Ethereum has entered a pivotal phase, breaking out of a bullish pattern that had constrained price movement for about two months. Ethereum The price has decisively broken above a major resistance zone, confirming new upward momentum.

This technical breakout coincided with a historic surge in network participation and marked a key moment for Ethereum’s recovery story.

Ethereum breaks 7-year record

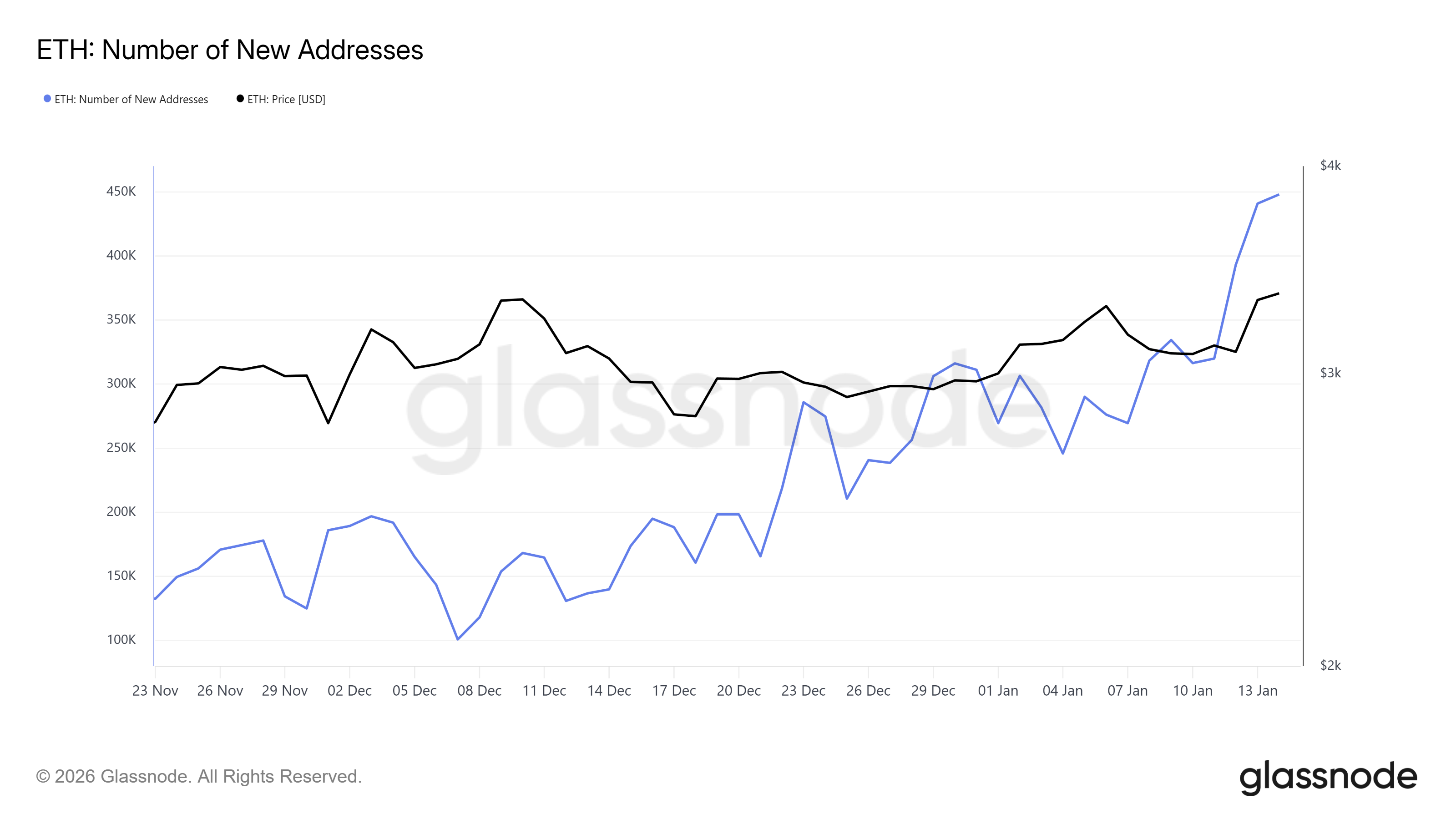

Ethereum recorded an unprecedented 447,000 new investors joining within 24 hours. The new address represents that you are interacting with the wallet Ethereum first time. This milestone reflects a sharp acceleration in recent trends, with daily new addresses already exceeding 300,000 over the past week.

The steady increase in first-time participants over the last month highlights the growth in organic demand. More than 300,000 new addresses are transacted every day, with the recent surge ending a seven-year record of 351,000. This inflow typically coincides with an improving price structure, a strengthening Ethereum breakout, and support for a sustained recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Ethereum new address. Source: Glassnode

The increase in address growth suggests widespread adoption beyond speculative trading. Increased participation strengthens the network’s utility, which has historically supported price stability during rallies. As new capital flows into the ecosystem, Ethereum gains resilience to short-term volatility.

why young Ethereum Are holders less likely to sell?

