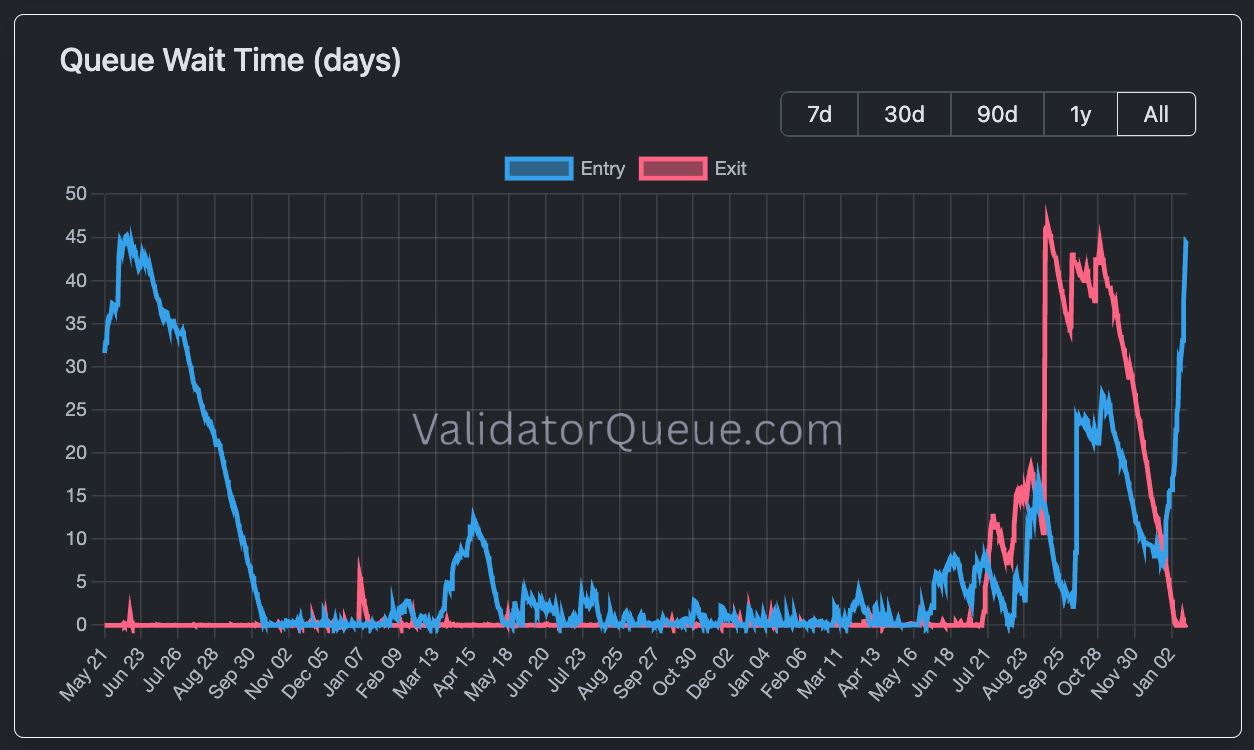

This is the largest backlog since late July 2023, just months after Ethereum fully implemented its proof-of-stake mechanism and made withdrawals possible.

Validator exit and entry wait times (ValidatorQueue.com)

The Ethereum network uses validators to process transactions and secure the blockchain. However, the number of new validators that can enter each day is limited to avoid sudden shocks to the stability of the network. If too many people try to join, the overflow will be queued.

At the center of the current surge is Ethereum treasury firm Bitmine, led by Thomas Lee of Fundstrat. The company has assets worth $13 billion. Ethereumconfirmed this week that it has already staked more than 1.25 million tokens, more than a third of its holdings, and is busy with new validator entries.

