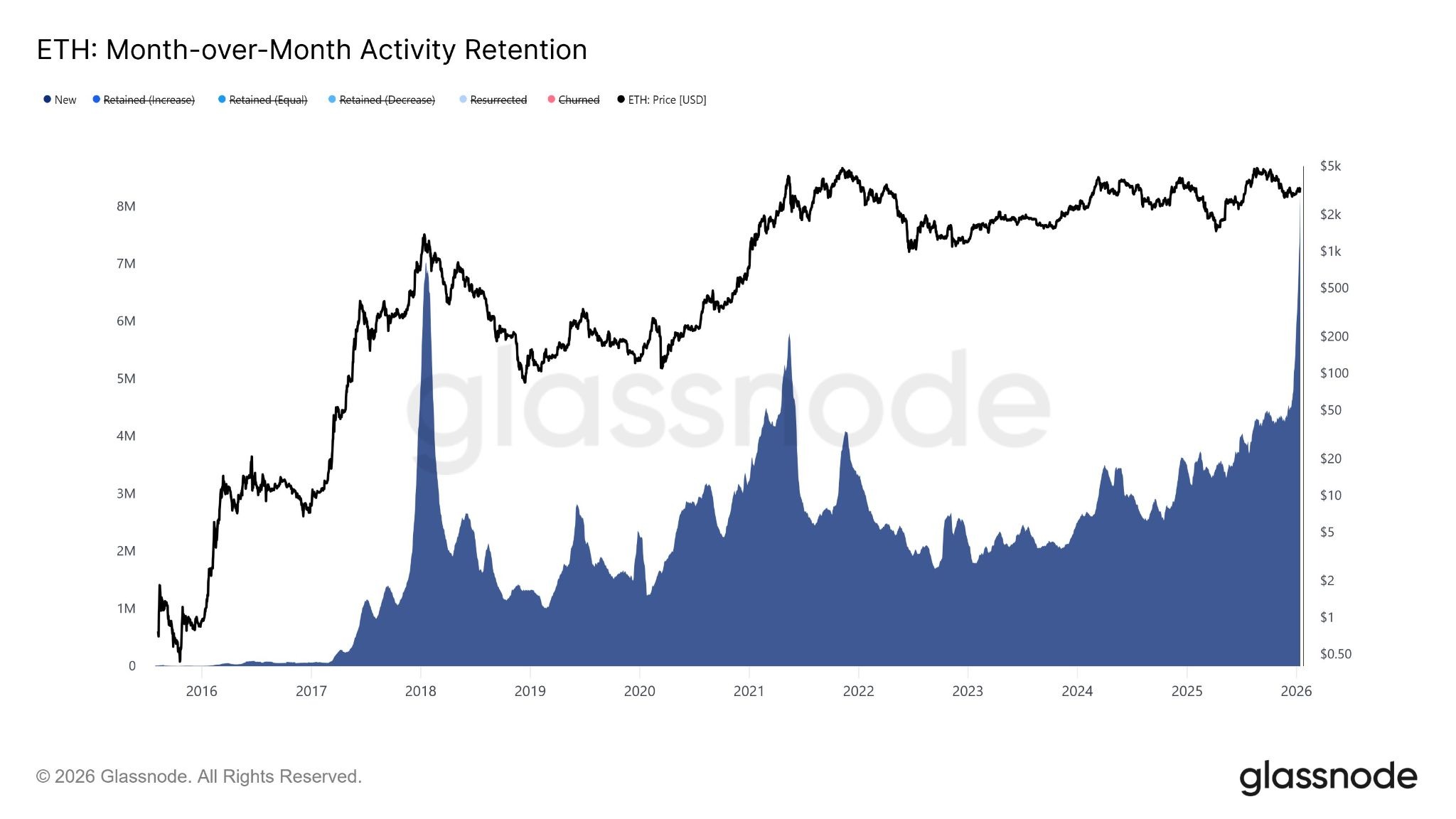

Ethereum network activity has shown a surge in new users, and the “activity retention rate” has nearly doubled in the past month, according to cryptocurrency on-chain analysis platform Glassnode.

Month-over-month “activity retention” shows a sharp spike in the new cohort, “demonstrating a sharp increase in addresses interacting for the first time in the past 30 days,” Glassnode reported on Thursday.

It added that this reflects a significant influx of new wallets getting involved in the Ethereum network, “rather than activity being driven solely by existing participants.”

This month, the number of new activity holds, or new network addresses, jumped from just over 4 million to about 8 million addresses.

Activity retention measures the number of users who remain active over time, essentially indicating whether users stay and continue to use the network, rather than appearing once and disappearing.

Ethereum’s activity retention rate soars to an all-time high. sauce: glass node

Ethereum daily trading hits new high

The number of active addresses on the Ethereum network has more than doubled since last year, to more than 1 million accounts as of January 15, up from around 410,000 accounts recorded at this time last year, according to EtherScan.

Meanwhile, Ethereum’s daily transaction count soared to a record 2.8 million on Thursday, an increase of 125% from the same period last year.

Related: Ethereum’s bulletproof efforts are paying off in user metrics

Macroeconomics media outlet Milkroad reported on Thursday that the reason for this was an explosion in the use of Ethereum’s stablecoins as fees plummeted.

“This is the result of Ethereum pushing execution to L2 while keeping payments secure at L1. That’s what scalable financial infrastructure really looks like.”

Stablecoin usage on Ethereum is at an all-time high while fees are at record lows. sauce: token terminal

‘There’s a lot to be optimistic about’ about Ethereum

Confidence and sentiment towards Ethereum is improving. “There is a lot to be optimistic about when looking at Ethereum,” Justin Danesan, head of research at Arctic Digital, told Cointelegraph.

“In the short term, new capital inflows into ETFs, stablecoins, and native crypto protocols appear to have turned around indicators that had been pushed into oversold territory, suggesting a significant price rally,” it added.

Ethereum network activity skyrockets, with daily transactions exceeding 2 million and staking reaching nearly 36 million Ethereumsaid Nick Luck, LVRG Research Director.

“These strong on-chain fundamentals, coupled with sustained ETF inflows and growing ecosystem optimism, Ethereum “The increased speed from recent scale ups and lower gas prices could tighten liquidity amid increased institutional participation, potentially pushing current resistance levels above the near-term,” he added.

All of this increased network activity and sentiment should be bullish for blockchain tokens. “There’s a lot of compression going on. EthereumAnd it is likely to break out next week,” MN Fund founder Michael van de Poppe said on Thursday.

ether (Ethereum) Price hit a two-month high of $3,400 on Wednesday, but had retreated slightly in Friday morning trading, trading around $3,300.

magazine: Trump denies SBF pardon, Bitcoin is ‘boring’: Hodler’s Digest