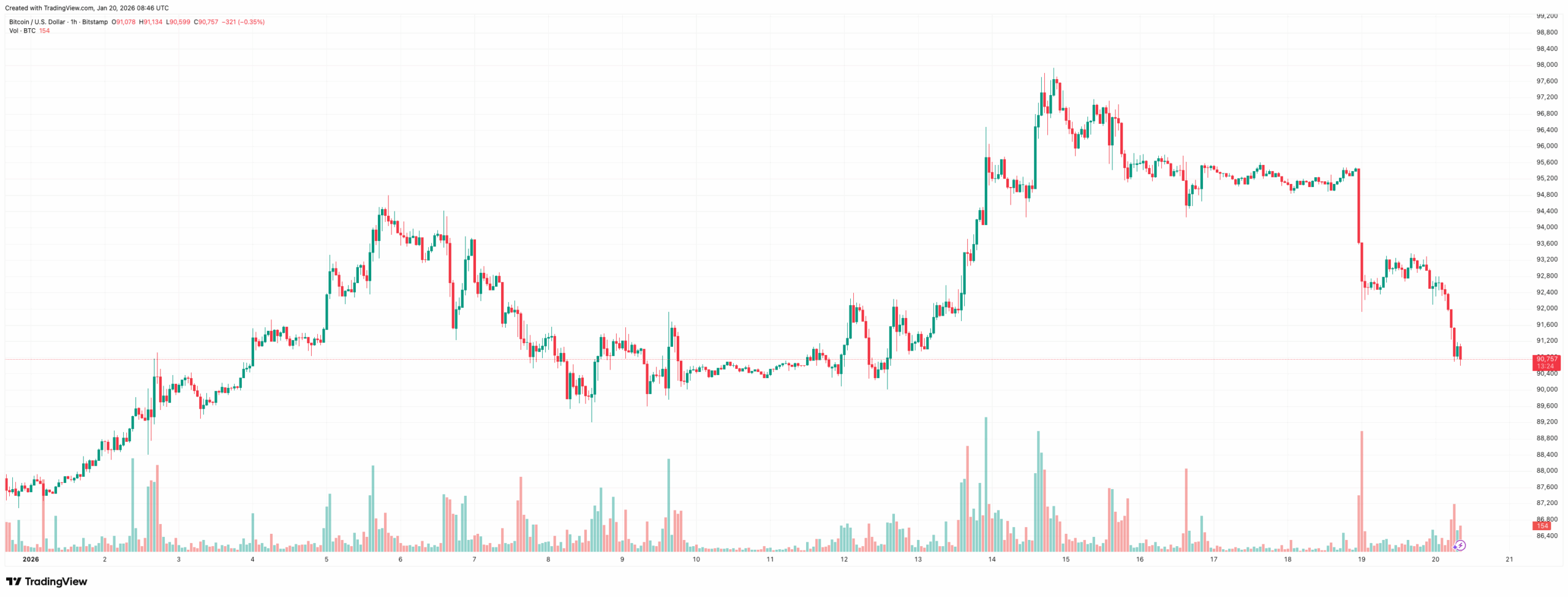

Bitcoin price fell 2.6% in the past 24 hours, hitting a low of around $90,600.

This has erased all of the gains since January 14th, and the cryptocurrency is once again trading at levels seen on the 12th, as shown in the chart below.

The price volatility is largely due to growing uncertainty in international trade as President Donald Trump continues to apply pressure regarding Greenland.