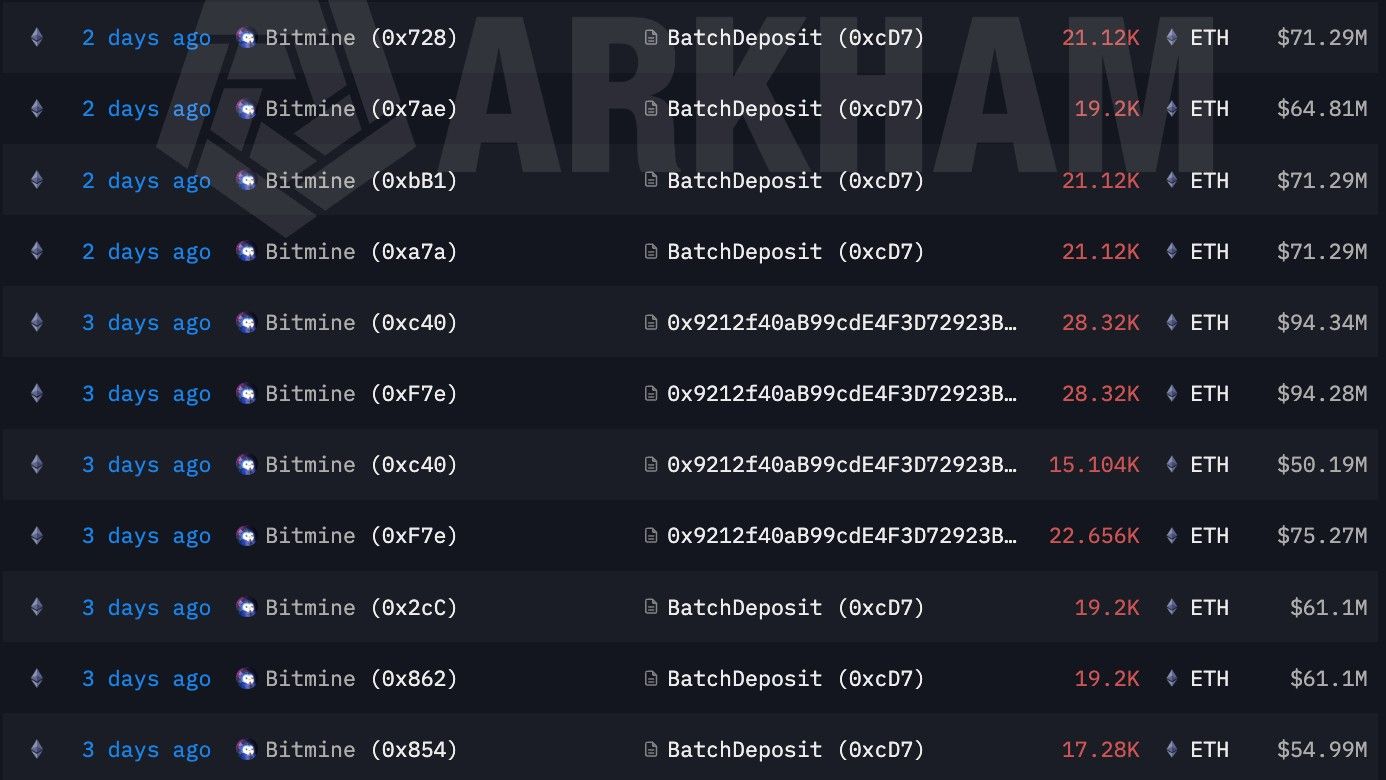

There are nearly 3 million more Ethereum If it remains unused on the balance sheet, the queue can be even longer. Blockchain data shows that BitMine is busy transferring hundreds of millions of dollars worth of data. Ethereum For the past few days, probably for staking purposes.

BitMine blockchain data Ethereum Transaction (Arkham Intelligence)

The current situation is markedly different from just a few months ago. In September and October, the Ethereum network was jammed in the opposite direction, with thousands of validators attempting to leave. This was largely due to infrastructure issues, which forced institutional staking provider Kiln to reorganize its validator network and increased exit wait times to 46 days.

This entry balance comes at a time when a new wave of institutional staking demand is likely to arrive.

ETF issuers and other large companies are watching closely as regulators define the legal boundaries for staking in the U.S. In December, asset management giant BlackRock filed for a staked Ether ETF, following Grayscale’s move to add staking to its Ether-focused ETFs.

“Activation pressure will continue,” said Josh Deems, head of revenue at Figment, an institutional crypto staking provider. “Many approved ETPs (exchange traded products) and Treasurys have not yet fully activated staking, and these vehicles collectively hold approximately 10% of Ethereum’s circulating supply.”

This impasse complicates asset management for these large companies and could potentially cause them to miss out on more than a month’s worth of income from staking yields while waiting in line.

Read more: Staking goes mainstream: What 2026 will look like for Ether investors