Gold’s rise is starting to look more like a crowded event than a stable trend.

The yellow metal topped $5,500 an ounce late Wednesday, a pace that increased its notional value by about $1.6 trillion in one day – roughly the size of Bitcoin’s entire market capitalization.

This is a detailed and punchy comparison, as gold’s “market capitalization” is an estimate based on above-ground supply, rather than a float-adjusted stock style measure.

But this one captures the vibe. In the market version of a markdown trade, cash goes to the old hedge first.

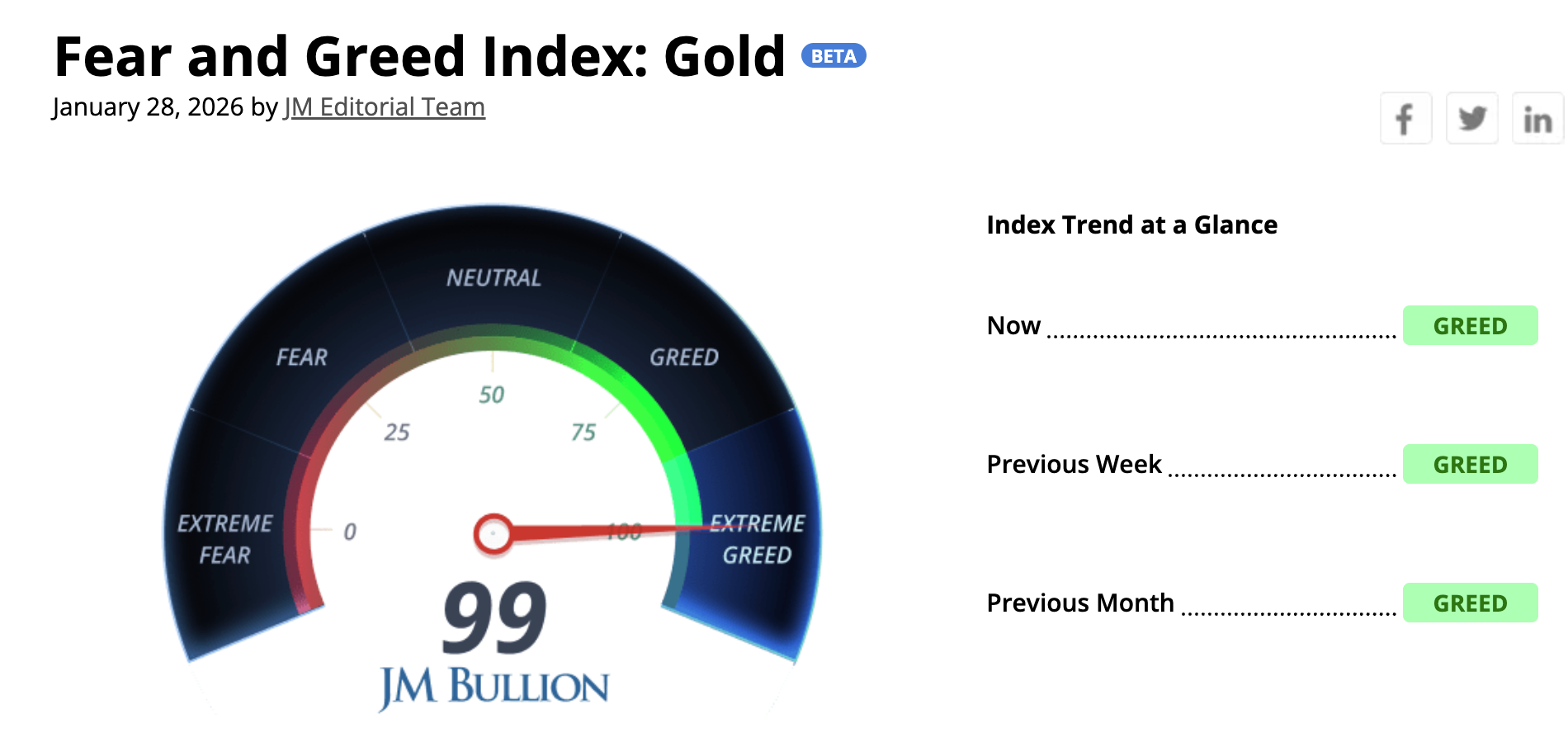

Emotions reflect that division. While gold-focused indicators are currently showing “extreme greed,” the cryptocurrency’s own fear and greed measures have remained in the opposite zone for much of this month.

The JM Bullion Gold Fear & Greed Index is a 0-100 sentiment gauge constructed from five inputs: physical gold premium, spot price volatility, social media tone, JM Bullion retail trade and Google Trends interest. Low readings suggest fear and capitulation, while high readings suggest crowded bullishness. This is meant to be a contrarian signal and not a price prediction.

Silver has also added fuel to the precious metals story, with sharp weekly gains and sharp intraday fluctuations that feel more like a positioning squeeze than a slow accumulation story.

In contrast, Bitcoin still trades like a high-beta risk asset that requires clean liquidity conditions and clear catalysts.

Even as metals prices crashed and headlines continued to fill the “hard asset” category, stocks hovered in the low $80,000s, still well below their October highs. This is troubling for the macro pitch that many crypto investors have relied on: that Bitcoin should act like digital gold when confidence in currencies and fiscal policy begins to waver.

However, this gap does not mean that the paper is dead. Bitcoin has outperformed most assets for longer periods of time and could move quickly once flows return.

But the past few weeks have reminded us that while store of value is a story, it’s also about who buys and why.

Marginal buyers looking for shelter are now choosing bars and coins over tokens and wallets, and Bitcoin is meant to prove its purpose once again.