Cryptocurrency market falls into trouble

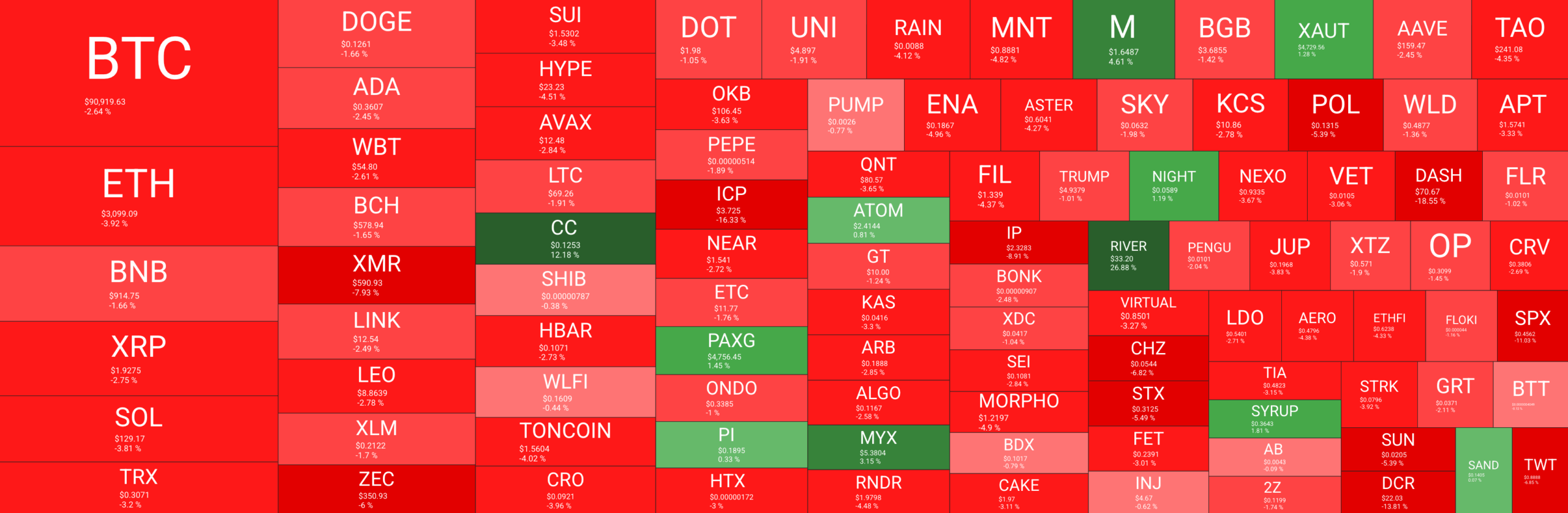

First of all, it is important to note that Bitcoin is not the only cryptocurrency that is losing money today.

In fact, only a handful of the top 100 coins by market cap trade in the green.

Ethereum was down 3.5%, XRP was down almost 3%, SOL was down 3.7%, and TRX was down 3.2%. Total capital currently stands at $3.16 trillion, with an overall daily trading volume of $109 billion, which is relatively average over the past three months.

Market sentiment has returned to “fear (32)”, indicating the indecision and uncertainty that has gripped the crypto industry over the past few months.

You may also like:

- Bitcoin slumps, gold shines as President Trump agrees to Davos

- Bitcoin hashrate dips below 1 ZH/s as miners face increasing profitability pressure

- Bitcoin dominates, $2.17 billion flows into cryptocurrencies, but geopolitics causes sudden reversal

but why?

Well, the past 24 hours have been eventful in geopolitics, which seems to be having a direct impact on crypto prices. Bitcoin is widely considered to be a risk-on asset, and investors don’t seem to see much risk at the moment. This is further evidenced by the rise in gold prices. As we previously reported, gold prices soared to an all-time high of over $4,700/oz.

Just yesterday, the president issued an official White House statement in a threatening tone, suggesting that the United States will continue to try to establish control over Greenland, an autonomous territory within the Kingdom of Denmark.

“Denmark can’t protect the land (read Greenland) from Russia and China, so why do they have ‘ownership’ in the first place? There is no written document, only that ships landed there hundreds of years ago, and we used to land ships there too. (…) The world will not be safe unless we have complete and total control over Greenland.”