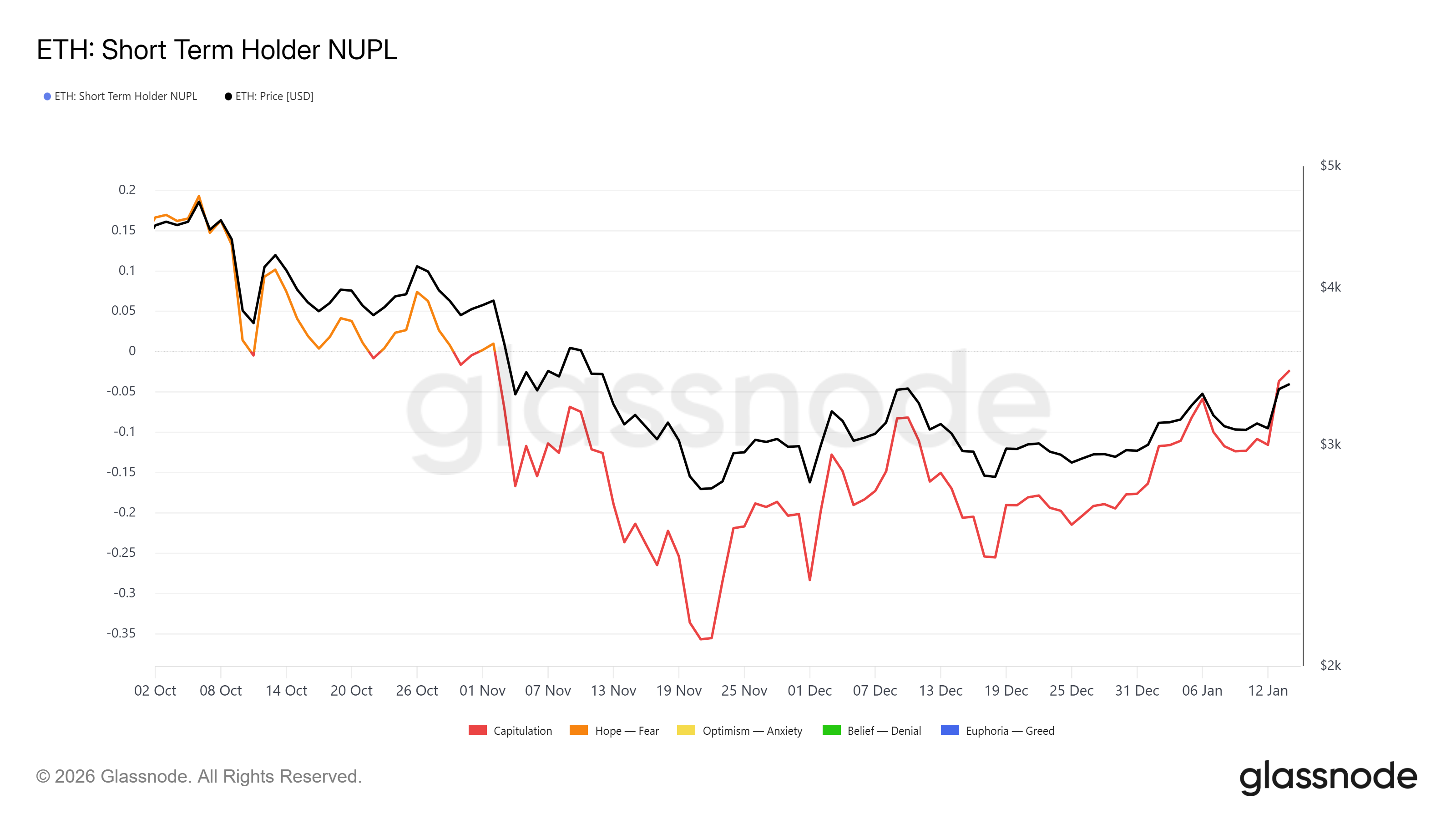

From a macro perspective, the net unrealized gains and losses indicators for short-term holders are starting to trend upward. This indicator tracks the profitability of recent buyers and provides insight into selling pressure. Although STH NUPL is rising, it remains firmly within the capitulation zone.

This positioning is constructive for price continuation. The average short-term Ethereum holder remains underwater, reducing the incentive to sell power. As long as losses continue, most STHs are likely to hold their positions, limiting their distribution in the early stages of a rally.

Ethereum NUPL. Source: Glassnode

Historically, the Ethereum rally is gaining momentum while STH NUPL remains negative but improving. Selling pressure often increases when the indicator breaks out of capitulation and turns positive. Until that change occurs, Ethereum This leaves room for it to rise without facing aggressive profit-taking.

Ethereum price breakout

Ethereum is trading around $3,317 at the time of writing, firmly above the $3,287 support level. This zone marked the upper boundary of the triangular pattern. Ethereum Escaped within the past 24 hours. This breakout predicts a 29.4% upside potential with a target of approximately $4,240.

Strengthening fundamentals support this outlook. Rising address growth and subdued selling suggest new money is driving momentum. A sustained move above $3,441 will strengthen the breakout. You can carry it by clearing that level. Ethereum A rally towards $3,607 confirmed the continuation of the trend and improved confidence in the medium term.

ETH price analysis. “>

ETH price analysis. “>

Ethereum Price analysis. Source: TradingView

However, downside risk remains if sentiment changes rapidly. Ethereum could fall below $3,287 if short-term holders sell prematurely to cover losses. A pullback within the triangle would weaken the bullish structure. In that case, Ethereum A move back towards $3,131 or $3,000 could invalidate the breakout theory.

The post “Ethereum makes history by registering 447,000 new holders on price breakout” was first published on BeInCrypto.