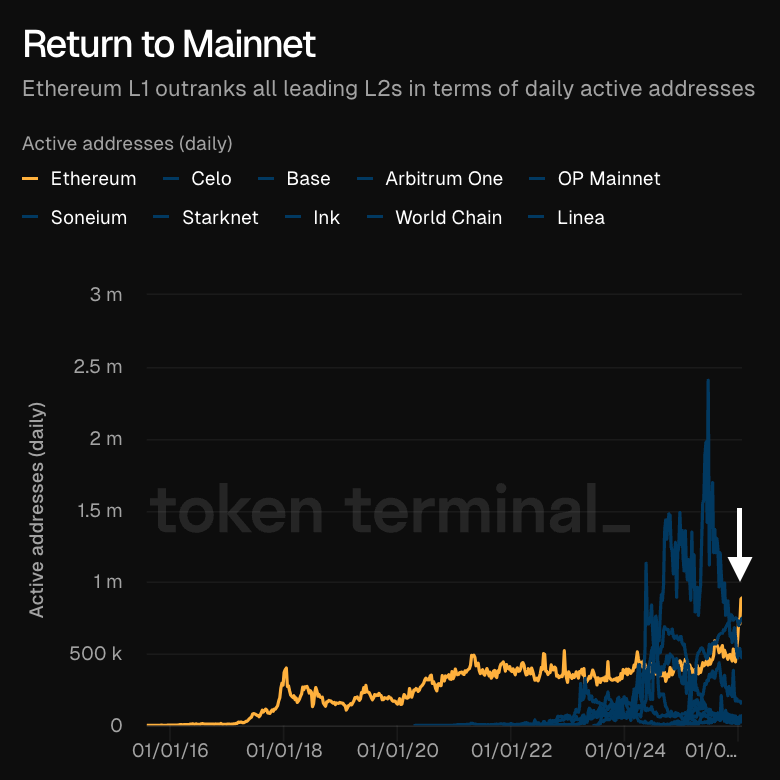

As gas fees remain low, network activity on the Ethereum mainnet currently exceeds network activity on Layer 2 scaling blockchains, although not all may be organic users.

Token Terminal announced on Thursday that daily active addresses on Ethereum are outpacing all major Layer 2s, and a “return to mainnet” is occurring.

The recent spike in active addresses has been approaching 1 million per day, with active addresses jumping to about 1.3 million on January 16, before settling down to about 945,000 active addresses per day, according to Etherscan.

This number is higher than all layer 2 blockchains, including popular networks Arbitrum One, Base Chain, and OP Mainnet. According to L2Beat, the total amount secured across all Layer 2s is now $45 billion, down 17% over the past 12 months.

The Ethereum network has seen a surge in activity this month after December’s Fusaka upgrade significantly reduced gas fees. However, not all of them are genuine users.

Ethereum L1 surpasses all L2 networks in daily active addresses. sauce: token terminal

Addressing the surge in poisoning attacks

Security researcher Andrei Sergenkov said Monday that the spike in network activity could be due in part to dusting or address poisoning attacks.

In address poisoning, fraudsters send small transactions from a wallet address that looks like a legitimate one, tricking users into copying the wrong address when making the transaction.

This has become economically viable as low network prices have made it cheaper to spam networks.

Related: Ethereum’s bulletproof efforts are paying off in user metrics

“It is reasonable to conclude that the recent surge in Ethereum network activity is essentially driven by an address poisoning campaign,” analysts at blockchain security firm Cyberse told Cointelegraph on Wednesday.

Analysts at Cybers said the behavioral classifications and statistical correlations “strongly suggest that address poisoning is not a peripheral factor, but rather a significant contributor to the recent increase in Ethereum transaction volumes.”

Ethereum remains the king of asset tokenization

Despite the false activity, Ethereum “remains the preferred blockchain for on-chain assets,” ARK Invest reported on Wednesday. Assets on Ethereum currently exceed $400 billion, and the global market for tokenized assets could exceed $11 trillion by 2030, it added.

Stablecoins account for the majority of these assets, with Ethereum accounting for 56% of the share of on-chain stablecoins and 66% of all tokenized real-world assets when layer 2 networks are included, according to RWA.xyz.

magazine: Here’s why cryptocurrencies are moving to Dubai and Abu Dhabi