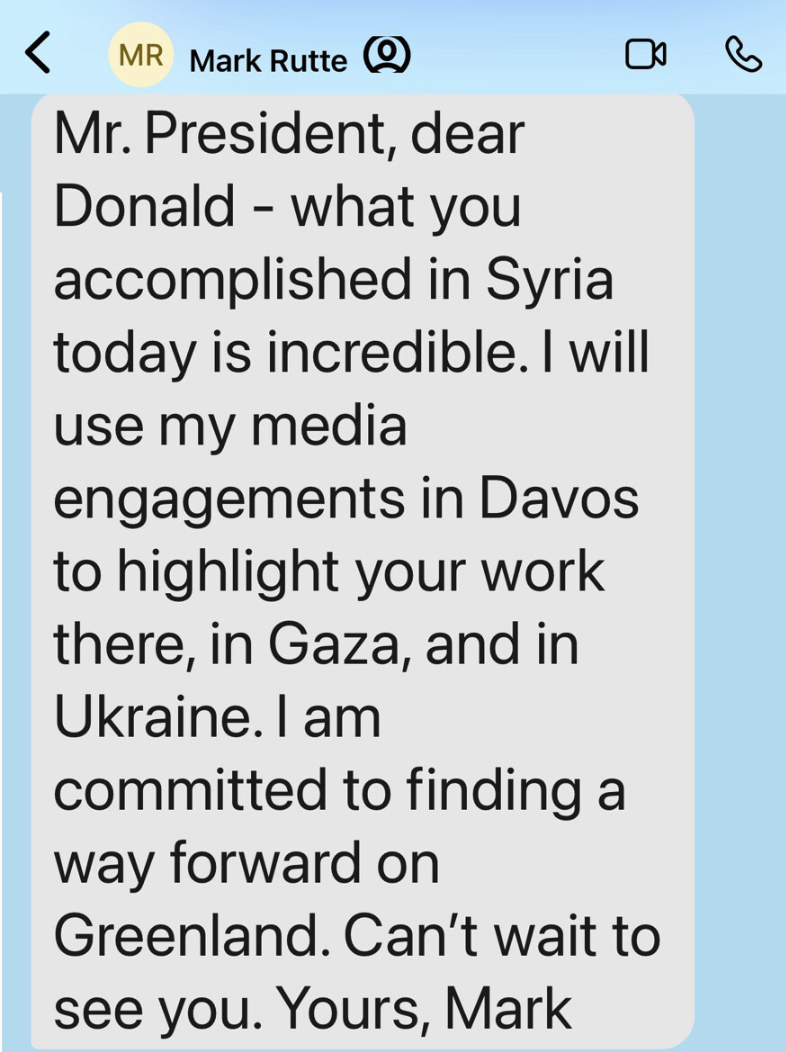

In response, China called on President Trump to stop using them as “an excuse to pursue selfish interests,” while the president himself confirmed that NATO Secretary-General Mark Rutte would meet in Davos.

So why the uncertainty? Well, Greenland is part of the full membership of the European Union and NATO. The US is fully threatening to take control of the country, and investors are concerned about the potential impact this could have on international relations. The United States is also a member of NATO, but Trump himself has said he intends to put American interests “first.”

“I’ve done more for NATO than anyone else since its creation, and now NATO should do something for America.”

He literally posted a photo of himself planting an American flag in Greenland.

French President Emmanuel Macron has also reached out to Trump, and the uncertainty is clear.

“Friends, we are completely aligned on Syria. We can do great things on Iran. I don’t understand what we are doing in Greenland…” Macron texted.

What’s next?

The Kobeisi Letter is a step-by-step analysis of what they have in mind, and so far it seems to be working.

Analysts say President Trump should soon begin saying he is working on solutions with the leaders of countries recently targeted by tariffs. They believe discussions on a Greenland trade deal will happen quickly and once announced, the market will reach new highs.

They believe that the current tariffs have not yet come into effect from February 1st, which indicates that:

President Trump’s entire negotiating strategy focuses on timing and pressure. He is giving a lead time of two to three weeks before tariffs go into effect to reach an agreement. President Trump’s goal is to prevent these tariffs from actually going into effect, and he wants a deal.

Whether this will happen remains to be seen, but what is certain is that turbulent times are ahead, so plan accordingly.